Background Information about the Bakken Shale

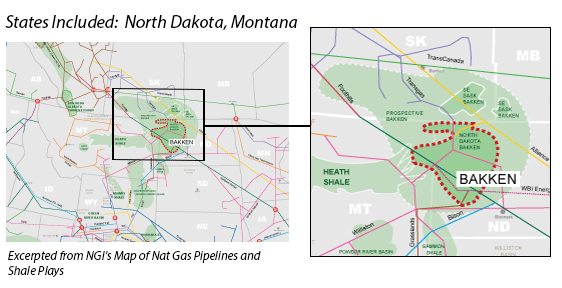

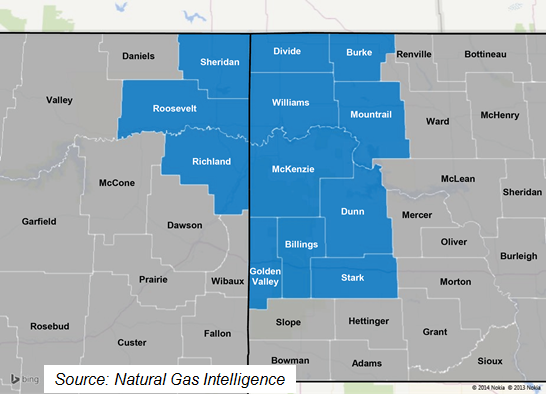

The Bakken Shale and the underlying Three Forks formation are both part of the Williston Basin, which spans portions of North Dakota, South Dakota, Montana, Manitoba, and Saskatchewan. Much of the industry development to date has occurred on the U.S. side of the border, primarily in Western North Dakota and Eastern Montana. In Canada, the majority of Bakken activity has been focused in Southeast Saskatchewan and Southwest Manitoba.

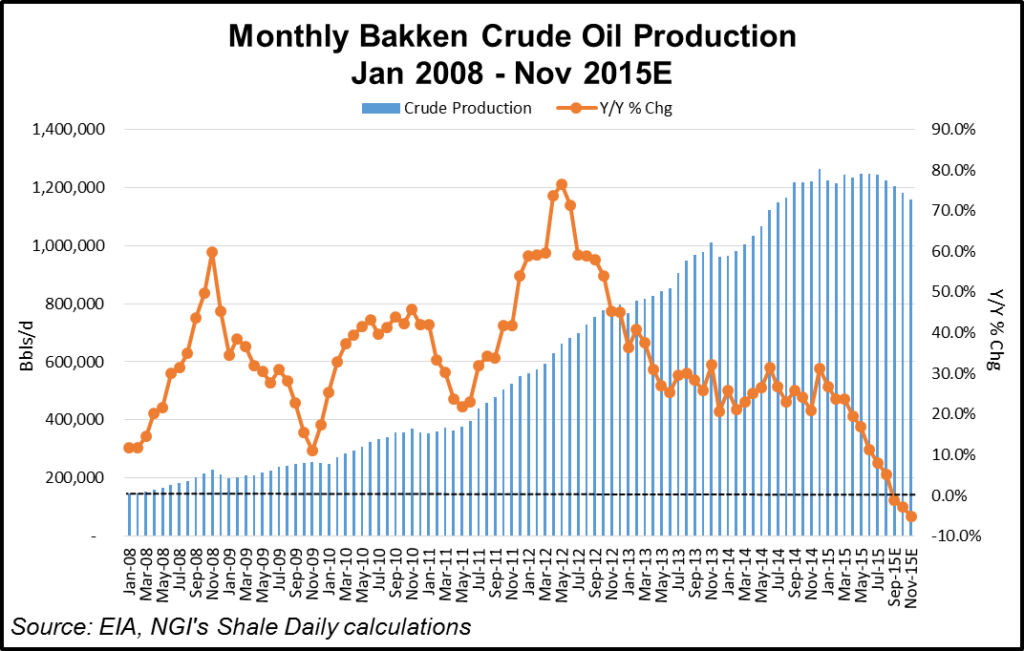

Most of the Bakken/Three Forks reserves are crude oil, and it is a high quality crude at that. The light sweet crude that is typical in the Bakken has an average API gravity of around 40, which is very similar to the West Texas Intermediate crude oil that is used as the benchmark for the NYMEX crude oil futures contract. Activity in the Bakken has been so robust that in March 2012, North Dakota passed Alaska to become the 2nd highest producing U.S crude oil state, up from 8th in 2002.

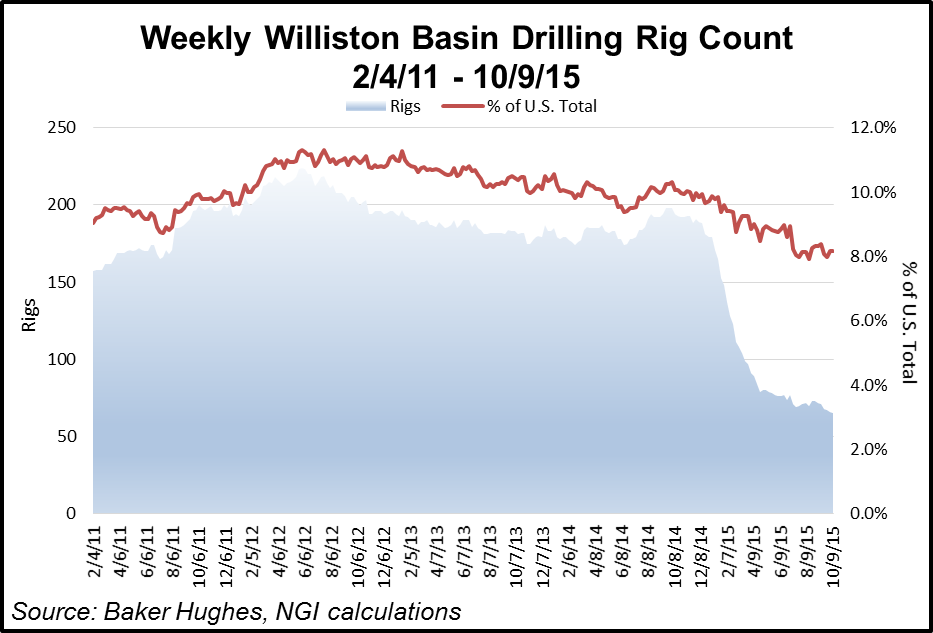

Although both the rig count and production was declining along with lower prices as 2015 was drawing to a close, absolute crude oil production continued to hold just above a million barrels a day at 1.16 million b/d in October 2015. It was in July 2013 that total Bakken crude production exceeded 1 million bbls/day for the first time.

Lynn Helms, director of the North Dakota’s Department of Mineral Resources said in November, 2015 he expects current price and production levels to continue throughout 2016. Larger producers are slowing down as a signal to the market, he said (see Shale Daily, Nov. 16, 2015).

“Oil price weakness is now anticipated to last through next year, and it is the main reason for the continued slowdown,” Helms said. Production and rig counts continued to drop in September, and the number of uncompleted wells increased by 98 to 1,091. Natural gas production in September dropped to 48.1 Bcf (1.60 Bcf/d) from 51 Bcf (1.64 Bcf/d) in August. Producing wells dropped slightly from an all-time high in August (13,031) to 13,025 in September. It was the first time in the last 12 years that the number of producing wells dropped.

Helms called the 2% (25,000 b/d) drop in production significant. “That’s sending a definite signal to the market that oil and gas operators are not willing to do a lot of drilling or hydraulic fracturing or produce oil at these low prices,” he said.

The current drop is deeper than operators would have anticipated going into this year, said Helms, noting that natural gas production also fell nearly 2% for the month.

“With the mild weather, natural gas prices are very low, under $2/Mcf, and it’s probably been more than a decade since that has happened [at this time of the year],” Helms said.

The rig count continued to fall, hitting 65 in early October after reaching 71 in September and 73 in August. Bakken sweet crude prices tumbled again, hitting $31.25/bbl in November, compared to $34.37/bbl in October. Only three of North Dakota’s dozen producing counties now have break-even prices that are below the $31.25/bbl price, he said.

57 of the 65 rigs at work in October 2015 were in the “Big 4” counties of McKenzie, Dunn, Mountrail, and Williams, North Dakota, which we believe represents the core of the play.

Helms said it could take up to a year for drilling to reverse course and ramp upward once prices turn around. “Many of the rigs that have been idled are being scavenged for parts,” he said. “It is going to take some weeks or months to put all the pieces back together, mobilize the equipment, get the crews back together and be able to get up and running again.”

Despite the downturn Tulsa-based Oneok Partners LP was planning to start up a new natural gas processing plant in November in the heart of the Bakken Shale play in McKenzie County, ND, and that is just the beginning of a series of infrastructure additions slated for the area by the end of next year (see Shale Daily, Nov.10, 2015).

Oneok’s 200 MMcf/d Lonesome Creek gas processing plant was set to start operations early in 2016, and the company plans to have additional processing and pipeline infrastructure in place, bringing to a close a multi-billion-dollar, six-year effort to meet demand for new takeaway capacity in the Williston Basin (see Shale Daily, May 20, 2014).

Related to the Lonesome Creek facility, Oneok has begun construction of a second expansion of its Bakken natural gas liquids (NGL) pipeline, a $100 million addition to boost the pipeline’s total capacity to 160,000 b/d. It is scheduled to be completed in the second quarter of 2016.

The Bakken NGL pipeline was originally built as a 60,000 b/d conduit and in 2014 was expanded to 135,000 b/d, but additional capacity was needed to handle NGL volumes envisioned from Lonesome Creek.

A year ago, Oneok established a $480-680 million program for infrastructure additions in North Dakota and Wyoming, capping a six-year $7.5-8.2 billion capital expenditure program to keep pace with the U.S. domestic oil/gas boom (see Shale Daily, Sept. 23, 2014).

But early in 2015, Oneok suspended plans to build a trio of gas processing plants in the Bakken and two other shale basins in three states as part of a revised capital spending budget in response to the crude oil price crash (see Shale Daily, Feb. 24, 2015). That included suspension of construction of the Demicks Lake facility in the Williston Basin in North Dakota.

Senior executives of Continental Resources Inc., one of the biggest Bakken Shale and Oklahoma oil producers, in November held onto their optimistic view of increasing onshore production and decreasing costs, although the company also saw more red ink in the third quarter.

The company’s production was up substantially in the Bakken in 3Q2015 results, with the Bakken providing 123,000 boe/d of Continental’s overall production in 3Q2015 of 228,278 boe/d. Based on the quarterly results Continental has increased its production growth guidance to 24-26% this year.

In the Bakken, Continental has slashed the time from spud-to-total depth (TD) to 15 days in 3Q2015 from 17.1 days in the first quarter, COO Jack Stark said. Some of the biggest advances are coming in drilling laterals, and Stark said Continental set a record in the Bakken, completing a 9,490-foot lateral in 2.4 days. “Overall, our enhanced completion costs in the Bakken are down 27% year-to-date to $7 million.” Operators reported more typical, less enhanced well drilling and completion costs more in the $6.2-$6.5 million range in October and November.

Its backlog of drilled but uncompleted wells in the Bakken grew to 123 in the third quarter, with 20-25 of those to be completed before the end of 2015.

Continental plans to continue to operate eight rigs in the Bakken through the end of this year, but if prices don’t begin to rise, that number would not be maintained next year when five of the eight drilling contracts expire. “We have flexibility, and we could keep all the rigs, but that won’t continue unless prices begin to recover,” CEO Harold Hamm said (see Shale Daily, Nov. 6, 2015.

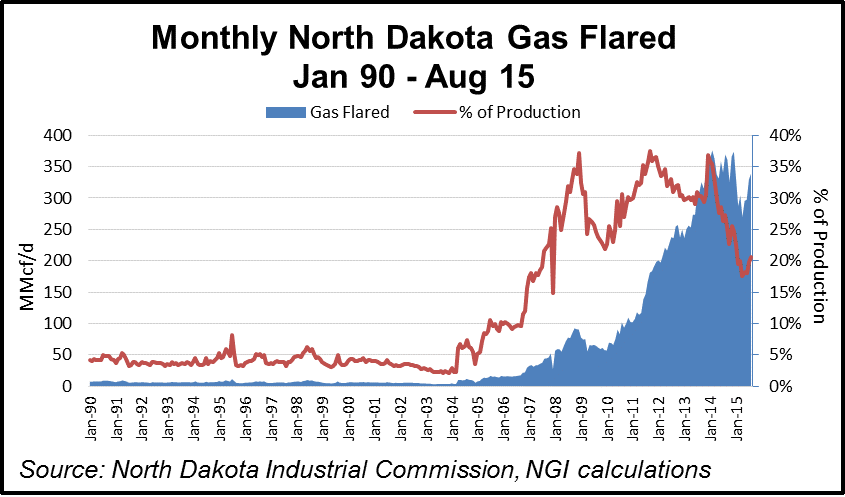

The crash in oil prices threatened reversals in the joint effort of the state of North Dakota and producers to continue lowering the amounts of flared gas at the wellhead (see Shale Daily, July 29, 2015).

Bakken operators are drilling better and more productive wells these days. In addition to drilling wells with longer laterals, several producers are seeing improved well yields from better completion techniques. For example, Whiting Petroleum and SM Energy have reported progress moving from sliding sleeves to a cemented liner plug and perf completion process, while Continental Resources, Halcon Resources, and Oasis Petroleum all have achieved better results by using more proppant and/or slick water fracking fluids.

Technological advancements such as these are also allowing operators to recover more of the original oil in place. In May 2014, Whiting Petroleum’s CEO Jim Volker remarked at an industry conference that “when we started [in the Bakken], we were seeing 10% recovery rates; now we all agree we’re getting to 20%. Ten years from now it might be up to 40%. So if we do a good job, we will be able to recover the higher numbers with just the same well spacing and takeaway capacity we put in place today.”

Before the crude oil price crash, Continental Resources’ Hamm told the audience at that same conference that he sees a doubling of Bakken production to 2 million b/d by 2020 or sooner, and Oasis Petroleum’s CEO Thomas Nusz added that “we have a resource life here [in the Williston Basin] that is 50 to 60 years, so it’s not your father’s oil business anymore,” citing some technically recoverable reserve estimates for the Bakken at 24-30 billion bbl levels. “This is going to be an important part of life in North Dakota for a long time,” Nusz concluded. In 2015 the bullish growth projections were replaced by cautious estimates of holding production above the 1 million b/d level.

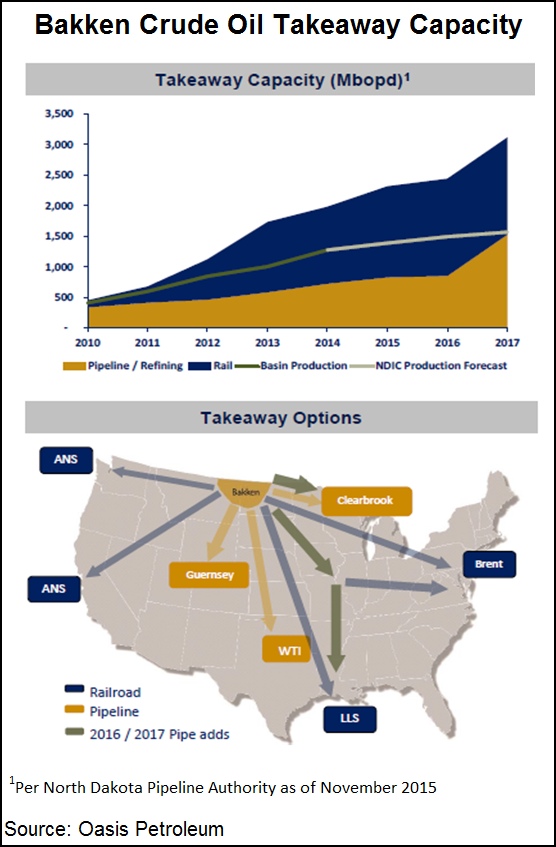

The slowdown takes some of the pressure off the shortage of takeaway capacity. In the absence of enough pipelines, rail transportation has rallied to the rescue. According to a September 2014 analysis conducted by the University of Texas Center for Energy Economics (CEE) in Austin, rail capacity to move oil (1.49 million b/d at last estimate) out of the Bakken is unlikely to be equaled by pipelines, which have about 824,000 b/d in total capacity, up from 200,000 b/d in 2008. Rail capacity for moving oil seven years ago was basically zero, so the growth on the rail side has been unprecedented.

Rail capacity at one time accounted for 63% of the total oil transport capacity from North Dakota, but that has dropped to under 50% in late 2015.” The three main rail lines that traverse North Dakota are BNSF Railway, Canadian Pacific (CP) and Northern Plains.

In the fall of 2015, the North Dakota Pipeline Authority estimated total Bakken takeaway capacity at 2.31 million b/d, while average production for the year to date was about 1.1 million b/d. The pipeline authority estimated the takeaway growing to 2.44 million b/d at the end of 2016. Rail capacity was 1.49 million and 1.59 million b/d, in those two years, respectively.

Part of growth in takeaway capacity came from the new 20,000 bbls/d Dakota Prairie Refinery that opened in summer 2015.

Enbridge Energy Partners announced the start-up date for its proposed 225,000 barrel Sandpiper Pipeline, which would carry crude oil from the Bakken, has been pushed back by a year to sometime in 2017 because of problems obtaining permits in Minnesota.

Bakken crude historically has traded at a $9-$10/bbl discount to WTI, or at roughly an 8%-10% discount to NYMEX, but was narrowing slightly in late 2015 to around $7 or $8. These discounts could contract some once more pipeline capacity comes online to complement rail capacity.

Pipeline takeaway and processing capacity is an issue on the natural gas side as well. Bakken operators are currently flaring roughly 20% of natural gas production in North Dakota because of a lack of gathering and processing capacity, although the state is working on getting that number down to 9% or less in 2020. (In October 2015 flaring was reduced to 14% statewide.) Producers have an extra economic incentive to bring that supply to market, since natural gas in the Bakken is extremely liquids rich.

Oneok is leading the charge to build more gathering and pipeline capacity in the area. MDU Resources has proposed the 400 MMcf/d Dakota Pipeline, but it remained on hold in 2015. Separately, North Dakota-based MDU’s pipeline unit, WBI Energy Transmission Inc., in the spring of 2015 asked FERC to start the environmental pre-filing review process for its proposed 22-mile, 24-inch diameter natural gas transmission pipeline for taking Bakken natural gas to the Northern Border Pipeline Co.’s interstate system feeding the Midcontinent.

According to North Dakota Industrial Commission data, as of Oct. 23, 2015, Whiting Oil & Gas, Continental Resources, Hess Corporation, ExxonMobil XTO, and Burlington Northern were the five largest producers on the North Dakota side of the play.

As the low-price environment lingered on, production in the Bakken consolidated further into its four top producing counties — Dunn, McKenzie, Mountrail and Williams — (see Shale Daily, Aug. 20, 2015), With production essentially flat and expected to stay that way throughout most of 2016, state officials considered easing restrictions on uncompleted wells to give producers longer time periods to ride out the low commodity prices (see, Shale Daily, Oct. 14, 2015).

Long-standing plans for a major multi-billion-dollar fertilizer plant and related natural gas pipeline were scrapped during 2015 because the economics didn’t pencil out (Oct. 30, 2015).

Counties

North Dakota: Billings, Burke, Divide, Dunn, Golden Valley, McKenzie, Mountrail, Stark, Williams

Montana: Richland, Roosevelt, Sheridan

Local Major Pipelines

Natural Gas: Northern Border, WBI Energy Transmission

Crude Oil: Bakken Pipeline (Enbridge), Bridger Pipeline, Butte, Dakota Access (proposed), Double H (proposed), Four Bears Pipeline, Keystone XL (proposed), North Dakota System (Enbridge), Plains Bakken North, Platte, Pony Express, Poplar System, Sandpiper (proposed), Tesoro, Upland Pipeline (proposed)

NGLs: Bakken NGL

More information about Shale Plays:

Utica | Permian | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily