Northern Oil and Gas Inc. has agreed to acquire “substantially all” the nonoperated Permian Basin assets owned by affiliates of Veritas Energy LLC, including 6,000 oil-weighted net acres. The transaction for $406.5 million was announced earlier this month. “This transaction completes the strategic transformation of our business that began in 2018,” CEO Nick O’Grady said.…

Tag / Acquisitions

SubscribeAcquisitions

Articles from Acquisitions

India’s Reliance Exits North America in Eagle Ford Deal with Ensign

A unit of Indian conglomerate Reliance Industries Ltd. reported Monday that it has divested all of its unconventional natural gas assets and has exited North America. Earlier this year Reliance pulled out of Appalachia. The latest exit follows Ensign Natural Resources LLC’s buyout of Reliance Eagleford Upstream Holding LP’s working interest in leases and wells…

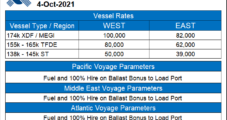

Stonepeak Expanding Natural Gas Reach by Taking Teekay LNG Private in $6.2B Deal

Private investment firm Stonepeak Infrastructure Partners is expanding its reach in the liquefied natural gas (LNG) shipping space with the takeover of Teekay LNG in a transaction valued at $6.2 billion. The deal announced Monday would give New York-based Stonepeak access to the third-largest LNG carrier fleet in the world. Teekay owns or has stakes…

ConocoPhillips Snapping Up Shell’s Permian Portfolio for $9.5B

Houston-based ConocoPhillips on Monday agreed to pay $9.5 billion to buy Royal Dutch Shell plc’s Permian Basin portfolio, which a Shell executive said reflected “our focus on value over volumes” as it accelerates its energy transition from fossil fuels. Shell’s Permian business includes ownership in 225,000 net acres with current production of around 175,000 boe/d.…

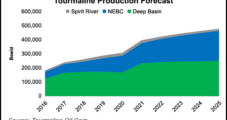

Canada’s Tourmaline Gets Natural Gas Production Bump After Acquisitions

Canadian independent Tourmaline Oil Corp. broke production records in 4Q2020 after a pair of acquisitions boosted its output. The independent which has assets in British Columbia and Alberta, said recently it exited the quarter producing more than 400,000 boe/d after acquiring smaller Canadian players Jupiter Resources Inc. and Modern Resources Inc. in December. The deals…

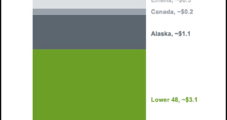

ConocoPhillips Sees ‘External Pressures’ Mounting for Energy Industry as Biden Presidency Begins

The Lower 48 will again factor heavily into ConocoPhillips’ operating plans this year despite what the company’s chief executive said are “external pressures” facing the industry as the Biden administration appears ready to more actively regulate oil and natural gas operations. Meanwhile, the world’s largest independent continues grappling with a global economy weakened by the…

Enerplus Builds Bakken Stronghold with Takeover of Pure-Play Bruin E&P

Canadian producer Enerplus Corp. has gained more exposure in North Dakota’s Bakken Shale with a $465 million takeover of Houston-based Bruin E&P HoldCo LLC. The deal announced Monday for the North Dakota assets of the Bakken pure-play is forecast to propel a 20% production jump for Calgary-based Enerplus to a combined 103,500-108,500 boe/d. The acquired…

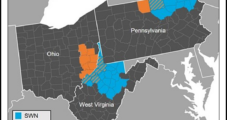

Southwestern Strikes All-Stock Deal for Appalachian Pure-Play Montage

Southwestern Energy Co. agreed to acquire Montage Resources Corp. in an all-stock deal that would create the third largest oil and natural gas producer in the Appalachian Basin, with 3 Bcfe/d of combined production. The deal is valued at $857 million, including debt, according to Raymond James & Associates Inc. It would give the Houston-based…

Northern Oil Looking to Continue Williston Bolt-On ‘Ground Game’

Northern Oil and Gas Inc. executives said oil price volatility increased its opportunities for small “ground game” acquisitions in 4Q2018, and plans are to look for bigger prospects in the Williston Basin this year.

Massachusetts Firm Sets Bi-Coastal Virtual Oil Pipeline

With acquisitions and infrastructure agreements in hand, Waltham, MA-based Global Partners LP, a publicly traded master limited partnership, is establishing a “virtual pipeline” for shipping North Dakota Bakken and Canadian crude oil to refineries on both the U.S. West and East Coasts.