Background Information about the Tuscaloosa Marine Shale

The Tuscaloosa Marine Shale (TMS) along the Louisiana/Mississippi border is one the most polarizing unconventional formations in North America, at least in the eyes of the investment community.

On the one hand, it has the potential to emerge into what one analyst described as a “potentially serious” oil play. On the other, the formation presents some geological challenges that have slowed its development thus far. But just as operators seemed to be overcoming these early hiccups, lower oil prices have impeded its progress even further.

Initial wells in the TMS produced anywhere from 85%-100% light crude oil (38o – 45o API), with the remainder being liquids-rich natural gas, from true vertical depths between 10,000-15,000′. This high oil content has some investors salivating in the hopes that the TMS may turn out to be the next Eagle Ford, and from a geological standpoint, the Tuscaloosa Marine Shale is in fact similar to the Eagle Ford Shale in Texas.

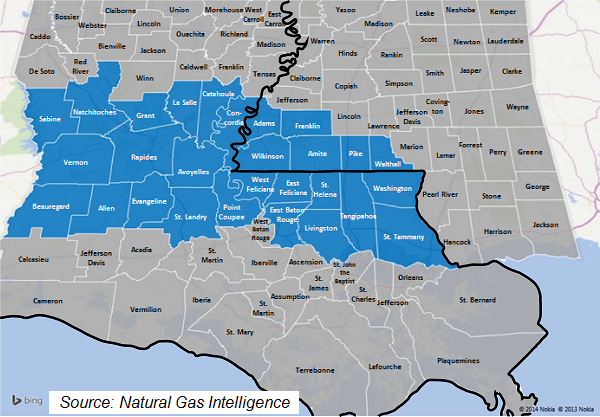

A portion of the TMS even has been called the Louisiana Eagle Ford shale. But unlike the Eagle Ford in Texas, the TMS has a varying degree of clay/silt content that has led some to question the ultimate commerciality in portions of the play. This may explain why much of the early horizontal drilling activity to date has been centered in Amite, Pike, and Wilkinson Counties, MS, and Avoyelles, East Feliciana, West Feliciana, St. Helena, and Tangipahoa Parishes, LA.

There are many wells in the TMS region already, since the area is also home to the more conventional Austin Chalk formation.

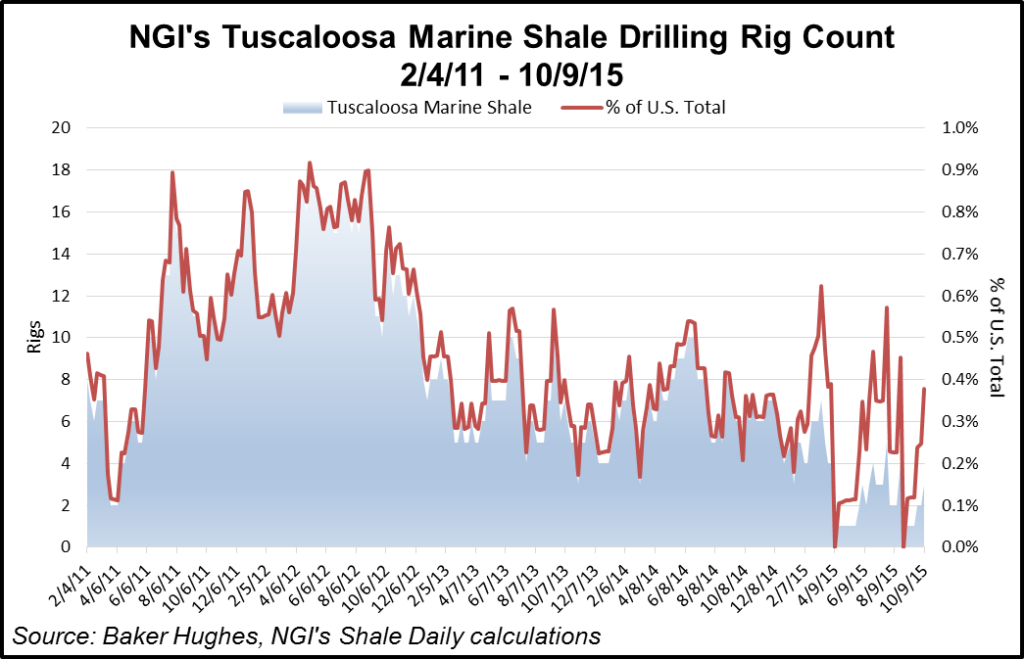

According to Baker Hughes data, there were 15 drilling rigs in the counties and parishes that comprise the TMS as of October 24, 2014, but activity has fallen off in the last year because of depressed commodity prices. We estimate only 3 rigs were working in the TMS area as of 10/9/15, 2 in Franklin County, MS, and the other in Adams County, MS. Interestingly, all three of these rigs were vertical, which suggests they were either being used to drill science wells, to hold leases, or possibly to target other formations.

Goodrich Petroleum reported on its 3Q14 conference call that there had been 52 horizontal wells drilled in the TMS as of October 2014, with 21 of those coming in 2014. Compare that to the more than 16,300 permitted wells in the Texas Eagle Ford through August 2014, and you get a sense of how much more drilling activity is needed to further delineate and de-risk the TMS in order to truly compare it to more established oil resource plays such as the Eagle Ford and Bakken shales.

Many of the initial wells in the TMS were negatively impacted because the target wells were in what the industry has dubbed the “rubble zone,” although Sanchez Energy COO Chris Heinson notes this isn’t actually a real zone. Rather, it is a highly fractured area that lies just above the Richland Sand.

“People have gotten themselves into trouble when they have tried to land above that Richland Sand because of the rubble zone: [there’s] just no telling how far it may extend vertically in the section. So some operators who were trying to avoid it ended up intersecting highly fractured zones when they landed north of that Richland sand,” Heinson explained.

However, Goodrich Petroleum and Halcon Resources both noted they have overcome this problem by setting the intermediate casing that approaches the pay zone at steeper angles. This, along with the general experience benefits that come from drilling more wells, have led to improved well results. During its 2Q14 conference call, Encana noted that seven of the last ten industry wells in the TMS had met its normalized type curve expectations, although all seven of those wells were drilled by Encana itself.

But even with the benefit of experience, operators in the TMS continue to turn in inconsistent results. In August 2014, a couple of Goodrich Petroleum TMS wells came in with underwhelming initial production rates compared with earlier wells, Sanchez Energy was sidetracking the lateral of its first operated TMS well after running into trouble, and Halcon Resources had experienced problems with its second TMS well. Part of the issue could be the presence of less natural fracturing in these wells, and that is a problem that may be difficult to overcome in the future.

As Goodrich Petroleum CEO Gil Goodrich noted on the company’s 2Q14 earnings conference call, his firm has been working with Schlumberger to map natural fracturing in the TMS, but it is still early in the process. Others are engaged in similar efforts, he said, adding that it is “a little bit difficult.” It is doubtful that the natural fracturing will show up on 3-D seismic surveys at resolutions fine enough to be helpful, Goodrich said, leaving the hunt for the best-fractured portions of the play largely up to “trial and error.”

Still, Goodrich seemed far more upbeat on the company’s 3Q14 conference call, noting that “during the third quarter, we continued to make meaningful progress in the Tuscaloosa Marine Shale. We and our industry partners have delivered an increasing number of consistent high rate wells, free of major mechanical or operational problems, and further demonstrated the repeatability of the play within the rapidly emerging core fairway.

Recent industry drilling success aside, now operators in the TMS face another potentially crippling problem: low crude oil prices, which has seen development in the play drop off significantly. For much of 2015, Baker Hughes data and NGI calculations revealed that most weeks there were 1-4 rigs in operation in the TMS, with a number of weeks where there was absolutely no activity.

Goodrich noted on its 3Q14 conference call that its breakeven price in the TMS is closer to $50 per barrel, given certain advantages in the play, such as a low basis differential to WTI, friendly royalty rates, and a lack of a meaningful severance tax until payout. That may be true, or at least true for Goodrich, but we would expect sustained lower crude oil to delay the overall industry transition of the TMS from a science to a development area. In August 2015, Credit Suisse opined that the TMS generated an internal rate of return (IRR) of just 5% given the NYMEX crude oil and natural gas strips at that time, meaning the play had lower than breakeven economics, assuming a 10% cost of capital.

During a 2Q15 conference call, Sanchez Energy CEO Tony Sanchez III said the company was focusing on its Catarina prospects in the Eagle Ford Shale, and that drilling and completion activity would be curtailed in the TMS, where it holds 66,000 net acres (see Shale Daily, Aug. 11, 2015).

In July 2015, Goodrich’s CEO announced that the company had sold some of its Eagle Ford acreage — a move that some analysts said positioned the company as more of a TMS pure-play operator (see Shale Daily, July 27, 2015). However, weak commodity prices have put development goals on hold.

In September 2015 Louisiana Oil and Gas Association President Don Briggs said the state’s oil and gas industry is in the midst of a crisis it hasn’t seen since the 1980s, and things could get worse if commodity prices remain low for an extended period of time (see Shale Daily, Sept. 1 2015).

“We’ve already seen several bankruptcies,” Briggs said in the interview with NGI’s Shale Daily. “Companies that are highly leveraged in a downturn like this are looking at [their options, which could include] Chapter 11. And if we have a continued period of time where this environment we’re in lasts for six to eight to 10 months, we will certainly see more. These are some very difficult times. There are companies looking for acquisitions and others looking for buyers. That’s a normal process when you’re going through a downturn like this. It’s very much like what happened in the mid-80s. At the beginning, we didn’t compare this downturn to that one, but in a lot of ways they are very similar.”

The weak commodity environment has seen the country’s oil and gas rig count plummet, and Louisiana has been no exception.

The number of drilling permits issued in Louisiana has also fallen off. According to Briggs, for the first seven months of 2015 a total of 390 permits were issued, down 55% from 868 permits over the same time frame in 2014. Of the 2015 total, 167 permits have been issued in three parishes in the north: Caddo, DeSoto and Lincoln, but those are more Haynesville Shale and likely Cotton Valley focused.

The TMS was largely an afterthought during the round of 3Q15 earnings conference calls. Goodrich Petroleum noted on its call that it moved the play into development mode in 2015, and continues to be enthused about its potential once oil prices recover, particularly since they believe they can increase TMS EURs by drilling longer laterals and using more proppant per stage. However, the message seems to be lost on the investment community, as analysts didn’t ask management a single question on the call. As of 11/26/15, GDP’s stock price stood at a 52-week low of $0.43/sh., down from its 52-week high of $7.59/sh.

Similarly, Sanchez Energy dedicated only one out of 34 slides in their November 2015 investor presentation to the TMS (and it was in the appendix), and spent only 5% of their 2015 capex budget on the play.

Still, the play is not completely forgotten. Dallas-based exploration and production company Aresco LP said in December 2015 that it has acquired “a substantial working interest” in the TMS in Louisiana and Mississippi. The company said a four-well drilling program targeting the lower TMS “A” Sand would begin immediately. Aresco’s newly acquired acreage covers 11 prospect areas containing up to 47 drilling locations across 20,000 acres in Louisiana and Mississippi. The seller was not disclosed (see Shale Daily, Dec. 7, 2015).

Counties/Parishes

Louisiana: Allen, Avoyelles, Beauregard, Catahoula, Concordia, East Feliciana, East Baton Rouge, Evangeline, Grant, LaSalle, Livingston, Natchitoches, Point Coupee, Rapides, Sabine, St. Helena, St. Landry, St. Tammany, Tangipahoa, Vernon, West Feliciana, Washington

Mississippi: Adams, Amite, Franklin, Pike, Walthall, Wilkinson

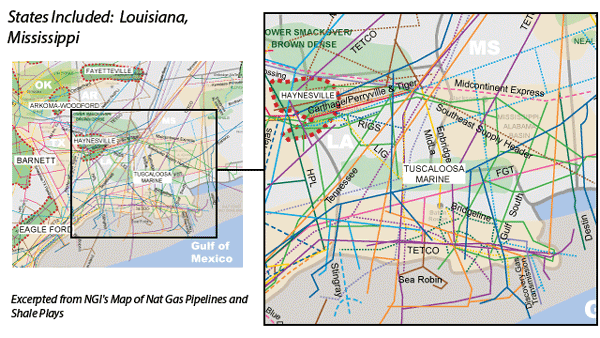

Local Major Pipelines

Natural Gas: ANR, Columbia Gulf, Florida Gas Transmission, Gulf South, Kinder Morgan Louisiana, Louisiana, Intrastate Gas, Pine Prairie Energy Hub, Southern Natural, Tennessee, Texas Eastern Transmission, Texas Gas Transmission, Transco, Trunkline

Crude Oil: Capline, Genesis, Mississippi/Alabama (Plains), North Louisiana (Exxon)

NGLs: Centennial, Dixie

More information about Shale Plays:

Utica | Permian | Bakken | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily