View more information about the North American Pipeline Map

Background Information about the Eaglebine Play

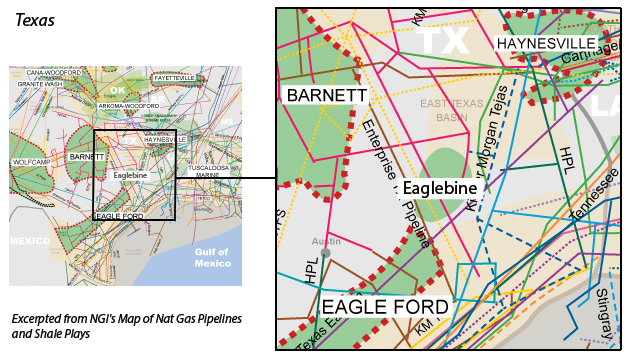

The Eaglebine is an emerging horizontal oil play in East Texas whose name is a hybrid of the Eagle Ford Shale and the Woodbine sandstone formation.

There is no set definition of the Eaglebine per se, but after reviewing company documents from known operators in the area, we generally characterize the Eaglebine as being located in Brazos, Burleson, Grimes, Houston, Lee, Leon, Madison, Milam, Robertson and Walker counties, TX, and resting anywhere between the Austin Chalk and Buda Lime formations underneath those counties.

The Railroad Commission of Texas actually includes most of those counties (except for Houston County) in its definition of the Eagle Ford, but we believe the Eagle Ford in those counties exhibits a higher silt and carbonate content. Therefore, we believe these Eagle Ford counties are considered by most of the industry to be a separate formation from the more familiar Eagle Ford Shale, which is located in the Maverick Basin to the west.

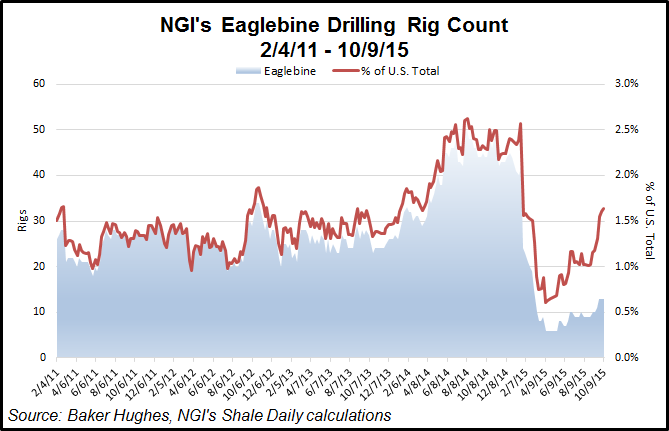

The Eaglebine area has been drilled vertically for years as the play is home to a number of other pay zones, such as the Austin Chalk, Buda Lime, Bossier Sands, Deep Bossier, Edwards, Freestone Trend, Georgetown, Glen Rose and Wilcox formations. Drilling activity in this region had been fairly active since at least 2011, but we believe activity in the Eaglebine had helped the rig count in the area to double in 2014. However, the play is still in its early stages.

As of early October 2015, the rig count in the Eaglebine had fallen sharply and was hovering around 13 units in the midst of the oil and natural gas price collapse. Of those 13 rigs, five were in Burleson County, followed by three in Madison, two in Brazos, two in Lee, and one in Grimes County. One year earlier there were 44 rigs active in the Eaglebine.

Early horizontal drilling results confirm the presence of light oil in the Eaglebine, and many operators and analysts have expressed optimism about the play. But the trick with the Eaglebine, as it is with all emerging plays, is to figure out the right drilling formula (lateral lengths, proppant, completion methods, etc.) to produce the oil commercially.

To wit, Encana has drilled at least 12 wells in the Eaglebine, but in its July 2013 corporate presentation, the company said its strategy in the area is to “establish commerciality through longer laterals and improved completion design.” However, there was no discussion of the Eaglebine in the company’s third quarter 2015 earnings release nor during the associated conference call.

Small cap stock ZaZa Energy (ZAZA, market cap $16 million as of 12/16/14 but only $2.2 million in mid-November 2015 as ZaZa struggled with liquidity in the midst of the commodity price collapse) is the publicly traded company that might be most closely associated with the Eaglebine (which it calls Eaglebine/Eagle Ford East), since ZaZa has declared the Eaglebine as being its primary focus. The company has partnered with partner EOG Resources to develop a large portion of its acreage. In a mid-2015 operations update, ZaZa said it had about 140,000 gross (35,000 net) acres within an area of mutual interest with EOG Resources in the Eagle Ford East. “Our operational strategy is focused on drilling proven, highly-economic Buda-Rose vertical stack and frack wells that will increase our cash flow, production, and reserves,” ZaZa CEO Todd Brooks said at the time.

Halcon Resources has also sparked interest with its El Halcon play, which is in the Lower Eaglebine. In November 2015 the company said it ran one rig in the play during the third quarter of 2015, spudded four wells and put three online. Wells were performing at the company’s 452,000 boe type curve for the area on a per lateral foot basis.

“The drilling program at El Halcon is in development mode and the Company expects to drill two to four wells per pad throughout the remainder of this year and in 2016,” the company said in its third quarter earnings press release. There are currently 102 Halcon-operated East Texas Eagle Ford wells producing and three company-operated wells being completed or waiting on completion, it said.

Anadarko Petroleum Corp. is another substantial Eaglebine acreage holder. The company says on its website that it has “achieved encouraging results in this emerging play, with wells demonstrating estimated ultimate recoveries of approximately 350,000 BOE with 90% oil composition…Anadarko is continuing to evaluate the potential of this area, while leveraging key assets that include a variety of gathering, compression and treatment facilities serving the midstream market throughout the area.

Clayton Williams Energy said on its 3Q15 conference call that it ref-fracked its original East Eagle Ford well in Lee County, which they drilled 3-4 years ago. No results just yet, but if it works, it could have “big implications,” according to the company.

Much of the acreage in the Eaglebine area may already be held from existing wells that target other formations, so this may serve as something of a barrier to entry for those looking to lease Eaglebine acreage, everything else being equal. ZaZa also has said there is horizontal drilling potential in what it calls the “Buda Rose,” which lies immediately below the lower Eaglebine interval and includes the Buda, Edwards, Georgetown and Glen Rose formations, among others.

Sunoco Logistics Partners’ Eaglebine Express crude pipeline serves the play with 60,000 b/d of capacity to coastal refineries.

In January 2015, Knight Warrior LLC said it was proceeding with a 160-mile crude pipeline to serve Eaglebine producers with service from the East Texas Eaglebine/Woodbine to Houston refining and export markets. The pipeline was scheduled for startup in the second quarter of 2016.

Counties

Texas: Brazos, Burleson, Grimes, Houston, Lee, Leon, Madison, Milam, Robertson, Walker

Local Major Pipelines

Natural Gas: Atmos, Enbridge Ghost Chili lateral, Energy Transfer, Enterprise Products, Gulf South, KM Tejas, Texas Eastern

Crude Oil: BP Pipelines, BridgeTex, Enterprise Crude Pipeline, ExxonMobil, Knight Warrior (proposed), Koch, Longhorn, Plains, Seaway, Sunoco Pipeline, SXL Interstate, TEPPCO South, West Texas Gulf (Sunoco)

NGLs: Arbuckle, Enbridge, Energy Transfer, Seminole, Southern Hills, Sterling, Sterling II, Sterling III (Proposed), Texas Express

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily