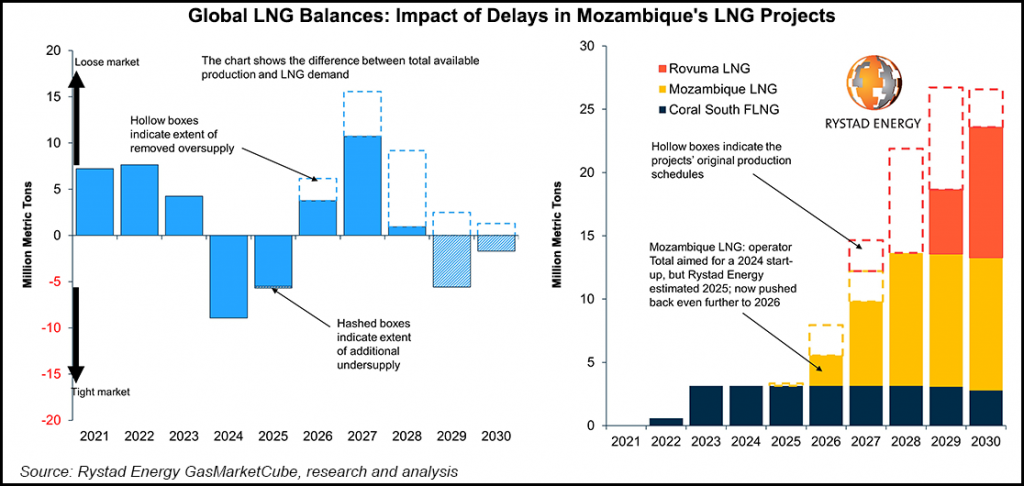

Anticipated delays in developing liquefied natural gas (LNG) export projects in Mozambique could cause the market to tighten even more than expected later this decade, with forecasts flipping from surplus to deficit in 2029, according to a new report from Rystad Energy.

The Norwegian consultancy said it now expects a supply deficit of 5.6 million metric tons per year (mmty) in 2029 if the delays materialize, compared to its previous forecast of a 2 mmty surplus.

But the signs of an undersupplied market may become apparent before then, as Rystad now expects around 9 mmty to come off the market between 2026 and 2029. The consultancy forecasts an oversupply of 4 mmty in 2026, down from its previous forecast of 6.4 mmty.

The situation is expected to only worsen the following...