Equinor ASA expects competition for LNG with Asia and weather to be the largest drivers of European natural gas prices as markets continue to shift, creating a floor for global benchmarks. After another mild winter helped Europe exit its second heating season without major Russian pipeline gas supplies and sizable storage inventories, CFO Torgrim Reitan…

LNG

Articles from LNG

LNG Said Vital for Argentina’s Vaca Muerta to Reach Potential

Argentina’s vast natural gas resources would only be fully developed with an LNG export facility, according to experts who spoke at a recent energy conference. “Clearly we think we need to develop the regional market,” said Pampa Energía’s director of commercialization and midstream, Santiago Patrón. The executive at one of Argentina’s top natural gas producers…

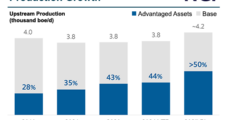

ExxonMobil Sees ‘Long-Term Future’ for Natural Gas and Oil – with Targets on Low Cost of Supply, Woods Says

ExxonMobil will add more natural gas – including LNG – into the portfolio, both in the United States and overseas, as long as they are “advantaged investment opportunities,” according to CEO Darren Woods. During the quarterly conference call on Friday, Woods was asked whether more liquefied natural gas assets would be added to the portfolio…

Hammerfest, Freeport Outages Send Global Natural Gas Prices Higher – Three Things to Know About the LNG Market

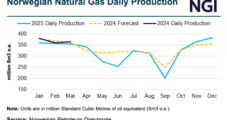

NO. 1: A gas leak at the Hammerfest LNG export terminal in Norway that occurred during maintenance has shut the plant down until Friday. The facility, which is operated by Equinor ASA was evacuated Tuesday, and the leak has since been stopped. The cause is under investigation. Hammerfest is Europe’s only large-scale export terminal. It…

Navigating the New LNG Regulatory Landscape – Listen Now to NGI’s Hub & Flow

Click here to listen to the latest episode of NGI’s Hub & Flow podcast. Neil Chatterjee, a former FERC chairman and commissioner, joins NGI’s Jamison Cocklin, managing editor of LNG, to discuss the political and regulatory aspects of President Biden’s pause on authorizing new liquefied natural gas export projects. Chatterjee, an environmental and energy attorney…

Baker Hughes CEO Heralds ‘The Age of Gas,’ Touts LNG as Climate Solution

The world’s energy companies are becoming more pragmatic in their approach to reaching net-zero emissions and Baker Hughes Co.’s customers plan to boost their natural gas exposure in the coming years, CEO Lorenzo Simonelli said. It is “becoming clearer just how complex the undertaking is for the transition of the world’s energy ecosystem,” Simonelli said…

Freeport LNG Reports Second Train 3 Outage in Two Weeks as Maintenance Continues

Freeport LNG Development LP has reported another outage of its third train, currently the only one not under extensive maintenance at its Texas terminal, days after production appeared to resume, according to pipeline data and regulatory filings. The firm told Texas environmental regulators the unit experienced a system trip on Tuesday afternoon that lasted until…

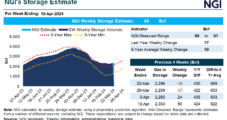

Natural Gas Futures Extend Slide Ahead of Potentially Plump Injection

After selling off sharply in the previous session, natural gas futures remained under pressure early Thursday as traders prepared to digest a potential surplus-expanding government inventory report. The May Nymex contract was off 0.4 cents to $1.649/MMBtu at around 8:30 a.m. ET. June was down 2.6 cents to $1.953. The market early Thursday was expecting…

Gulf Coast LNG Construction Milestones Mount, Foreshadowing Growing U.S. Natural Gas Demand

The outlook for added feed gas demand in the coming months is beginning to firm, portending a possible tight supply balance next year. Earlier in the week, Cheniere Energy Inc. asked FERC for permission to connect the first train of its Stage 3 expansion at Corpus Christi to power and gave an update of its…

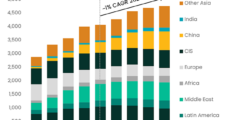

EU Energy Watchdog Says LNG Demand Could Peak This Year

The European Union’s (EU) LNG demand is likely to peak this year and buyers on the continent are likely to be over-contracted by 2030 as efforts to displace Russian natural gas over the last two years have been successful, according to the bloc’s energy watchdog. Since 2022, when Russia invaded Ukraine and cut off gas…