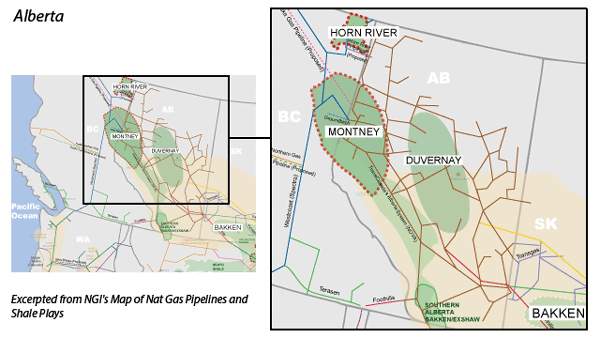

View more information about the North American Pipeline Map

Background Information about the Duvernay Shale

The Duvernay Shale is an emerging oil and liquids-rich gas formation in the Western Canada Sedimentary Basin that is thought to hold 443 Tcf of natural gas, 11.3 billion bbls of NGLs, and 61.7 billion bbls of oil, according to a report released in November 2012 by the Alberta Geological Survey.

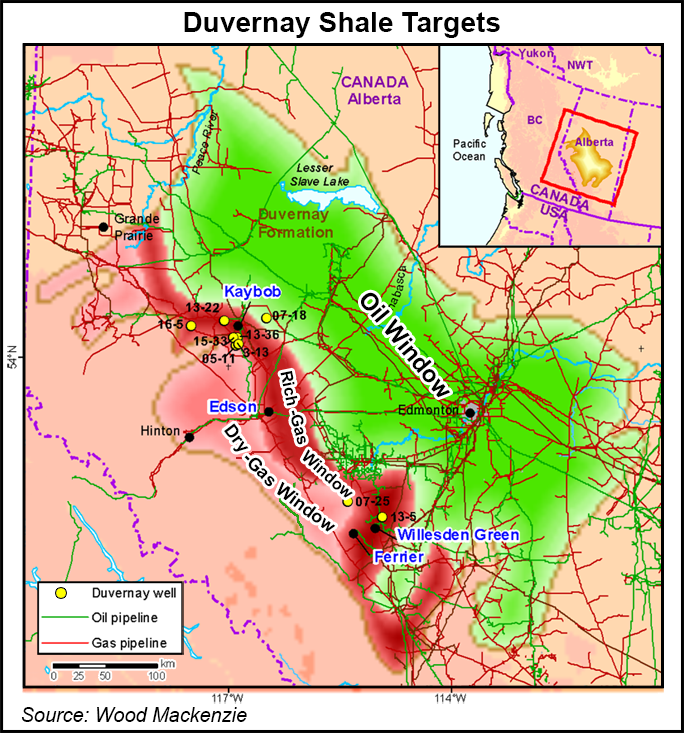

Consulting firm Wood Mackenzie Ltd. also highlighted the potential of the play in a report it issued only several weeks before the release of the Alberta Geological Survey study. “It has the potential to be as big as the Eagle Ford, but it’s a much different play,” said Wood Mackenzie analyst John Dunn. “It’s further on in life,” in terms of the shale’s formative life, but based on early well results, “it certainly has the potential.” In fact, many in the industry believe the Duvernay is the closest analog to the Eagle Ford, since they are both over-pressured reservoirs, and both formations feature volatile oil, condensate, wet gas, and dry gas windows that are all believed to be productive.

In a separate report in July 2015, Wood Mackenzie estimated that liquids production in the Duvernay would grow from 27,000 b/d in 2015 to more than 320,000 b/d in 2025. But the firm also noted that takeaway capacity in the play is constrained (see Shale Daily, June 24, 2015).

Macquarie Research noted that prospective operators spent C$1.4 billion to purchase more than 1 million acres in Alberta with Duvernay potential between late 2009 and August 2011, and Wood Mackenzie reported the industry had drilled roughly 80 Duvernay wells as of October 2012. Most of the activity has been centered in Kaybob in the northwest, which appears to be an early sweet spot. Drilling is expected to pick up south of Kaybob in Edson, Rimbey, Willesden Green and Ferrier as acreage is high graded, according to Andy McConn of Wood Mackenzie.

Even though the Duvernay has long been known to hold a lot of unconventional reserves, one thing that has inhibited full development until now is its remote location. But a lack of infrastructure isn’t a hindrance, at least not yet.

“It comes with development, and that is in early stages,” McConn told NGI’s Shale Daily. “What it would look like, in terms of pipelines, midstream operations, is the same thing that’s happened all across North America, which wasn’t prepared for the huge surge in production,” he said. “The Duvernay is subject to some of the same issues occurring in different plays, like the Bakken. In differentials, we’re not seeing quite the prices because it’s so early in the play’s life, but as development ramps up, we will see where the shortfalls are. But today infrastructure is not viewed as an inhibitor.”

Although the Duvernay Shale certainly has the potential to be a highly productive and economic play, its development has been very slow thus far, at least relative to other North American resource plays. For example, as of October 2014, there had not been much multi-well pad drilling in the region, an activity which is a hallmark of accelerated or “development mode” production. We believe there are several reasons for the slow pace of development in the Duvernay thus far:

1. Much of the acreage in the Duvernay is held by a block of large companies (see acreage table), and these entities either tend to focus on limiting production growth in order to maximize free cash flow over the long-term, or they are faster growers who have a number of other compelling properties in their portfolios that are competing for the same capital.

2. We believe the mineral rights to the Duvernay by and large are held by the Crown, and the Canadian government tends to issue less restrictive leases than those in the United States. Operators in the Duvernay have up to nine years to drill the formation in order to hold it by production, as opposed to the three years or so that is more typical in the U.S. As a result, Canadian operators have much more time to be selective in choosing which properties to drill.

3. The Duvernay is something of a deeper play, so that adds to drilling costs in the formation. Wood Mackenzie opined that the Duvernay “is home to some of the most expensive wells onshore” in North America, noting that total estimated costs to drill a well in late 2012 were US$12-14 million, versus most U.S. unconventional wells that were below $10 million at the time. Wood Mackenzie believes those costs will come down as producers use pad drilling, retain long-term hydraulic fracturing crews, have better water sourcing, and optimize completion techniques. In fact, several Canadian operators at an industry conference held in New York in October 2014 agreed that the ultimate goal is to get Duvernay drilling and completion costs down to US$10 million.

Gas production from the Duvernay could one day be liquefied and exported to Asian markets by any of the multiple liquefied natural gas export projects proposed for western Canada. The economics of Duvernay wells could also be helped because it is relatively close to Canadian oil sands (bitumen) production. The Duvernay is liquids rich, and the condensate it produces can be used as a diluent to help get the bitumen to market. Because of this, condensate prices out of the Duvernay actually have exceeded crude oil prices in the region many times in the recent past. Encana Corp. estimated on its 3Q2015 earnings call that the Duvernay earned rates of return in excess of 30% at $50/bbl crude oil.

In 2014, Encana built two eight-well pads in the Duvernay Shale between January and March (see Shale Daily, May 13, 2014). The company also secured two separate deals to process rich natural gas from the play. Under the first agreement, with joint venture partner Brion Duvernay Gas (formerly Phoenix Duvernay Gas), Encana agreed to process up to 195 MMcf/d for over five years, through 2020. The gas would be transported via the Alliance Pipeline to a plant in Channahon, IL owned by Aux Sable Liquids Products LP. The second agreement, also between Encana and Brion, calls for processing up to 180 MMcf/d and connecting with a receipt zone with Alliance in Alberta from November 2017 through 2020 (see Shale Daily, Nov. 24, 2014). Encana planned to spend $250-350 million on capital expenditures (capex) in the Duvernay in 2015, with accelerated development in the Simonette area (see Shale Daily, Dec. 16, 2014). Three to five rigs were to drill 15-25 net wells. Net liquids production from the Duvernay was expected to average 6,000-7,000 b/d.

Last February, in the wake of low commodity prices, Apache Corp. slashed its capex budget by $2 billion and streamlined its capital program, electing to work on efficiency improvements, downspacing and other testing to delineate its holdings in the Duvernay, among other plays (see Shale Daily, Feb. 12, 2015). The company placed its first Duvernay pad, consisting of 7 wells, online in October 2015. Those pad wells came in at roughly $11.6 million each, down from the $18.1 million per well the company spent drilling one off wells in the play in 2014.

Also last February, Encana said it would focus on the Duvernay and three other plays in 2015, with its development program in the Duvernay targeting the Kaybob and Simonette areas (see Shale Daily, Feb. 26, 2015). Encana said it planned to average two or three rigs there, to drill approximately 15 net wells, and would spend nearly $230 million, mostly for completions. Encana reported that during 2Q2015, its wells in the Duvernay had production rates of up to 2,000 b/d of condensate and 11.5 MMcf/d of natural gas after 27 days on production (see Shale Daily, July 24, 2015). Meanwhile, Royal Dutch Shell plc indicated that it would keep its assets in the Duvernay idle until commodity prices recover (see Daily GPI, July 30, 2015).

Chevron noted on its 3Q2015 earnings call that they are coming down the cost curve in the Duvernay, and have learned where the sweet spots of the play are located through its delineation drilling. The company just recently embarked on a horizontal drilling program.

Pembina Pipeline Corp. announced in November 2015 that it would begin construction of its third natural gas processing plant (see Shale Daily, Nov. 10, 2015). The plant, which would cost C$125 million (US$94 million) and be called the Duvernay 1, is forecast to start stripping up to 5,500 bbl out of 100 MMcf/d in 2017. The plant will be built at a site 260 kilometers (160 miles) northwest of Edmonton. Pembina has two new plants farther west, near the Alberta-British Columbia boundary: Musreau II, where construction was recently finished, and Musreau III with a completion target of 2016. Pipeline additions are also underway.

Other players in the Duvernay include Spain’s Repsol SA, Chevron Corp. and a unit of Kuwait Petroleum Corp. Repsol acquired part of its Duvernay portfolio through its takeover of Talisman Energy Inc. in late 2014 (see Shale Daily, Dec. 16, 2014). Meanwhile, Chevron sold a 30% stake in its Duvernay position to KUFPEC Canada Ltd. for $1.5 billion in the fall of 2014 (see Shale Daily, Oct. 6, 2014).

Provinces

Alberta

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily