Undeterred by the prospect of a hefty triple-digit build in the latest round of government inventory data, natural gas futures rode their recent upward momentum to early gains Thursday. After climbing 9.3 cents in the previous session, the November Nymex futures contract was up another 19.0 cents to $7.120/MMBtu at around 8:40 a.m. ET. Predictions…

Topic / NGI Archives

SubscribeNGI Archives

Articles from NGI Archives

Natural Gas Futures Reverse Lower Early as Technical Outlook Said Unchanged

With prices still hovering between key technical inflection points as traders size up winter supply risks, natural gas futures reversed lower in early trading Friday. Giving back gains from the previous session, the October Nymex contract was off 19.9 cents to $9.063/MMBtu as of around 8:45 a.m. ET. From a technical standpoint, the outlook for…

September Natural Gas Rebounds Early as Traders Await EIA Report

Natural gas futures rebounded in early trading Thursday as traders awaited the latest government inventory data, expected to show a lighter-than-average summer injection into Lower 48 stockpiles. After posting an 8.5-cent loss in the previous session, the September Nymex contract was up 12.6 cents to $9.370/MMBtu as of around 8:45 a.m. ET. Estimates ahead of…

Euro Weather Model Seen Leaning Cooler as Natural Gas Futures Called Slightly Higher

Natural gas futures pared some of their losses in early trading Wednesday as traders were left to contemplate August forecasts that advertised less intense summer heat. After tumbling 57.7 cents in Tuesday’s session, the September Nymex contract was up 6.6 cents to $7.772/MMBtu at around 8:55 a.m. ET. The American weather modeling added cooling degree…

Volatility Expected into August Expiry as Natural Gas Futures Pull Back Early

Natural gas futures retreated in early trading Wednesday as analysts predicted more volatility heading into the prompt month expiration. The August Nymex contract, set to roll off the board Wednesday, was down 24.3 cents to $8.750/MMBtu at around 8:45 a.m. ET. Natural gas prices went on a “wild ride” in Tuesday’s session, turning in a…

Natural Gas Futures Pare Gains as Traders Look Ahead to EIA Report

Coming off a furious rally in the previous session, natural gas futures pared their gains early Thursday as traders awaited the latest round of government inventory data for more insights into how sweltering temperatures have impacted balances. After rocketing 74.3 cents higher in Wednesday’s session, the August Nymex contract was off 21.4 cents to $7.793/MMBtu…

Natural Gas Futures Pare Gains Early as Forecasts Ease Back on Heat

Shrugging off weaker numbers in updated production estimates, natural gas futures pared their gains in early trading Tuesday as sweltering forecasts cooled somewhat. The August Nymex futures contract was off 24.7 cents to $7.232/MMBtu at around 8:40 a.m. ET, cutting into the previous session’s 46.3-cent rally. Updated domestic production estimates from Wood Mackenzie were showing…

Spurred by ‘Searing Heat,’ Natural Gas Futures Continue to March Higher

Continued expectations for widespread sweltering temperatures based on the latest forecasts had natural gas futures surging higher in early trading Monday, extending gains from late last week. After posting a 41.6-cent gain in Friday’s session, the August Nymex contract was up 23.4 cents to $7.250/MMBtu as of around 8:50 a.m. ET. Major weather models over…

July Cooling Demand Bolsters Natural Gas Futures as Traders Await Storage Data

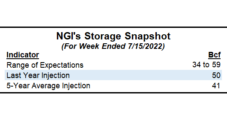

A robust cooling demand outlook into the second half of July supported further gains for natural gas futures early Thursday as traders prepared to assess the latest government inventory data. The August Nymex contract was up 19.0 cents to $6.879/MMBtu at around 8:50 a.m. ET, extending a 52.6-cent rally from the previous session. Surveys ahead…

Natural Gas Futures Just Shy of Even Early Friday as Analysts Mull EIA Surprise

While traders and analysts continued to mull the implications of a leaner-than-expected build in the latest government inventory data, natural gas futures were trading close to even early Friday. After dipping as low as $6.079/MMBtu in after-hours trading, the August Nymex contract was off 0.1 cents to $6.296 at around 8:50 a.m. ET. The Energy…