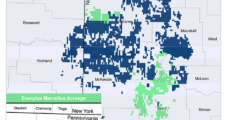

Privately held exploration and production (E&P) firms in the Eagle Ford Shale and Midcontinent regions could prove attractive targets for public producers seeking exposure to future strengthening of natural gas prices, according to Enverus Intelligence Research (EIR). EIR’s Andrew Dittmar, principal analyst, highlighted the Eagle Ford, the South Central Oklahoma Oil Province (SCOOP) and the…

M&A

Articles from M&A

Kimmeridge Looks to Add to SilverBow’s Board After Pulling Merger Offer

Activist investor Kimmeridge Energy Management Co. LLC has withdrawn its proposal to merge its natural gas-focused subsidiary with Eagle Ford Shale producer SilverBow Resources Inc. The New York-based investment firm, which holds a 12.9% stake in SilverBow, in March proposed a tie-up between Kimmeridge Texas Gas LLC (KTG) and the Eagle Ford producer along with…

SLB Jumping into Merger Game with ChampionX, Aker Carbon Deals to Accelerate E&P Efficiencies, CCUS

In its second transaction in less than a week, SLB Ltd. agreed Tuesday to buy ChampionX Corp., considered a leader in oilfield reservoir optimization. The all-stock merger with ChampionX, headquartered in The Woodlands north of Houston, was valued at nearly $8 billion. Once the transaction is completed, now expected by year’s end, ChampionX shareholders would…

SilverBow Reviewing Kimmeridge Proposal to Form Biggest Eagle Ford Pure-Play

SilverBow Resources Inc.’s board plans to “carefully review and consider” a proposal from activist investor Kimmeridge Energy Management LLC to merge its natural gas production subsidiary in a tie-up that could become the largest South Texas exploration and production company. In a letter to shareholders, Kimmeridge proposed to merge Kimmeridge Texas Gas LLC (KTG) into…

Amid Oil and Natural Gas Consolidation Frenzy, Chevron’s Guyana Mega-Deal Facing Hurdles

ExxonMobil is trying to put a stop to Chevron Corp. and its bid to enter the lucrative Guyanese offshore oil and natural gas patch. The company has filed for arbitration, claiming Chevron’s bid to snap up Hess Corp.’s Guyana assets goes against a contract clause that grants ExxonMobil a right of first refusal. Last October,…

EQT’s Rice Touts Natural Gas ‘Competitive Advantage’ in $5B-Plus Recombination Deal with Equitrans

EQT Corp., the largest natural gas producer in the United States, agreed Monday to buy former entity Equitrans Midstream Corp., bringing back together Appalachian-based giants in what executives said was a game-changing opportunity. The all-stock transaction, estimated Monday at around $5.5 billion, would hold 27.6 Tcfe of proved reserves across nearly two million net acres.…

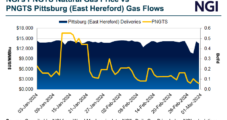

TC Offloading New England Natural Gas System to Advance Strategy

TC Energy Corp. has inked a $1.14 billion agreement to sell the Portland Natural Gas Transmission System (PNGTS) to BlackRock Inc. and Morgan Stanley Infrastructure Partners as it pares debt and streamlines its North American pipeline business. The Calgary-based pipeline giant holds 61.7% ownership of PNGTS, a 295-mile, 290 million Dth/d line. Énergir LP subsidiary…

Atlas Energy, Hi-Crush Combination Set to Deliver ‘More Sand, More Barrels’ for Permian E&Ps

Austin, TX-based Atlas Energy Solutions Inc. has clinched an agreement valued at $450 million to acquire Hi-Crush Inc., merging two proppant sand operators to create the largest operator in the Permian Basin. In the agreement, scheduled for completion by the end of March, Atlas would pay $150 million cash, trade $175 million in common shares…

Jera Inks Equity, Offtake Agreements for Woodside’s Scarborough LNG Project

Jera Co. Inc., one of the world’s largest LNG buyers, has secured a 15.1% stake in Woodside Energy Group Ltd.’s Scarborough project as it continues to look for stable long-term supply for Japanese power production. Under the transaction, valued at $1.4 billion, Jera would obtain a non-operating interest in the Scarborough partnership and offtake an…

Chord, Enerplus Building $11B Bakken Oil, Natural Gas Heavyweight with Merger

Chord Energy Corp. has agreed to acquire fellow Williston Basin producer Enerplus Corp. in a stock and cash transaction that would create a company with a combined enterprise value of about $11 billion. The purchase price equates to almost $4 billion, based on closing share prices Wednesday when the deal was announced, noted Enverus Intelligence…