Background information about the Marcellus Shale

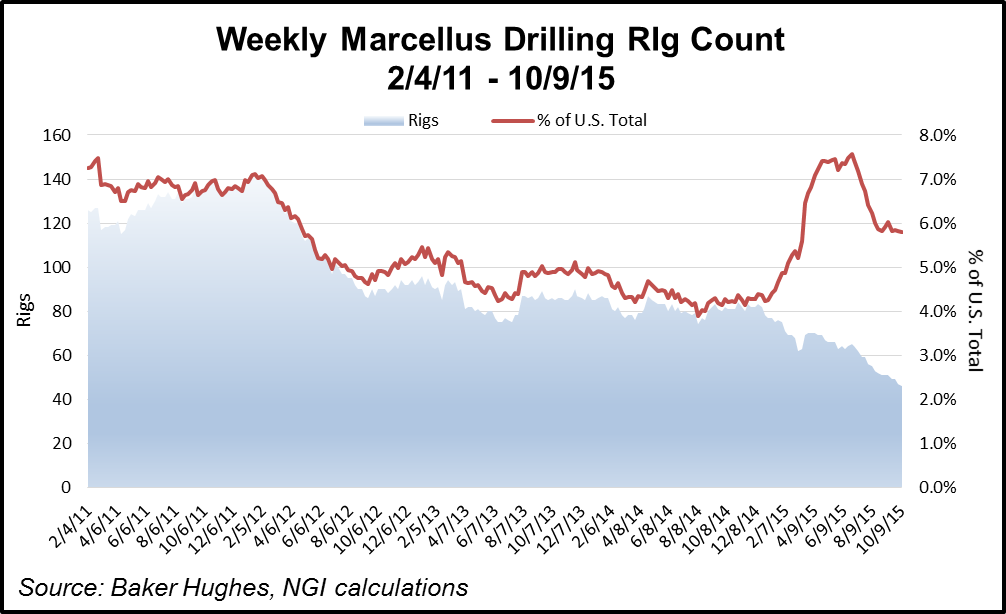

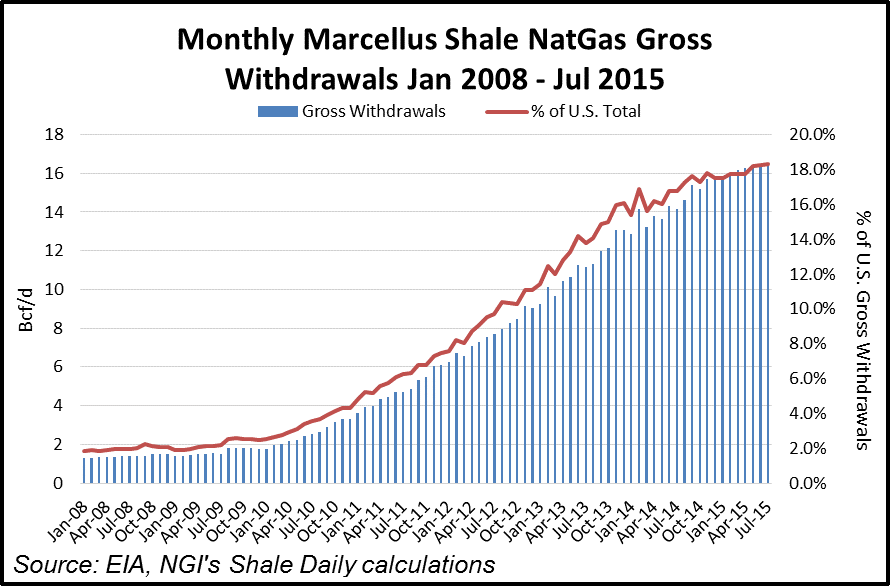

The Marcellus Shale remains one of the most prolific plays in North America, in terms of both acreage and reserve potential. It is among the fastest growing sources of natural gas production in the United States, rising from less than 1.7 Bcf/d at the beginning of 2010 to 16.4 Bcf/d in July 2015. In Pennsylvania alone, according to state data, operators produced more than 4 Tcf of natural gas — mostly from the Marcellus Shale — in 2014 (see Shale Daily, Feb. 17, 2015). While a commodities downturn was expected to push production down to roughly 15.9 Bcf/d heading into the end of 2015, according to the EIA, the Northeast is still expected to drive a significant portion of the country’s natural gas production in 2016 and beyond.

In a September 2015 survey by Jefferies LLC, analysts projected the country to exit 2016 producing roughly 72 Bcf/d, down 0.8% from 2015’s projected exit rate. While slowing growth in the Northeast was partly expected to help push that number down, combined with the Utica Shale, Marcellus Shale natural gas production in West Virginia and Pennsylvania is still projected to increase 8% and 4% from 2015 levels, respectively. Although the growth needle was expected to move slower than in recent years on lower capital spending, fewer rigs and restricted takeaway, Jefferies said its model shows 2016 Northeast supply increasing by 1.4 Bcf/d year-over-year — split fairly equally between both the Marcellus and Utica. Even after a year of falling oil prices and depressed natural gas, the EIA at mid-year 2015 projected that natural gas production in the Marcellus Shale would ultimately reach an astounding 147 Tcf through 2040.

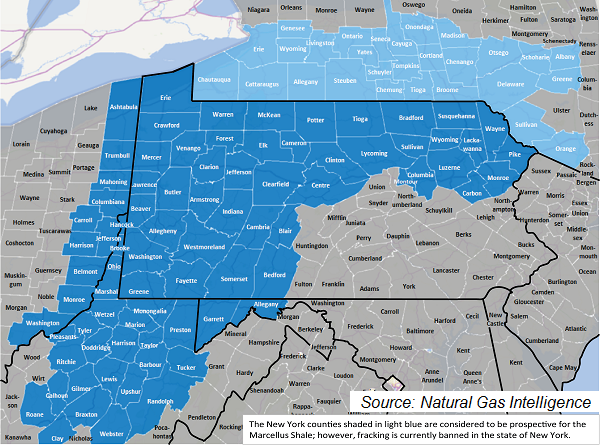

Much of the industry activity to date in the Marcellus has centered in Pennsylvania and West Virginia, where thousands of wells have been drilled. There has been limited drilling in East Ohio and Western Maryland as well. In Ohio, where operators typically drill the Marcellus from multi-well pads that share the Utica, just 43 Marcellus wells have been permitted and 28 have been drilled, according to state data at the time of this writing. The formation is also considered highly prospective in Southern New York, but a ban on high-volume hydraulic fracturing in that state currently prevents any development there (see Shale Daily, June 29, 2015).

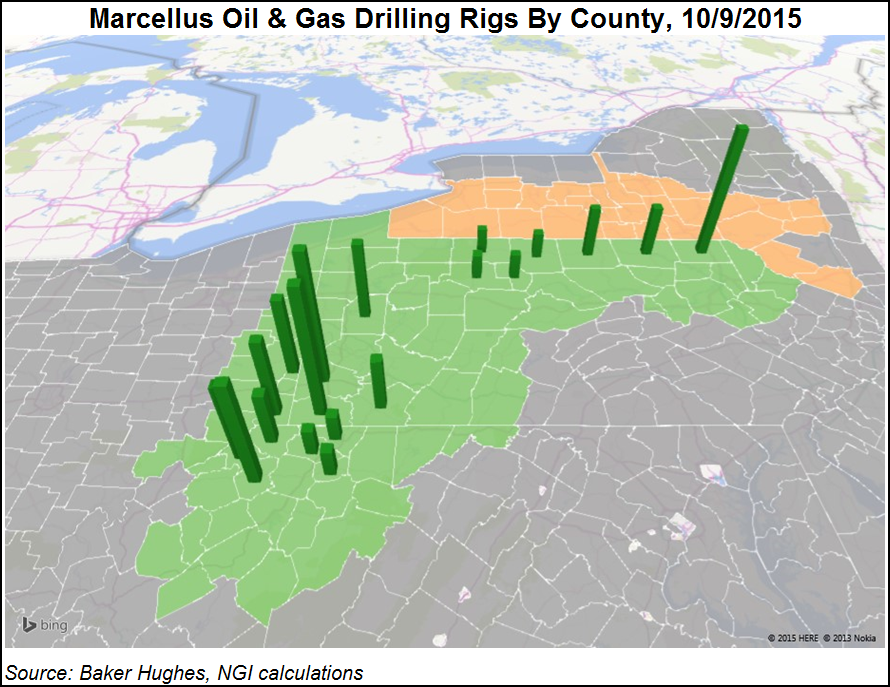

Range Resources Corp. drilled the first Marcellus well in 2004, the vertical Renz #1 well in Southwest Pennsylvania’s Washington County. Much of the play’s initial industry development occurred in that part of the state, as well as in neighboring West Virginia. Production in those areas features a dry and a wet gas window.

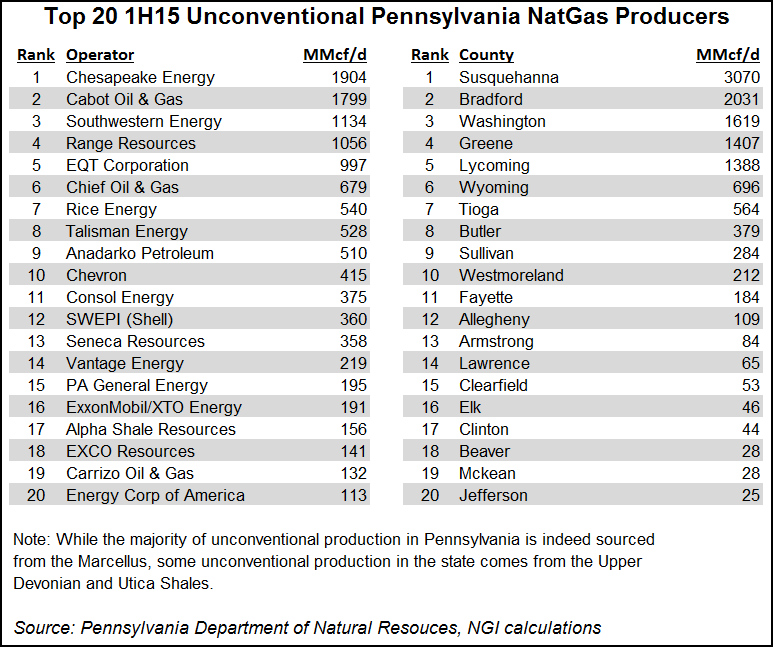

The first Marcellus well in Northeast Pennsylvania was drilled several years later. Despite the fact that production in that region is primarily dry gas, some of which has been hindered by a lack of takeaway capacity for years now, Northeast Pennsylvania is currently home to two of the state’s most productive counties: Susquehanna and Bradford counties, according to state data released at year-end 2014, the latest available at the time of this writing.

Although it remains the Appalachian Basin’s low-risk, high-quality asset, more of the region’s leading producers, however, are slowly turning their attention away from the Marcellus to what lies underneath it. Range Resources, EQT Corp. and Consol Energy Inc. have all tested Utica Shale wells in Pennsylvania at 59 MMcf/d or more. Similar results in West Virginia have operators considering a shift in their 2016 capital budgets. The Pennsylvania tests were conducted in the southwest part of the state — in Greene, Westmoreland and Washington counties. EQT said in late 2015 that it would both suspend its Upper Devonian Shale drilling and defer some Marcellus wells to build in a 10 well deep, dry Utica program in 2016. Similarly, Consol’s management said in late 2015 that they would lean more heavily on the Utica for production growth in the coming years. Range Resources has determined that, for now, estimated ultimate recoveries (EUR) in the Utica can’t compete with its Marcellus assets. After the company completes a third Utica well in Southwest Pennsylvania in early 2016, it would stop and continue developing the Marcellus, management has said.

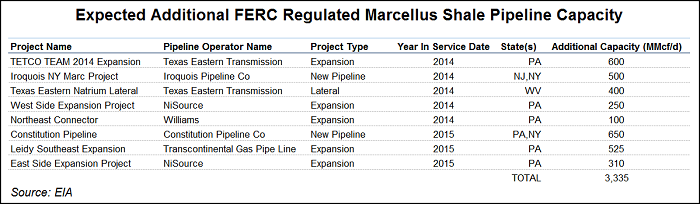

Natural gas tends to be priced differently throughout Pennsylvania and West Virginia, and for that reason, we have established separate Southwest Pennsylvania/West Virginia and Northeast Pennsylvania price indexes for the Marcellus Shale in our NGI’s Shale Daily publication.The pace of production growth in the Marcellus might have been even faster to date, if it were not for a lack of midstream capacity in the area. Bottlenecks in the Marcellus will begin to ease in earnest in 2016, but the rapid growth of production in the face of pipeline constraints has done a number on basis differentials in the region. Appalachia producers used to enjoy a premium to Gulf Coast pricing, but that has all but disappeared in recent months.

In fact, weak netback prices led producers to curtail approximately 1.2 Bcf/d of production in the Appalachia as of November 2015. roughly 750 MMcf/d of which were in Bradford and Susquehanna Counties, PA.

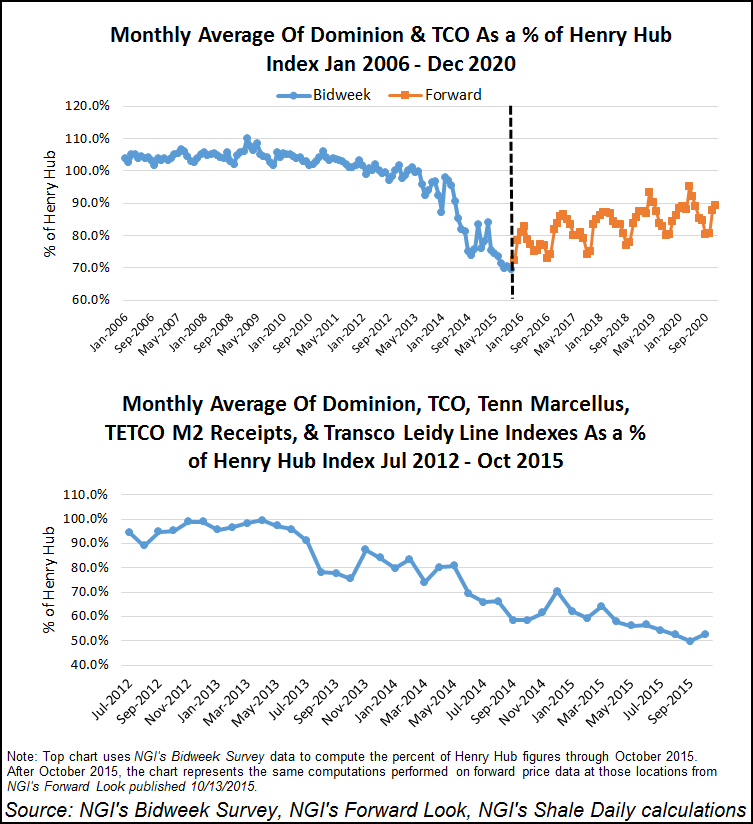

The premium of the average of NGI’s Columbia Gas (TCO) and Dominion Bidweek Indexes to the Henry Hub Index has been in a steady decline since peaking at 110.1% in February 2009, so much that the average of those two Appalachian pipes has traded at a growing discount to the Hub through October 2015. The Appalachian basis discount is even more pronounced when we take the average of Columbia Gas, Dominion, and our Tennessee Marcellus, Texas Eastern M2-Receipts, and Transco-Leidy indices. We began publishing these latter three indices at various points in mid-2012.

But help is on the way. Several projects came on line in 2015 to help the capacity issue, most notably the Rockies Express East-to-West expansion, which added 1.2 Bcf/d of incremental westbound capacity from its easternmost point in Clarington, OH, to Moultrie, IL. The output of Appalachian producers moving to the Midwest on the large-diameter REX pipeline is expected to be felt throughout much of the continental pipeline network. As a result, and in order to more closely follow daily flows in the region on REX, NGI has developed the Rockies Express Zone 3 tracker.

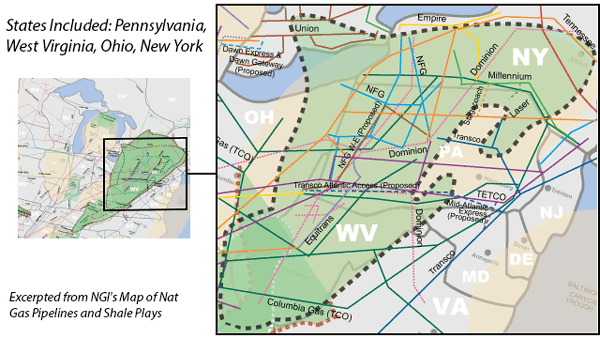

Longer-term, there are numerous natural gas pipelines that are in various stages of development to increase takeaway capacity out of the Marcellus and Utica, so much so that both Range Resources and Eclipse Resources estimate that there will be at least 6.1 Bcf/d and 14.0 Bcf/d of excess capacity out of Appalachia in 2016 and 2017, respectively. Range forecasts that excess capacity rises to 21.1 Bcf/d in 2018.

To be fair, those estimates may prove to be a bit aggressive, since they include some projects that may not be built. For example, some of the industry’s leading executives and pundits do not expect both of the competing Mountain Valley Pipeline and the Transco Atlantic Sunrise expansion line, nor both of the competing Nexus Gas Transmission and Rover Pipelines to be built. As of October 2015, three of those projects remained in progress.

But excess capacity from Appalachia does appear to be forthcoming, and we believe that will have two major implications for operators in the Marcellus in particular. One is that the ability to move Appalachian gas to many more points throughout the United States and Canada greatly increases the probability that the price of U.S. natural gas will be determined largely by the incremental cost of production in Appalachia. There is no question that the basin represents the fastest growing, and therefore the incremental source of natural gas supply in the United States. But if enough of that gas cannot move out of the region, it can only have so much impact on the price of gas in other parts of country. That will likely no longer be an issue by the end of 2018.

The other major impact is on netback prices in the Appalachia. Whether growing takeaway capacity will be enough to improve basis differentials in the Marcellus will depend on a number of factors, such as the continued pace of development in the Marcellus itself; competing supply from the nearby Utica Shale; the ability of Eastern Canada to accept more imports from the U.S., and throughput at the Cove Point LNG export facility in Maryland. Cove Point, which consists of 136 miles of natural gas pipeline to connect it with interstate lines, has already generated revenue and earnings from annual payments under regasification, storage and transportation contracts. In September 2014, the Federal Energy Regulatory Commission authorized the proposed export facility, making it the first East Coast export project to proceed after earning U.S. Department of Energy approval in 2013. Under current plans, the Cove Point export operations could be in service by late 2017, with approval to export up to 5.75 million tons of LNG per year. Construction on the facility began in October 2014 and was 47% complete in 4Q15, according to Dominion Resources Inc.

So far, it looks like future Marcellus basis differentials are expected to improve somewhat, as seen by the forward price outlook in the chart shown earlier in this section.

As previously mentioned, the Marcellus is generally considered to be dry gas, particularly in Northeast Pennsylvania. However, the gas is more liquids-rich in a number of counties in Southwest Pennsylvania and West Virginia. Several NGL pipelines have been built or proposed to handle the increase in ethane and liquids production out of this area, including Enterprise Products Partners LP’s Appalachia-to-Texas Express (ATEX); Kinder Morgan Inc.’s Utica Marcellus Texas Pipeline (UMTP); Sunoco Logistics Partners LP’s Mariner East 1, 2 and 3 and Mariner West. Responding to shipper demands, Sunoco launched a binding open season in September 2015 for the Mariner East 2 Expansion Project (Mariner East 3) (see Shale Daily, Sept. 14, 2015). NGLs would be shipped on all three Mariner East pipelines to the company’s Marcus Hook Industrial Complex, south of Philadelphia, for distribution to local, domestic and international markets. Propane deliveries have already started on Mariner East 1, while ethane deliveries were expected to begin in 4Q2015. All three pipelines would have a combined capacity of 770,000 b/d.

Marcus Hook is also expected to be a major hub for international ethane exports. Petrochemical giant INEOS Europe AG became the first European company to contract for U.S. ethane feedstock in 2012, when it agreed to transport Range Resources’ ethane overseas. The first U.S. ethane shipments to Europe were on track to begin in late 2015 and escalate throughout 2016 and 2017. In June 2015, INEOS accepted delivery of the first ship in an eight-vessel fleet that would specialize in the intercontinental deliveries.

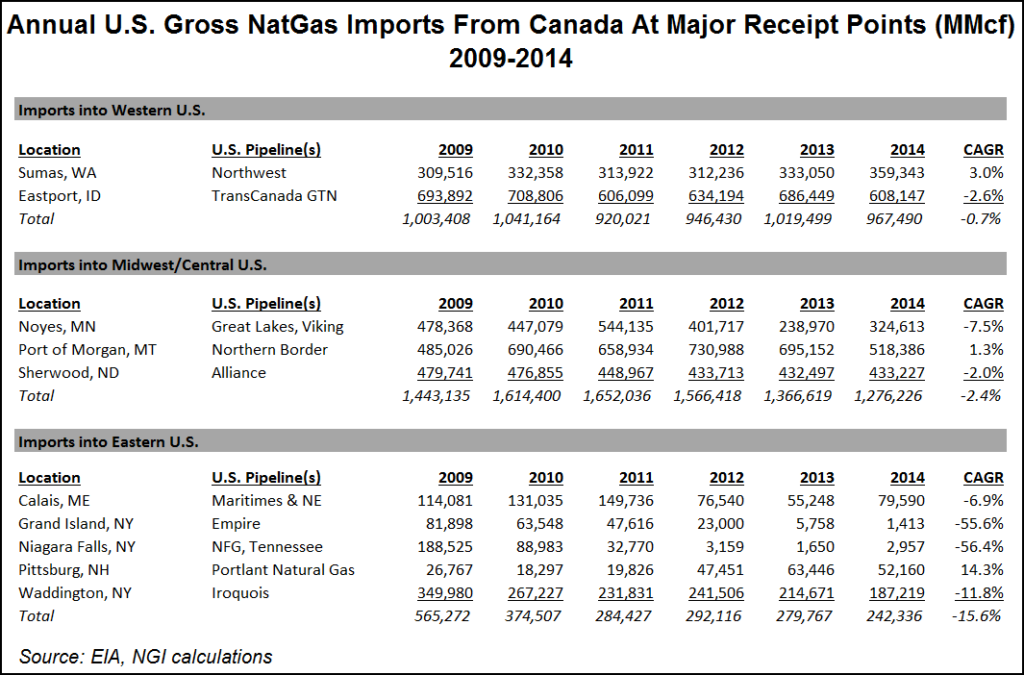

Increased Marcellus production has led to a significant decline in the amount of natural gas the eastern U.S. imports from Canada. U.S. gross imports into the Eastern U.S. have fallen from 565 MMcf/d in 2009 to just 242 MMcf/d in 2014, good for a cumulative annual growth rate of -15.6%. Niagara has turned into a net export point for the U.S., and is expected to grow with several planned infrastructure expansions scheduled to come on line in the next year.

Counties

Maryland: Allegany, Garrett

Pennsylvania: Allegheny, Armstrong, Beaver, Bedford, Blair, Bradford, Butler, Cambria, Cameron, Carbon,Centre, Clarion, Clearfield, Clinton, Columbia, Crawford, Elk, Erie, Fayette, Forest, Greene, Indiana, Jefferson, Lackawanna, Lawrence, Luzerne, Lycoming, McKean, Mercer, Monroe, Montour, Pike, Potter, Somerset, Sullivan, Susquehanna, Tioga, Venango, Warren, Washington, Wayne, Westmoreland, Wyoming

West Virginia: Barbour, Braxton, Brooke, Calhoun, Clay, Doddridge, Gilmer, Hancock, Harrison, Lewis, Marion, Marshall, Monongalia, Ohio, Pleasants, Preston, Randolph, Ritchie, Roane, Taylor, Tucker, Tyler, Upshur, Webster, Wetzel

Ohio: Ashtabula, Belmont, Carroll, Columbiana, Guernsey, Harrison, Jefferson, Lake, Mahoning, Monroe, Trumbull, Washington

New York: Albany, Allegany, Broome, Cattaraugus, Cayuga, Chautauqua, Chemung, Chenango, Cortland, Delaware, Erie, Genesee, Greene, Livingston, Madison, Onondaga, Ontario, Orange, Ostego, Schoharie, Schuyler, Seneca, Steuben, Sullivan, Tioga, Tompkins, Wyoming, Yates

Local Major Pipelines

Natural Gas: Columbia Gulf Transmission, Constitution Pipeline (Proposed), Dominion Transmission, Empire Pipeline, Equitrans, Leidy Hub, Millennium, Mountain Valley (Proposed), Nexus Gas Transmission (Proposed), National Fuel Gas, Rover (Proposed), Spectra Carolina (Proposed), Tennessee, Texas Eastern Transmission, Transco

Crude Oil: None

NGLs: ATEX Express, Mariner East, TEPPCO, UMTP (Proposed)

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily