Weekly natural gas cash prices gained ground on the back of strong gains in West Texas in a week that was marked by stronger LNG feed gas flows and modestly higher weather-driven demand. NGI’s Weekly Spot Gas National Avg. for the April 22-26 trading period climbed 9.5 cents to $1.230/MMBtu. Among the top weekly gainers,…

Markets

Articles from Markets

May Natural Gas Futures Narrow Losses on Expiry Day; Cash Prices Fall

Natural gas futures fell Friday, with the May contract touching lows below $1.500/MMBtu before bouncing back on its last day as the front month. The June contract also fell, under pressure from milder weather patterns taking over and delaying expectations for summer’s heat to arrive. At A Glance: May Nymex rolls off board LNG exports…

Discounts Abound in Natural Gas Markets to Close Out Week — MidDay Market Snapshot

As mild weather threatened to further pad storage surpluses, natural gas futures sagged through midday trading Friday. Meanwhile, spot market buyers seeking supplies for weekend and Monday delivery were finding bargains aplenty. Here’s the latest: June Nymex futures down 7.5 cents to $1.911/MMBtu as of 2:15 p.m. ET From recent levels, natural gas futures face…

May Natural Gas Bidweek Prices Depressed on Second Day of Trade

As bidweek continued into a second day Thursday (April 25), baseload prices maintained the weak tenor established in Wednesday’s opener, according to NGI’s Bidweek Alert (BWA). Deal volumes were predominantly lower from Wednesday levels. Bidweek trading concludes on Friday. Leading on volume, Dawn in the Midwest saw 249,000 MMBtu/d in total volumes traded in 64…

Ahead of May Expiry, Natural Gas Futures Faltering as Storage Surplus Grows

As traders contemplated a swelling storage surplus amid mild springtime temperatures, natural gas futures were down sharply ahead of the front month expiration Friday. With volume thin in its final day of trading, the May Nymex contract was off 9.9 cents to $1.539/MMBtu as of 8:35 a.m. ET. June was trading 5.5 cents lower at…

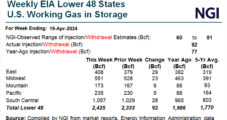

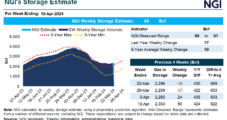

Natural Gas Futures Slide as Hefty Wind Generation Plumps Up Weekly Storage Print

Natural gas futures tried to shake off a stronger-than-expected government inventory print Thursday but settled lower as benign weather and LNG hiccups weighed. At A Glance: EIA reports 92 Bcf injection West Texas cash flips negative Freeport LNG stays down Following a nearly 16-cent decline, the May Nymex contract settled down 1.5 cents day/day at…

Natural Gas Forwards Slide Overall as West Texas Outlook Brightens for Bulls

With excess storage inventories continuing to hang over the market through the shoulder season, natural gas forwards declined notably at the front of the curve for most regions during the April 18-24 trading period, data from NGI’s Forward Look show. May fixed prices at benchmark Henry Hub exited the period at $1.653/MMBtu, down 6.1 cents…

Natural Gas Futures Steady Following Midweek Swoon — MidDay Market Snapshot

After a midweek nosedive, natural gas futures hovered close to even through midday trading Thursday, largely weathering the bearish impact of a high-side injection miss in the latest U.S. Energy Information Administration (EIA) storage data. Here’s the latest: Soon-to-expire May Nymex futures down 2.2 cents to $1.631/MMBtu at around 2:10 p.m. ET Henry Hub spot…

Mild Weather and Supply Woes Weigh on May Natural Gas Bidweek Prices

Baseload natural gas prices were trending lower for May delivery as mild weather and a glut of supply in Texas kept bidders from rushing to buy on the first day of bidweek trading Wednesday (April 24), according to NGI’s Bidweek Alert (BWA). In West Texas, Waha traded at fixed prices between negative 44.0 cents and…

Natural Gas Futures Extend Slide Ahead of Potentially Plump Injection

After selling off sharply in the previous session, natural gas futures remained under pressure early Thursday as traders prepared to digest a potential surplus-expanding government inventory report. The May Nymex contract was off 0.4 cents to $1.649/MMBtu at around 8:30 a.m. ET. June was down 2.6 cents to $1.953. The market early Thursday was expecting…