View more information about the North American Pipeline Map

Background Information about the Arkoma-Woodford Shale

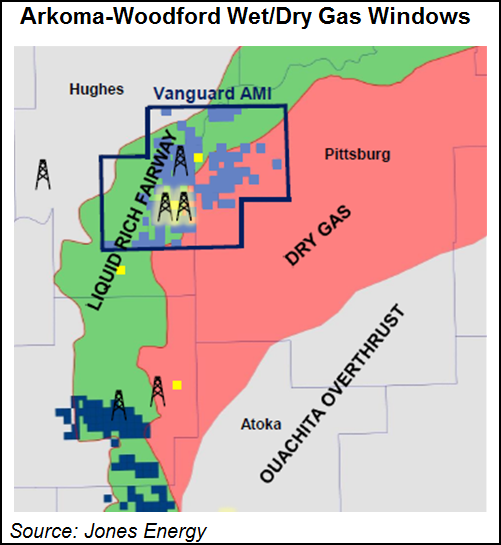

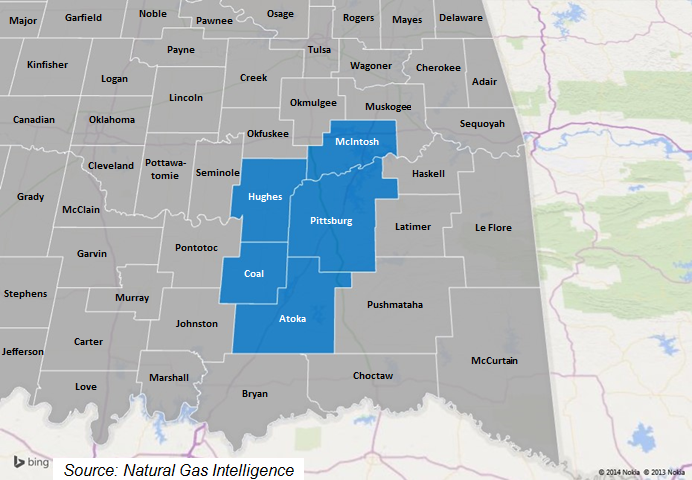

The Arkoma-Woodford may have been one of the first unconventional plays to emerge in the United States, but a “first mover” advantage doesn’t always lead to longer-term success. According to the Tulsa Geological Society, the play kicked off with vertical drilling in 2003, and saw its first horizontal well in late 2004. The Arkoma-Woodford is primarily a dry natural gas formation, although gas on the western half of the play tends to be somewhat more liquids rich than that on its eastern half. The majority of horizontal drilling in the Arkoma-Woodford has been centered in Atoka, Coal, Hughes, and Pittsburg counties in Southeastern Oklahoma, with some scattered activity in McIntosh County, OK as well.

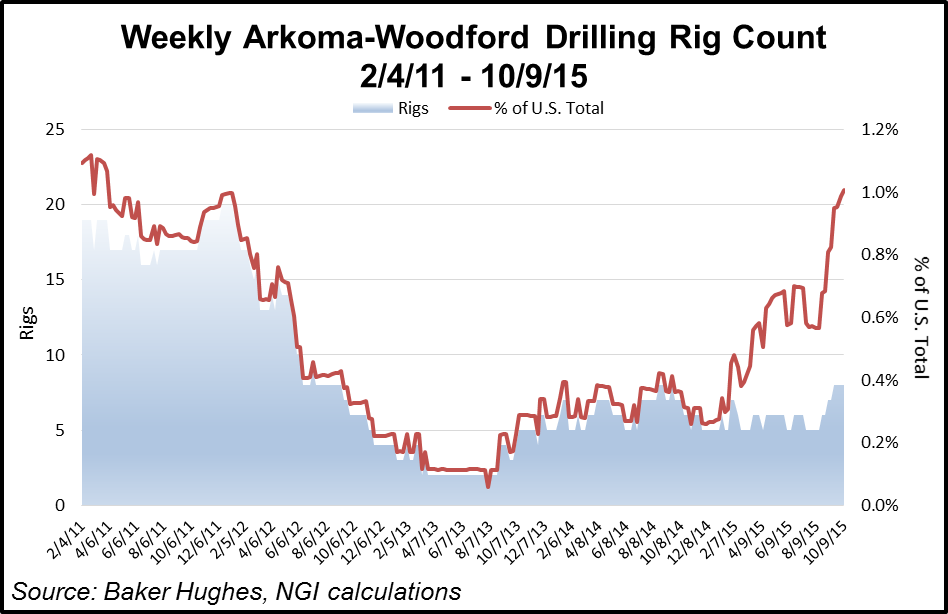

At one point in 2008, there were more than 50 drilling rigs working the Arkoma-Woodford, but these days, low gas prices have all but choked off investment in the region, particularly in the dry gas window. Most publicly traded companies barely even mention the play in their investor relations presentations anymore, and rig activity in the Arkoma-Woodford has slowed to a near standstill. There were just 8 drilling rigs in the Arkoma-Woodford in early October 2015, three each in Coal and Pittsburg counties, and the other two in Hughes County. That low rig count could be explained in large part by poor drilling economics in the area. At several points in 2015, Credit Suisse calculated the breakeven NYMEX price for the Arkoma-Woodford to be ~$5.75/MMbtu, among the highest for gas driven resource plays in North America.

Despite such economic headwinds, those 8 rigs were actually 2 more than were working the Arkoma-Woodford the year prior, which makes it only one of two unconventional regions (along with the Cana-Woodford) that could boast a year-over-year increase in its operating rig count. However, we believe this is the result of the Arkoma rig count already being so low, and from a handful of operators who are targeting the core areas of the play, where drilling economics are likely somewhat better.

ExxonMobil is the largest Arkoma-Woodford acreage holder, followed by Newfield Exploration and Vanguard Natural Resources. PetroQuest had been a major player in the area, but the company sold the majority of its Woodford position in 2015.

Counties

Oklahoma: Atoka, Coal, Hughes, McIntosh, Pittsburg

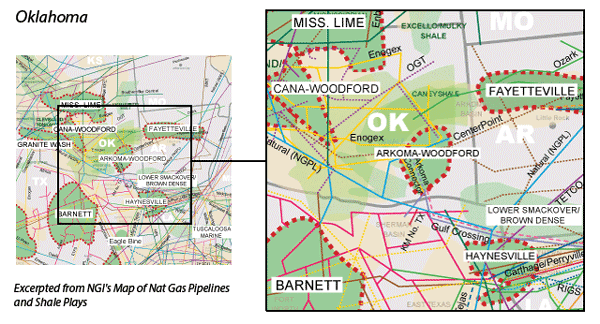

Local Major Pipelines

Natural Gas: Arkoma Connector, CenterPoint Energy, Enogex, Gulf Crossing, Midcontinent Express, NGPL, OGT, Ozark

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily