Despite a slower than expected economic recovery from the Covid-19 pandemic, China gradually regained its position as the world’s largest LNG importer in July, raising the potential for a winter supply squeeze. China’s liquefied natural gas imports from the beginning of the year through July totaled 42.2 million tons (Mt), placing it around 2 Mt…

Rystad

Articles from Rystad

World’s Natural Gas, Oil Reserves Seen Gaining on Efficiencies, Led by Lower 48, Deepwater

Natural gas and oil investments around the world may be lower today, but activity and production levels remain on par with the industry’s halcyon period between 2010 and 2014, according to Rystad Energy. “Persistent claims of chronic underinvestment in the global oil and gas industry are overblown,” researchers said. Upstream Investments have declined since spending…

Russian LNG Exports Continue to Grow as Kremlin Targets Expansions

Russian LNG exports to Europe are on the rise despite the continent’s efforts to diversify natural gas supplies and impose a series of sanctions against the country for its war in Ukraine. Most of the liquefied natural gas exported from Russia to Europe has been sourced from PAO Novatek’s Yamal LNG facility in the country’s…

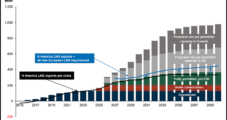

API: European LNG Demand, Role of U.S. Natural Gas Outpaces Previous Estimates

The European Union has made significant progress to replace Russian natural gas, but an abrupt stop to pipeline flows could mean future U.S. LNG projects will be the key to rebalancing energy markets on the continent, industry groups highlighted in a new analysis. In a new report by Rystad Energy AS, conducted for the American…

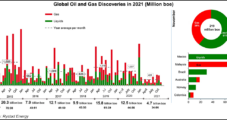

Oil, Natural Gas Discoveries Worldwide Decline to Lowest Level in 75 Years

Global oil and natural gas discoveries in 2021 were tracking to hit their lowest full-year level in 75 years and decline considerably from 2020. Total discovered volumes through November were calculated at 4.7 billion boe, according to an analysis by Rystad Energy. No major discoveries had been announced through the first three weeks of December,…

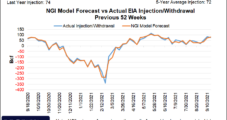

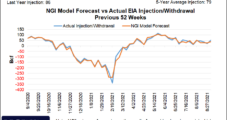

October Natural Gas Futures Skyrocket Ahead of Expiration, Reach New 2021 High

Natural gas futures sailed higher on Monday, rallying for a third straight session ahead of prompt month expiration and amid a potential global energy supply crunch. The October Nymex contract spiked 56.6 cents day/day and settled at $5.706/MMBtu. October rolls off the board as the prompt month at the close of trading Tuesday. November jumped…

Natural Gas Futures, Cash Prices Soar Above $5.00 as Nicholas Amplifies Production Worries

Natural gas futures surged on Monday as a new tropical storm threatened to further shake the Gulf of Mexico’s (GOM) production foundation, a development that could hamper supply/demand balances at a time when gas in storage for winter is already light. The October Nymex contract cruised 29.3 cents higher day/day and settled at $5.231/MMBtu. November…

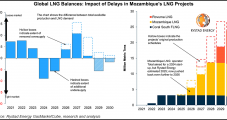

Rystad Sees Global LNG Market Flipping from Surplus to Deficit in 2029 on Mozambique LNG Delays

Anticipated delays in developing liquefied natural gas (LNG) export projects in Mozambique could cause the market to tighten even more than expected later this decade, with forecasts flipping from surplus to deficit in 2029, according to a new report from Rystad Energy. The Norwegian consultancy said it now expects a supply deficit of 5.6 million…

Global Oil Production Costs Seen Down 35% Since 2014

Breakeven costs for all unsanctioned oil projects have fallen to around $50/bbl on average, down around 10% over the last two years and 35% since 2014. With oil production less expensive to produce versus six years ago, the “clear cost savings winner” is offshore deepwater development, according to Rystad Energy’s latest assessment. Rystad’s cost of…

The Offtake: LNG in Brief

A roundup of news and commentary from NGI’s LNG Insight Tellurian Energy Inc. has named Charif Souki as executive chairman. Souki co-founded the company in 2016 and had been serving as nonexecutive chairman. The company is looking to better leverage his “marketing expertise and relationships” as its Driftwood LNG export project in Louisiana has struggled…