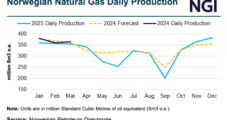

Equinor ASA expects competition for LNG with Asia and weather to be the largest drivers of European natural gas prices as markets continue to shift, creating a floor for global benchmarks. After another mild winter helped Europe exit its second heating season without major Russian pipeline gas supplies and sizable storage inventories, CFO Torgrim Reitan…

Earnings

Articles from Earnings

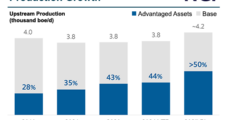

ExxonMobil Sees ‘Long-Term Future’ for Natural Gas and Oil – with Targets on Low Cost of Supply, Woods Says

ExxonMobil will add more natural gas – including LNG – into the portfolio, both in the United States and overseas, as long as they are “advantaged investment opportunities,” according to CEO Darren Woods. During the quarterly conference call on Friday, Woods was asked whether more liquefied natural gas assets would be added to the portfolio…

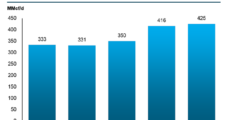

Matador Bullish Even on Weak Waha Prices, as NGLs Diversifying Delivery Options

Dallas-based independent Matador Resources Co. delivered better-than-expected results during the first quarter, with Permian Basin-heavy natural gas production jumping 36%. Gas output reached nearly 390 MMcf/d, 4% higher than guidance. That came even as average realized gas prices were $2.96/Mcf, about 25% lower year/year. What stoked the performance was the diversified portfolio, executives explained during…

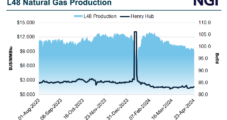

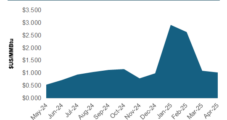

Plunging Haynesville Production Leads Overall Natural Gas Supply Cut; Price Response Muted

Natural gas exploration and production (E&P) companies in the Haynesville Shale continue to drive overall cuts to Lower 48 supply. Output there is down nearly 20% from a year earlier and continues to slide following well-telegraphed efforts to slow activity and balance an oversupplied market. Prices, however, have yet to respond, given a substantial supply…

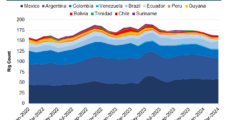

Latin America Oil, Natural Gas Activity Climbs for Halliburton, SLB and Weatherford

Performance in Latin America during the first quarter proved to be strong for Halliburton Co. and Weatherford International plc, with each reporting double-digit revenue gains from a year ago. The oilfield services giants joined SLB Ltd. and Baker Hughes Co. in reporting their quarterly results. SLB reported a 2% gain in sales year/year across its…

Range Resources Sees Strong Natural Gas Demand, Keeps Production Steady

Range Resources Corp. kept natural gas production steady through the first quarter, even as others pulled back, and it expects to maintain the same pace through 2024. The Appalachian Basin pure play’s executives reiterated to analysts during a call to discuss first quarter earnings on Wednesday that they intend to hold output flat this year.…

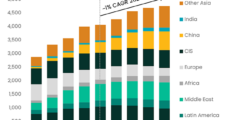

Baker Hughes CEO Heralds ‘The Age of Gas,’ Touts LNG as Climate Solution

The world’s energy companies are becoming more pragmatic in their approach to reaching net-zero emissions and Baker Hughes Co.’s customers plan to boost their natural gas exposure in the coming years, CEO Lorenzo Simonelli said. It is “becoming clearer just how complex the undertaking is for the transition of the world’s energy ecosystem,” Simonelli said…

EQT Plans MVP Expansion to Serve Data Center Boom in Southeast

EQT Corp. said it would continue cutting 1 Bcf/d of production as U.S. natural gas prices remain near four-year lows, but management anticipates strong power generation demand in the coming years that has it planning an expansion of the Mountain Valley Pipeline (MVP). After a seven-year battle and a congressional mandate rescued the system from…

Don’t Look Now but North American Natural Gas Demand to Soar in ‘25 and Beyond, Says Halliburton CEO

The timing for the next leg of growth in North America remains uncertain, but there’s “no question” that natural gas output will drive the market into 2025 and beyond because of LNG exports and rising electricity demand, Halliburton Co. CEO Jeff Miller said. Speaking to analysts during the first quarter conference call, Miller was asked…

SLB’s Strong International Oil, Natural Gas Business Overcomes Softer North American Activity

SLB Ltd., the world’s leading oilfield services operator, is forecasting “softness” to continue across North America’s oil and gas basins, but offshore activity is ticking higher. CEO Olivier Le Peuch held a conference call on Friday to discuss first quarter performance. Because the business reaches into every onshore and offshore area of the globe, SLB…