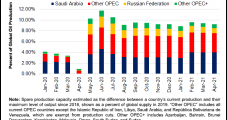

The Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, scrapped plans to restart production talks this week after meetings held before the July 4 holiday failed to reach a deal on output policy. The cartel did not set a date to resume talks, leaving the group with no plan for increased production…

Tag / Oil prices

SubscribeOil prices

Articles from Oil prices

OPEC-Plus Debating Modest Bump in Crude Output Through 2021

The Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, debated on Thursday a proposal to further boost crude oil production, anticipating steadily increasing demand for travel fuels in the second half of 2021. Citing successful vaccination efforts and economic momentum in leading countries such as the United States and China, the Saudi…

Latin American Oil, Natural Gas Companies Positioned to Prosper in Coming Years

Oil and gas prices are on the up and Latin American producers should be able to reap some benefits thanks to recent cost-cutting efforts, according to a new report from Fitch Ratings. Latin American oil and gas companies have before tax full-cycle costs of approximately $34/bbl, Fitch said. This is well below most price forecasts…

Mexico’s Pemex said Poorly Positioned to Capitalize on Oil Price Rally

As major economies across the globe emerge from the doldrums of the pandemic and travel surges, oil prices could further spike and reach $100/bbl by next year, according to the most bullish Wall Street forecast yet this year. It could also mark the final surge in oil prices, however, as pressure intensifies on energy companies…

Oil Price Boom Forecast to Reach $100, Potentially Marking Crude’s Last Great Rally

As major economies across the globe emerge from the doldrums of the pandemic and travel surges, oil prices could further spike and reach $100/bbl by next year, according to the most bullish Wall Street forecast yet this year. It could also mark the final surge in oil prices, however, as pressure intensifies on energy companies…

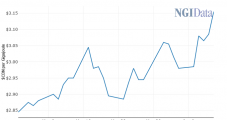

After Lull, U.S. Petroleum Demand Jumps and Stockpiles Dwindle

Demand for U.S. petroleum spiked last week as consumption of gasoline and jet fuel jumped alongside a fading pandemic and increased travel. The U.S. Energy Information Administration (EIA) said Wednesday that demand during the week ended June 11 increased 16% week/week, with gasoline demand up 10%, jet fuel consumption ahead 22%, and demand for distillate…

Alberta Set for Strong Economic Comeback on Higher Oil Prices

Canada’s top oil- and gas-producing province is expected to score the nation’s strongest comeback this year on improved commodity prices after taking the biggest dive in 2020 driven by the Covid-19 pandemic, according to a new report. As measured in 2012 dollars, the “real” trend yardstick used by the Conference Board of Canada, Alberta’s gross…

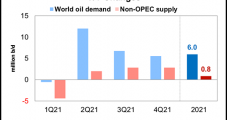

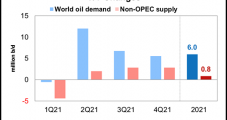

Bolstered by Rebound of Major Economies, Global Oil Demand to Surge, OPEC Says

An acceleration in travel and economic activity should hasten the resurgence in global oil demand in the second half of 2021, cutting into supplies and justifying increased crude production, the Organization of the Petroleum Exporting Countries (OPEC) said Thursday. In its closely watched Monthly Oil Market Report, the Saudi-led cartel affirmed expectations it reported a…

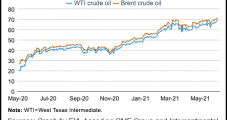

Covid-19 Uncertainty Still Weighing on Oil Prices, Says World Bank

Continued uncertainty around the Covid-19 pandemic has kept a lid on rallying oil prices, according to the World Bank. Though prices have been supported by continued production restraint by the Organization of the Petroleum Exporting Countries and their allies, aka OPEC-plus,“the pickup in oil prices has been partly dampened by uncertainty regarding the evolution of…

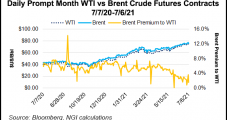

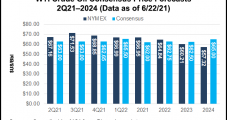

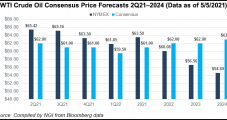

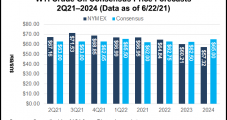

Brent Oil Prices to Decline into 2022 as Global Production Escalates, Says EIA

Brent prices are forecast to average $68/bbl in 3Q2021 before production worldwide begins to escalate, sending the average price down to around $60/bbl in 2022, the Energy Information Administration (EIA) said Tuesday. In the Short-Term Energy Outlook, researchers noted that Brent averaged $68/bbl in May, a 25% uptick from January. “In the coming months, we…