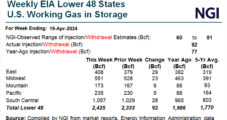

Weekly natural gas cash prices gained ground on the back of strong gains in West Texas in a week that was marked by stronger LNG feed gas flows and modestly higher weather-driven demand. NGI’s Weekly Spot Gas National Avg. for the April 22-26 trading period climbed 9.5 cents to $1.230/MMBtu. Among the top weekly gainers,…

Topic / NGI All News Access

SubscribeNGI All News Access

Articles from NGI All News Access

May Natural Gas Futures Narrow Losses on Expiry Day; Cash Prices Fall

Natural gas futures fell Friday, with the May contract touching lows below $1.500/MMBtu before bouncing back on its last day as the front month. The June contract also fell, under pressure from milder weather patterns taking over and delaying expectations for summer’s heat to arrive. At A Glance: May Nymex rolls off board LNG exports…

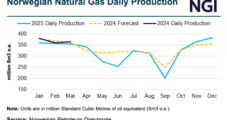

Equinor Expects Asia, LNG Competition to Drive European Natural Gas Prices

Equinor ASA expects competition for LNG with Asia and weather to be the largest drivers of European natural gas prices as markets continue to shift, creating a floor for global benchmarks. After another mild winter helped Europe exit its second heating season without major Russian pipeline gas supplies and sizable storage inventories, CFO Torgrim Reitan…

TotalEnergies Amplifying U.S. RNG for Industrial Decarbonization

TotalEnergies SE has inked an agreement with BlackRock Inc.-backed Vanguard Renewables to advance nearly a dozen U.S. renewable natural gas (RNG) projects over the next year with total annual production capacity of 2.5 Bcf. Boston-based Vanguard, funded by BlackRock’s Diversified Infrastructure segment, plans initially to develop 10 projects. The first three from the joint venture…

LNG Said Vital for Argentina’s Vaca Muerta to Reach Potential

Argentina’s vast natural gas resources would only be fully developed with an LNG export facility, according to experts who spoke at a recent energy conference. “Clearly we think we need to develop the regional market,” said Pampa Energía’s director of commercialization and midstream, Santiago Patrón. The executive at one of Argentina’s top natural gas producers…

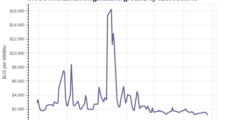

Natural Gas Forwards Mostly Lower as MVP Startup Impacts Summer Pricing

With excess storage inventories continuing to hang over the market through the shoulder season, natural gas forwards declined notably at the front of the curve for most regions during the April 18-24 trading period, data from NGI’s Forward Look show. May fixed prices at benchmark Henry Hub exited the period at $1.653/MMBtu, down 6.1 cents…

Mexico Energy Under Sheinbaum Could Follow Similar AMLO Model, Expert Analyst Says

Mexico’s reliance on U.S. natural gas imports is likely to increase if Claudia Sheinbaum, who is expected to win Mexico’s June 2 presidential election, maintains the state-centric approach of outgoing President Andrés Manual López Obrador, aka AMLO, according to analyst Carlos Ramírez Fuentes. Ramírez, a political and economic risk consultant at Mexico City-based Integralia Consultores,…

Discounts Abound in Natural Gas Markets to Close Out Week — MidDay Market Snapshot

As mild weather threatened to further pad storage surpluses, natural gas futures sagged through midday trading Friday. Meanwhile, spot market buyers seeking supplies for weekend and Monday delivery were finding bargains aplenty. Here’s the latest: June Nymex futures down 7.5 cents to $1.911/MMBtu as of 2:15 p.m. ET From recent levels, natural gas futures face…

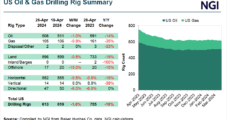

U.S. Natural Gas Count Eases to 105; Oil Rigs Down Five, BKR Data Show

The U.S. natural gas rig count eased one unit lower to 105 for the week ended Friday (April 26), while a decline of five oil-directed rigs dropped the combined domestic tally six units week/week to 613, according to updated numbers from Baker Hughes Co. (BKR). The 105 active natural gas rigs in the United States…

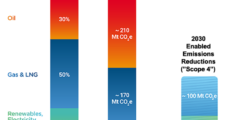

ExxonMobil Sees ‘Long-Term Future’ for Natural Gas and Oil – with Targets on Low Cost of Supply, Woods Says

ExxonMobil will add more natural gas – including LNG – into the portfolio, both in the United States and overseas, as long as they are “advantaged investment opportunities,” according to CEO Darren Woods. During the quarterly conference call on Friday, Woods was asked whether more liquefied natural gas assets would be added to the portfolio…