Background Information about the Eagle Ford Shale

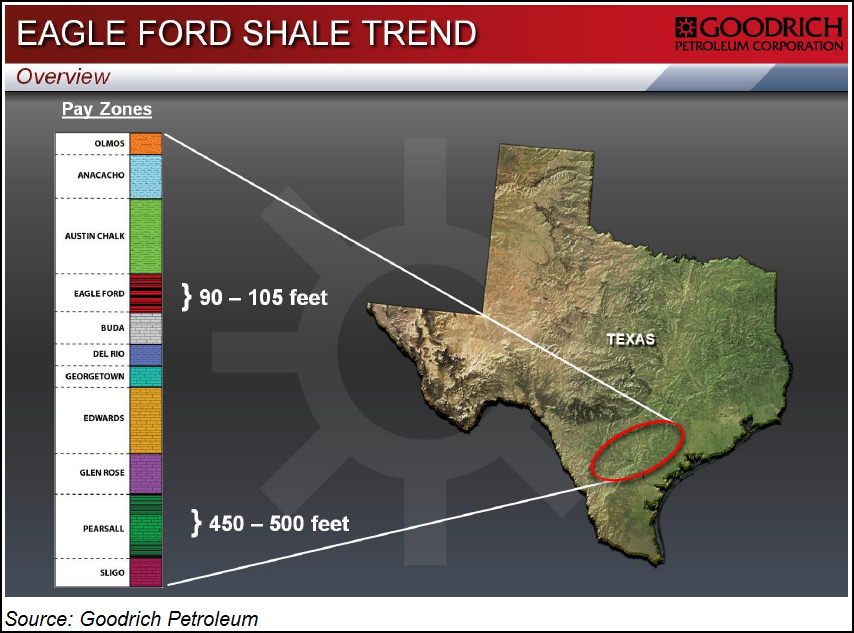

The Eagle Ford Shale, which is located in South Texas and features separate dry gas, wet gas/condensate, and crude oil windows, may only have about six years of production history, but it has quickly become one of the hottest resource plays in North America.

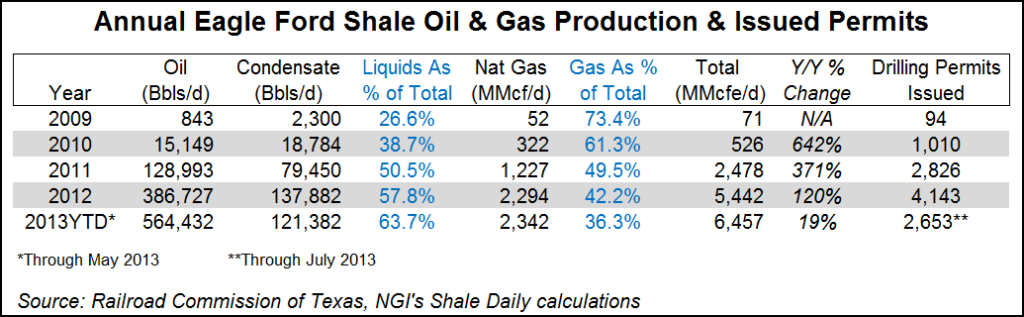

According to the Railroad Commission of Texas, Petrohawk (now part of BHP Billiton) drilled the industry’s first Eagle Ford well in LaSalle County, TX, in 2008. That first well has led to a surge in Eagle Ford drilling activity, so much so that production has grown from basically nothing in 2009 to respective totals of 1.07 million b/d of crude oil, 278,423 b/d of condensate and 5.26 Bcfe/d of natural gas in July 2015, subsequently making the Eagle Ford one of the most prolific oil and gas producing basins in the county. Still, the commodity price rout that began in 2014 and continued through 2015 was taking its toll on the Eagle Ford, too. EIA was projecting production declines in the Eagle Ford as recently as November 2015 (see Shale Daily, Nov. 9, 2015).

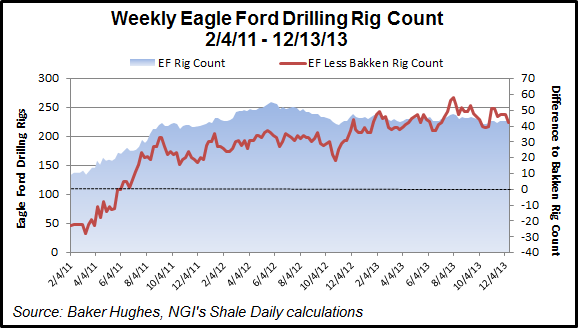

The production growth in the Eagle Ford has increased, despite the fact that the drilling rig count in the play has fallen from 259 rigs on May 25, 2012 to 80 rigs in early October 2015. Part of the decline is because of the transition to multi-well pad drilling, which enables more wells to be drilled per rig. National Oilwell Varco estimated that as of September 2015, 93% of the Eagle Ford wells being drilled were on pad deployment. Production growth has also been helped by a number of other factors, such as downspacing, the migration to longer laterals, and better completion techniques. For example, Rosetta Resources (now Noble Energy), SM Energy, Pioneer Resources, and Cabot Oil & Gas have all reported better well results by pumping more sand during hydraulic fracturing.

Part of the allure of the Eagle Ford area is it is home to several stacked oil and gas formations that lie above and below the Eagle Ford, such as the Olmos and Austin Chalk (above), and the Buda and Georgetown Lime (below). The Pearsall Shale also lies beneath the Eagle Ford.

Several companies are testing whether the Upper Eagle Ford and Lower Eagle Ford are in fact separate formations in certain parts of the play, which would likely increase the number of productive wells that could be drilled in the formation. According to an October 2015 presentation by Earthstone Energy, there were more than 30 Upper Eagle Ford wells completed by multiple operators. So far, companies such as Rosetta Resources and Pioneer Natural Resources have reported “encouraging” test results. Carrizo Oil & Gas, ConocoPhillips, Devon Energy, Encana, Goodrich Petroleum, Penn Virginia, SM Energy Inc, and Swift Energy all either have drilled or are in the process of drilling wells in the Upper Eagle Ford.

Marathon Oil Corp. was producing from both the upper and lower Eagle Ford during the summer of 2015; however, at that time management also was scaling back activity to deal with depressed commodity prices (see Shale Daily, Aug. 7, 2015). Still, the Eagle Ford remains an important engine for growth for Marathon and others. Marathon said in November that its Eagle Ford play was economic even with lower prices (see Shale Daily, Nov. 6, 2015). Several sources have said some portions of the Eagle Ford remain economic at $35/bbl NYMEX, particularly in and around Karnes County, TX.

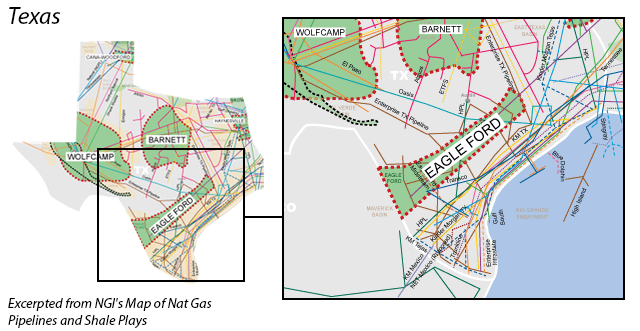

Unlike in the burgeoning Bakken Shale play in North Dakota and Montana, where energy infrastructure was practically non-existent a decade ago, crude oil and natural gas pipeline takeaway capacity is relatively plentiful out of the Eagle Ford Shale. Moreover, there are several major crude oil refineries in South Texas, particularly in the Houston and Corpus Christi areas, so Eagle Ford producers already have something of a readily available captive market for their supply nearby.

There has been concern that the United States as a whole may not be able handle the growing amount of lighter crude oil production, such as that coming from the Eagle Ford. Some refiners have expanded or are expanding capabilities to handle light crude. Valero Energy is one such company. Also planned are new/expanded crude blending facilities in the Gulf Coast region that would allow for crude to be better tailored to meet refiner specifications. One of these facilities, the Hazelwood Energy Hub, was proposed for South Louisiana in October 2015 (see Shale Daily, Oct. 6, 2015). Energy interests and their supporters in Washington have also been working to lift or relax a ban on the export of U.S. crude oil (see Shale Daily, Oct. 8, 2015; Sept. 10, 2015), and in August 2015, the U.S. government approved a plan that will allow the U.S. to trade up to 100,000 barrels per day of light oil and condensate with Mexico in exchange for heavier oil.

The U.S. also has been exporting more natural gas to Mexico to support increasing gas fired generation in that country. U.S. exports to Mexico currently stand at 3.4 Bcf/d, but could grow up to 6.0 Bcf/d by 2020, especially if Pemex is slow to increase its domestic production. The Eagle Ford is in prime position to step up natural gas exports to Mexico, and several pipeline projects are designed to do just that, including the 2.1 Bcf/d NET Mexico Pipeline that went into service in December 2014, and the proposed 500 MMcf/d Nueva Era Pipeline in Mexico that would receive gas from a border interconnect in Webb County, TX.

A more immediate problem is what to do with the surging condensate production in the U.S., in general, and in the Eagle Ford in particular, where said production has grown from practically nothing in 2009 to nearly 280,000 b/d in July 2015. Condensate is typically too light to be in much demand by U.S. refineries, which are geared more toward processing heavier oil. As a result, condensate tends to trade at a significant discount to crude in the United States. Several operators have either proposed or are in the process of building condensate splitters, but we believe that this is a relatively limited solution because the economics of splitters rely heavily on the demand for naphtha.

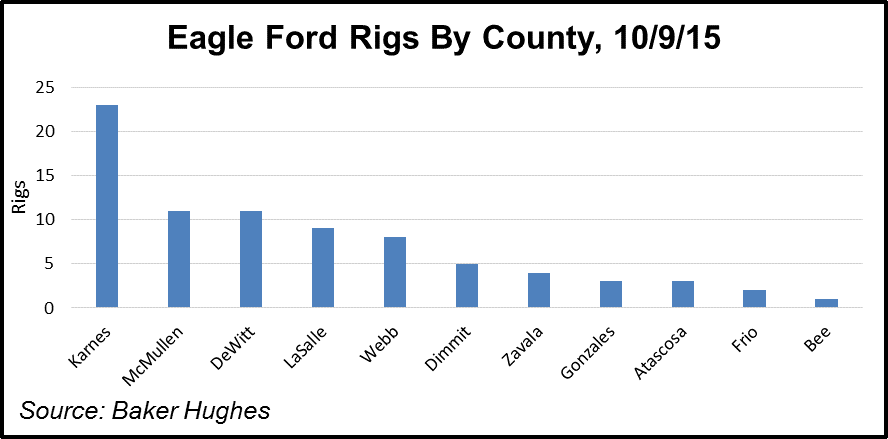

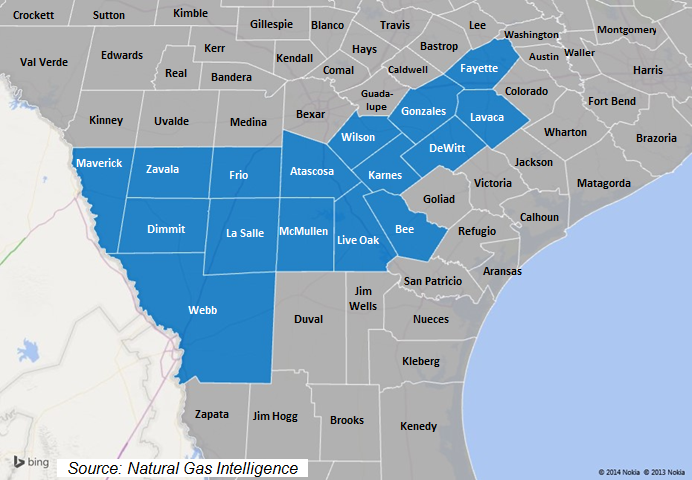

More than a dozen Texas counties comprise the Eagle Ford Shale. Because the play is so prolific, a number of Eagle Ford counties routinely feature in Railroad Commission of Texas (RRC) top-10 lists of producing counties for crude oil, natural gas, and condensate.

According to RRC data from August 2015, five Eagle Ford counties were among the state’s top-10 crude producers. They are Karnes, La Salle, DeWitt, McMullen and Gonzales. Top natural gas-producing counties (including casinghead gas) in the Eagle Ford were Webb, Dimmit, DeWitt, Karnes and La Salle. And when it comes to just condensate production, the Eagle Ford is a leader in the state, with seven of the top-10 producing counties in August 2015: Dimmit, Karnes, DeWitt, Webb, Live Oak, La Salle and McMullen.

While the rig count was declining in the Eagle Ford during 2015 — as it was just about everywhere else — producers plying the play were focusing their activity on Karnes County, which is in the heart of the play (see Shale Daily, Oct. 16, 2015). Karnes County accounted for 23 of the October 9, 2015 rig count, followed by DeWitt and McMullen Counties with 11 rigs each.

Counties

Texas: Atascosa, Bee, DeWitt, Dimmit, Fayette, Frio, Gonzales, Karnes, LaSalle, Lavaca, Live Oak, Maverick, McMullen, Webb, Wilson, Zavala

NOTE: The Texas Railroad Commission also lists Brazos, Burleson, Grimes, Lee, Leon, Milam, and Robertson Counties as being prospective for the Eagle Ford, but we consider those to be part of the Eaglebine play.

Local Major Pipelines

Natural Gas: Eagle Ford Crossover, Energy Transfer, Enterprise Products, Gulf South, HPL, KM Tejas, KM Texas, NET Mexico, NGPL, Tennessee, Texas Eastern Transmission, Transco

Crude Oil: Double Eagle, Energy Transfer, Enterprise, ETC Rio Bravo, Harvest, Kinder Morgan, Koch Pipeline, Longhorn, NuStar, Plains, Springfield Pipeline, TEPPCO South, VEX Pipeline

NGLs: Aegis, Copano, Energy Transfer, Maverick Field NGL System, Phillips 66 (LPG), Sand Hills, Texas Pipeline, Three Rivers

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily