View more information about the North American Pipeline Map

Background Information about the Green River Basin

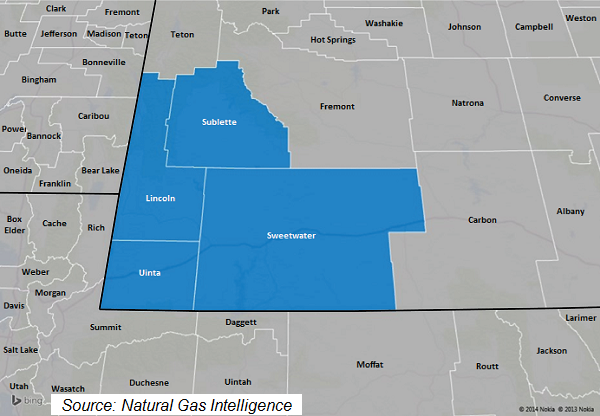

The Green River Basin (GRB) is actually a subset of what the United States Geological Survey calls the Greater Green River Basin, which also includes the Great Divide, Vermillion, and Washakie Basins in Wyoming, and the Sand Wash Basin in Colorado. For our purposes, we define the Green River Basin as all production within Lincoln, Sublette, Sweetwater, and Uinta Counties in Wyoming. This includes production in eastern Sweetwater County, which contains the aforementioned Great Divide, Vermillion, and Washakie Basins.

Production in the GRB is dominated by natural gas and natural gas liquids (NGLs) from tight sands formations, primarily the Pinedale Anticline and the Jonah Field in Sublette County, and the Wamsutter Field in eastern Sweetwater County. In 2009, the U.S. Energy Information Administration pegged the Pinedale Anticline and Jonah Field as the 3rd and 7th largest U.S. natural gas fields as measured by proved reserves, respectively. The Wamsutter Field was 39th.

Both the Pinedale Anticline and Jonah Fields draw production from the over-pressurized Upper Cretaceous Lance Pool (which includes both the Lance and Mesaverde Formations), and produce high quality, “sweet” natural gas. The Pinedale lies at depths anywhere between 8,000’-19,000’, with similar depths in the adjacent Jonah Field. The area also featured some of the first pad wells in the United States, and currently features drilling at as low as 5-10 acre spacing in some areas, among the tightest spacing allowed in the country.

The Green River Basin is a particularly environmentally sensitive area, and that has led to drilling restrictions over the years. For example, operators were not permitted to drill year round in the Pinedale until September 2008, and operators in the Pinedale were early adopters of pad drilling in no small part to minimize surface disruptions.

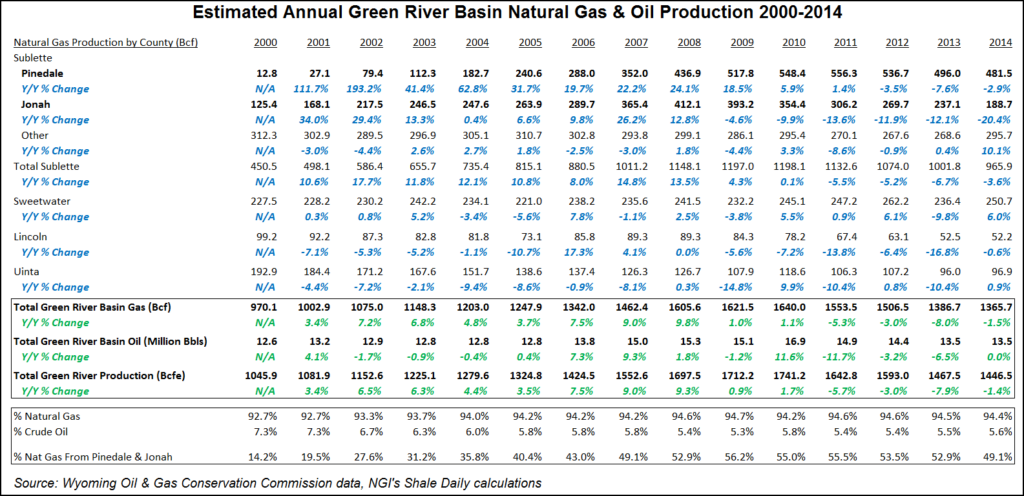

Overall, natural gas and NGLs have accounted for 93%-95% of annual production in the Green River Basin since 2000, although that figure may change one day if the industry figures out how to profitably extract the massive amounts of oil shale reserves that underlie the basin. For more information on U.S. oil shale, please refer to the United States Geological Survey’s website: http://energy.usgs.gov/OilGas/UnconventionalOilGas/OilShale.aspx

Production growth in the GRB has been led by the Pinedale and the Jonah, which combined grew from just 14.2% of its total production in 2000 to a high of 55.5% in 2011, before slipping back to 52.1% in 2013. Both of those areas posted double digit year-over-year growth rates throughout most of the 2000s, but annual production in the Jonah has fallen significantly since 2009, and production turned negative on a year-over-year basis in the Pinedale in 2012. However, in mid-2014, Ultra Petroleum Corp., which has the largest acreage position in the Pinedale with 49,000 net acres, believed that more than 75% of the field had yet to be developed, so the production declines, in the Pinedale at least, are more likely the result of lower natural gas prices relative to crude oil than because of that area reaching a mature stage.

In 2015, Ultra Petroleum said it was targeting an asset sale by year’s end. The Houston-based exploration and production (E&P) company was looking to reduce its debt and continue focusing production on its Pinedale Anticline in the Green River Basin of Wyoming (see Shale Daily, Nov. 3, 2015).

CEO Michael Watford discussed the planned asset sale in an earnings conference call. He said Ultra has “too much debt” and the company is “closing in on an asset sale that should provide a fair amount of relief.” Ultra planned to strike a deal by the end of the year and is looking at “a couple of highly actionable, reasonable opportunities, so I think we’ll go down the path and select one of those and get it done.” He declined to specify how much production might be included in an asset sale. The third quarter was characterized by further efficiency gains in the Pinedale and a shift away from its Marcellus Shale holdings in Pennsylvania.

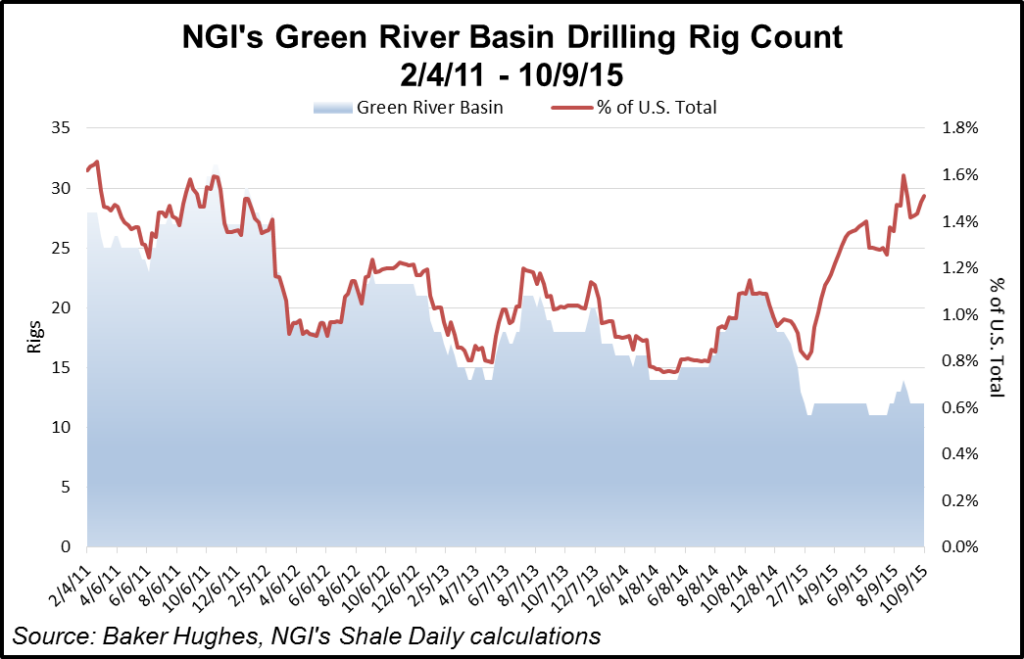

The rig count in the Green River has been in a general state of decline since peaking at 32 in October 2011, and stood at just 12 in early October 2015. All 12 of those rigs were in Sublette County, WY, home of the aforementioned Pinedale and Jonah fields. Ultra Petroleum CEO Michael Watford noted on the company’s 2Q14 conference call that natural gas prices would need to improve to “well above $4, closer to $4.50, “ before Ultra added to the four rigs it was already running in the Pinedale at that time.

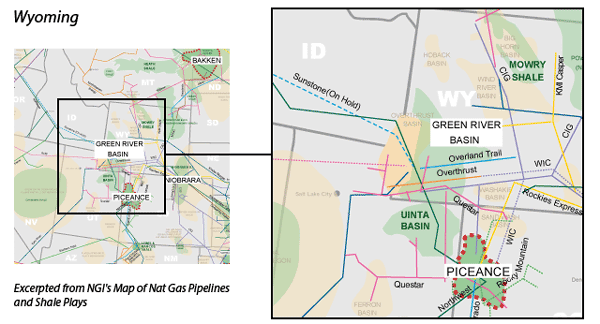

Traditionally, ExxonMobil, Ultra Petroleum, Encana, and QEP Energy combined for approximately 60% of total production in the Green River Basin, although Encana sold its assets with the US$1.8 billion sale of its Jonah assets to an affiliate of TPG Capital in March 2014 (see Shale Daily, March 31, 2014). In addition, the GRB is home to the major Opal natural gas hub in Lincoln County, which is the pipeline connecting point for Kern River, Northwest, Colorado Interstate Gas (CIG), Rockies Express, Questar, Overthrust, and Wyoming Interstate Company (WIC) pipelines.

Encana Jonah Field assets, now part of TPG Capital, are in Sublette County, where Jonah provided one of the largest natural gas discoveries in the 1990s. In total, Encana’s area in Jonah included a productive expanse of 24,000 acres and more than 1,500 active wells. Estimated year-end 2013 proved reserves totaled 1.493 Bcfe. The transaction with TPG also includes more than 100,000 undeveloped acres adjacent to Jonah known as the Normally Pressured Lance (NPL) area. Encana CEO Doug Suttles at the time called the sale the “unlocking of value from a mature, high-quality asset.” Encana sold a lot of its gassy properties to focus on liquids onshore plays, whittled its exploration list to only five plays this year: Montney Formation, Duvernay Shale, Tuscaloosa Marine Shale, Denver-Julesberg Basin and San Juan Basin (see Shale Daily, Feb. 13, 2014).

Counties

Wyoming: Lincoln, Sublette, Sweetwater, Uinta

Local Major Pipelines

Natural Gas: CIG, Kern River, Northwest Pipeline, Opal Hub, Overland Trail Transmission, Questar, Questar Overthrust, Rockies Express, Ruby, WIC

Crude Oil: Frontier (Plains), Rocky Mountains (Plains)

NGLs: Overland Pass, Rocky Mountains (Enterprise)

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily