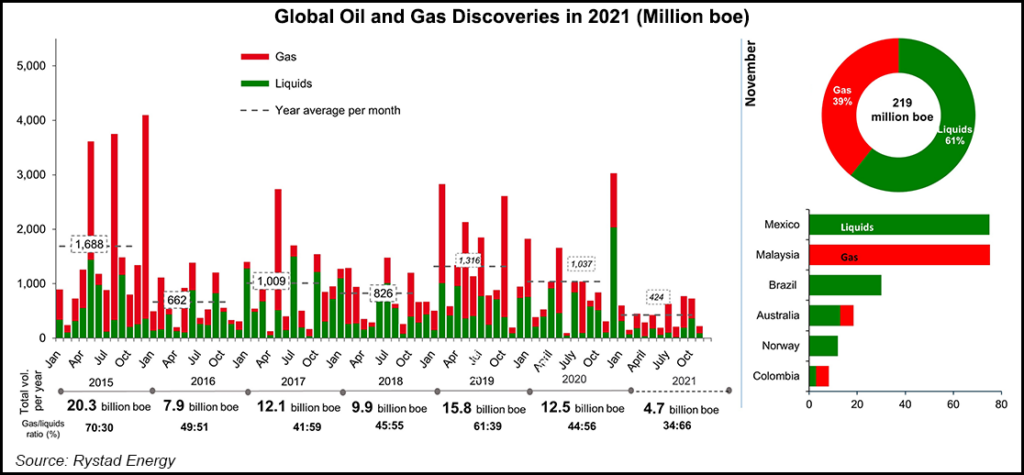

Global oil and natural gas discoveries in 2021 were tracking to hit their lowest full-year level in 75 years and decline considerably from 2020.

Total discovered volumes through November were calculated at 4.7 billion boe, according to an analysis by Rystad Energy. No major discoveries had been announced through the first three weeks of December, setting the industry on course for its “worst discoveries toll since 1946.”

By comparison, around 12.5 billion boe was unearthed around the globe in 2020, the consultancy noted.

“Liquids continue to dominate the hydrocarbon mix, making up 66% of total finds,” the Rystad team said of 2021 discoveries.

Seven were announced in November, with an estimated 219 million boe of new oil and gas volumes. Through Dec. 20, the...