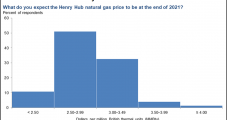

Executives expressed a more optimistic outlook on capital availability and commodity pricing for the oil and gas sector in the latest editions of two surveys conducted by Haynes and Boone LLP. Most respondents to the law firm’s spring 2021 Borrowing Base Redeterminations Survey forecast that borrowing bases will rise by 0-10% this spring versus fall…

Tag / Oil prices

SubscribeOil prices

Articles from Oil prices

Enerplus Continuing to Build Bakken Stronghold with Hess Purchase

Hess Corp. is selling off some of its Bakken Shale acreage in North Dakota to Calgary-based Enerplus Corp. for $312 million. The deal, set to be completed in May, includes the Little Knife and Murphy Creek acreage. The Hess assets are spread across 78,700 acres in the southernmost portion of its Bakken position. Total net…

Subdued Production Should Support Oil, Natural Gas Prices in 2021, Moody’s Says

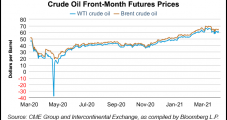

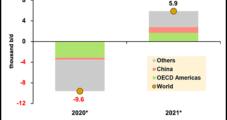

Though global oil supply is beginning to climb, it is rising gradually off of depressed levels and is not expected to exceed the anticipated demand recovery this year. The supply/demand balance should support crude prices near their current levels through 2021, though fluctuations are all but certain, Moody’s Investors Service said in a report this…

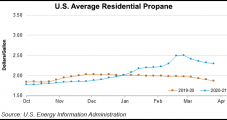

Propane Prices Spike During Winter Heating Season, EIA Says

A surge in heating demand propelled U.S. propane prices during the 2020-21 winter season, according to a new federal report. Residential propane prices in the United States averaged about $2.30/gal at the close of March, up 43 cents from a year earlier, according to the U.S. Energy Information Administration (EIA). About two-thirds of the natural…

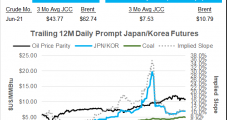

Shell’s LNG Trading, Production Results for 1Q Slump Below Guidance

Royal Dutch Shell plc said its Integrated Gas trading results for 1Q2021 fell “significantly below average,” in part because 80% of last year’s liquefied natural gas (LNG) term sales were oil-price linked, with a lag of up to six months. In a preview of quarterly results issued on Wednesday, the energy major said Upstream and…

Brent to Average $65 in 2Q, Retreat to $61 in Second Half of 2021, EIA Says

After rising $3/bbl in March on demand optimism, Brent crude oil prices are set to average $65.00 in the second quarter of 2021, according to updated projections from the U.S. Energy Information Administration (EIA). Brent rose to $65.00 in March amid expectations for oil demand to grow on higher Covid-19 vaccination rates and increased global…

Betting on Mounting Oil Demand, OPEC and Allies Agree to Boost Production

The Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, agreed on Thursday to ramp up crude production in anticipation of increased demand. The shift comes despite elevated uncertainty about the coronavirus pandemic and its still festering impacts on global travel and economic activity. Saudi Arabia-led OPEC and an allied group of leading…

Texas Slowly Adding Upstream Jobs After ‘Difficult Season’

The Texas upstream oil and gas industry added 2,300 jobs during February, still not back to its pre-pandemic levels, but slowly rising since last September, according to the Texas Oil & Gas Association (TXOGA). Texas Workforce Commission data indicated that the upstream sector has added 7,400 jobs since the low point in September. Total upstream…

Oil, Gas Activity Improving Dramatically in Permian and Beyond, Says Dallas Fed

Oil and natural gas activity sharply expanded during the first three months of the year in Texas, New Mexico and Louisiana, according to a survey by the Federal Reserve Bank of Dallas. Every quarter the Dallas Fed, as it is better known, surveys executives of exploration and production (E&P) firms and oilfield services (OFS) companies…

Citing Vaccines, OPEC Boosts Oil Demand Outlook for 2021

A week after extending production cuts, the Organization of the Petroleum Exporting Countries (OPEC) on Thursday raised its forecast for world oil demand in 2021, reflecting the cartel’s expectations for a stronger economic recovery in the second half of the year. OPEC, in its Monthly Oil Market Report (MOMR) released Thursday, said it now expects…