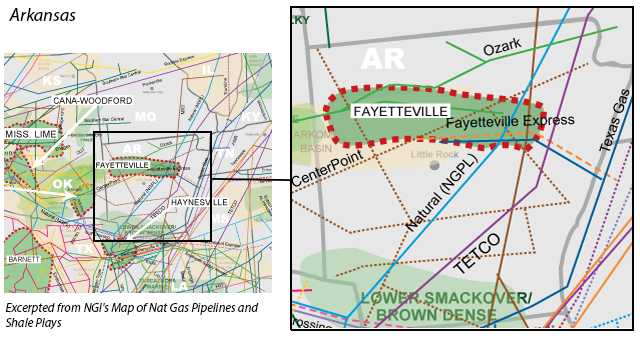

View more information about the North American Pipeline Map

Background Information about the Fayetteville Shale

One of the first U.S. shale plays to be developed en masse, the Fayetteville Shale is a dry natural gas formation located on the Arkansas side of the Arkoma Basin. The 2,838-square mile play held 20.4 Tcf of technically recoverable natural gas as of January 1, 2013, according to the Energy Information Administration.

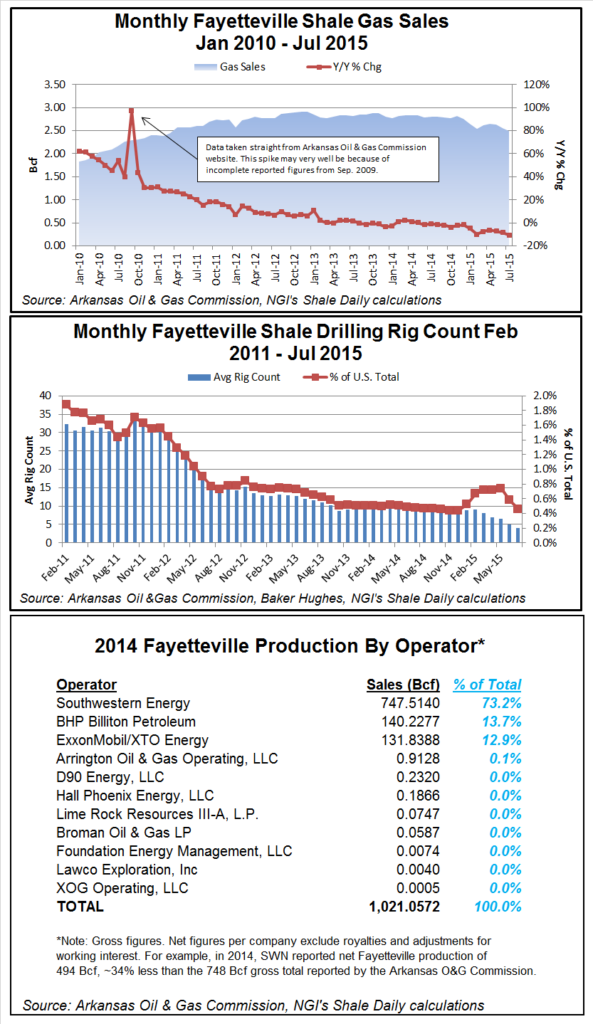

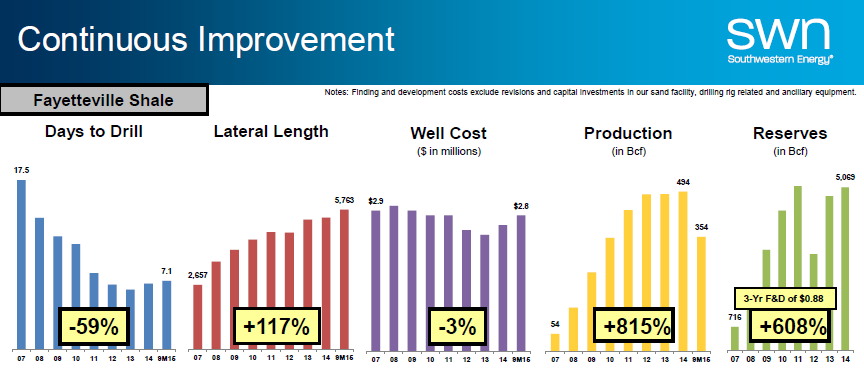

Southwestern Energy (SWN) remains the dominant player in the Fayetteville. The company discovered the play, and held 888,000 net acres there as of October 2015. According to statistics from the Arkansas Oil & Gas Commission, there were 15 operators in the Fayetteville in 2015, but almost 100% of total 2015 production came from just three: SWN, through subsidiary SEECO, BHP Billiton and ExxonMobil/XTO Energy.

But SWN, which made its name in the Fayetteville, has over the past two years shifted its focus to the Appalachian Basin, and the importance of the Fayetteville to the company is waning. In 2Q2011, SWN had 107 Bcfe of production in the Fayetteville, which accounted for nearly 88% of the company’s total quarterly production. By 2Q2015, production out of the play had inched up to 121 Bcfe, but made up less than half of SWN’s total production. In 2015, SWN, like so many other oil and natural gas industry businesses, was forced to lay off employees because of tumbling commodity prices (see Shale Daily, Aug. 7, 2015). Most of SWN’s layoffs were from its Fayetteville Shale operations.

Southwestern conceded during its 3Q15 earnings conference call that the Fayetteville is a “swing” area for them in terms of where they would add incremental investment dollars, and will most likely remain that way in the future. Since SWN is more focused on the Appalachian these days, and because Southwestern is the largest player in the Fayetteville, that means the drilling economics of the Marcellus Shale in particular could very well be the main driver behind the future growth potential of the Fayetteville.

Another major presence in the play, BHP Billiton Ltd., put its Fayetteville assets up for sale in 2014, but received little interest from potential buyers (see Shale Daily, Oct. 27, 2014).

Production growth in the Fayetteville began slowing about two years ago, leading to some speculation that perhaps the play had reached a more mature stage. However, the Bureau of Economic Geology at The University of Texas at Austin concluded in a 2014 study that the Fayetteville Shale at the time had 38 Tcf of technically recoverable reserves left, 18 Tcf of which was economical at $4.00/Mcf. At that price, the study’s authors argued that production from the Fayetteville would plateau during the period of 2012-2015, and would begin a gradual decline as the annual well count decreases.

Credit Suisse pegged breakeven prices in the Fayetteville core to be ~$3.50/MMBtu NYMEX at various times in 2015, while RBC Capital put them more in the $2.75-$3.25 range. RBN Energy estimated in July 2015 that at a $2.75 NYMEX price, the Fayetteville would generate returns of just 5% — and that assumed a 25% reduction in drilling and completion costs.

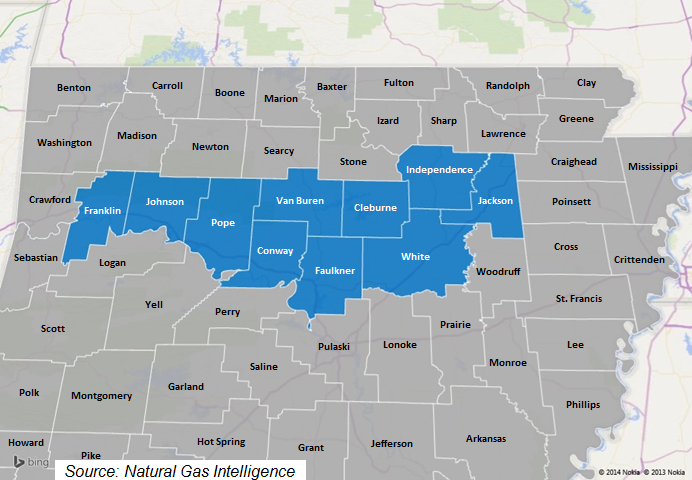

Since the time of the aforementioned study, natural gas prices and activity in the Fayetteville have stumbled. In early October 2015, there were just four rigs operating in the Fayetteville, less than half the nine in the play a year earlier. Those four rigs were concentrated in Conway (2), Faulkner (1), and White (1) counties.

Production in the Fayetteville has stagnated to such a degree that FERC in mid-2015 cleared Ozark Gas Transmission LLC to abandon to an affiliate 159 miles of mainline natural gas transmission facilities that had been serving the play (see Shale Daily, June 2, 2015). The abandoned facilities were to be leased to Magellan Pipeline Co. LP for conversion to refined petroleum products service.

Low natural gas prices and a consequent pullback from drilling in the Fayetteville have hit Arkansas hard, with gross natural gas severance tax revenue falling to $10.88 million during July-September 2015, a 54% decline from the year-ago period, when it was nearly $23.87 million, according to the Arkansas Department of Finance and Administration (see Shale Daily, Oct. 13, 2015).

Counties

Arkansas: Cleburne, Conway, Jackson, Johnson, Faulkner, Franklin, Independence, Pope, Van Buren, White

Local Major Pipelines

Natural Gas: CenterPoint Energy, Fayetteville Express, Mississippi River Transmission, NGPL, Ozark, Texas Eastern Transmission, Texas Gas Transmission, Trunkline

Crude Oil*: Pegasus (ExxonMobil)

NGLs*: ATEX, TEPPCO

*The Fayetteville is a dry gas formation. We have included these pipelines for completeness.

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily