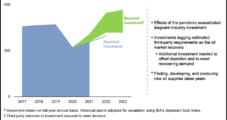

Only a few U.S.-based exploration and production (E&P) companies have provided formal capital spending plans for 2023, but expenditures overall are forecast to decelerate from a year ago. E&P executives are surveyed twice a year by Evercore ISI to determine the level of capital expenditures (capex) and activity, which often are revised. Respondents indicated that…

Tag / Oil prices

SubscribeOil prices

Articles from Oil prices

Brent to Fall to $78 Next Year as Global Inventories Rise, EIA Says

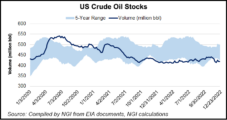

Amid increasing global inventories, Brent crude oil prices are expected to average $83/bbl in 2023, an 18% decline from 2022 levels, before falling further in 2024, according to updated projections from the U.S. Energy Information Administration (EIA). Next year may see prices for the global crude benchmark fall to $78, with rising global inventories expected…

Oil Prices Slide Amid Signs of Weaker Domestic, Global Demand in 2023

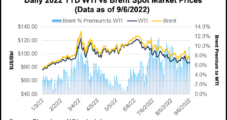

U.S. and global crude prices opened the New Year mired in a slump, led lower by uneven domestic demand and hints of global sluggishness amid intensifying expectations of recession. After dropping Tuesday, West Texas Intermediate (WTI) prices in the United States slid below $74/bbl in intraday trading Wednesday, down more than 4%. Brent crude, the…

Biden Administration to Begin Replenishing SPR Oil Reserves

Crude oil for the Strategic Petroleum Reserve (SPR) is expected to be repurchased at a lower price than the $96/bbl average it was sold for this year, according to the Biden administration. The Department of Energy’s (DOE) Office of Petroleum Reserves said repurchasing the oil would be “an opportunity to secure a good deal for…

OPEC-Plus Cut Could Send Oil Prices Soaring Above $100, Entice U.S. E&Ps to Ramp Up

Lower 48 energy producers, in response to a massive OPEC-plus supply cut that is expected to spur a surge in oil prices, could bolster crude output in the final months of 2022 to both capitalize and ensure domestic supply/demand balance, analysts said Thursday. U.S. exploration and production (E&P) companies could increase output to 12.7 million…

Natural Gas, Oil Industry Profits Forecast to Retreat in 2023 on Slower Demand, Economic Pull Back

Global energy company earnings, which surged on stronger oil and natural gas prices, should ease in 2023 as the industry adjusts to slower demand growth and an economic slowdown, according to Moody’s Investors Service. “The pace of improvement in fundamental industry conditions will also decelerate after a strong post-lockdown rebound in earnings and credit quality…

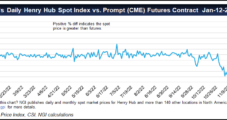

Henry Hub Natural Gas in 4Q Likely to Average $9, with Brent $98, Says EIA

Natural gas spot prices at Henry Hub will average roughly $9/MMBtu during the fourth quarter before retreating to around $6 on average in 2023 amid rising domestic production, according to the latest projections from the Energy Information Administration (EIA). Spot prices at the national benchmark averaged $8.80 in August, versus $7.28 in July, the agency…

OPEC-Plus to Cut Output as West Seeks to Cap Russian Crude Prices

OPEC and its Russian allies, on Monday agreed to reduce global crude oil output by 100,000 b/d in October, in what the Saudi-led cartel said was a proactive move to stabilize the market. At the monthly ministerial meeting, the cartel noted the “adverse impact of volatility and the decline in liquidity on the current oil…

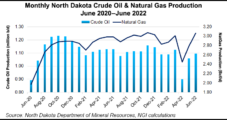

North Dakota Natural Gas Production Surges as Capture Rate Holds Steady

Natural gas production in North Dakota swelled by 9.7% in June versus May to 3.06 Bcf/d, while oil production rose 3.5% to 1.1 million b/d, according to the latest figures from the North Dakota Industrial Commission (NDIC). The increases reflect a full recovery from disruptions caused by April snowstorms, as well as strong market fundamentals…

ExxonMobil’s Woods Says Permian, LNG to Assist Europe, but Diversification Key

ExxonMobil’s ability to invest through the pandemic enabled the supermajor to ramp up supply quickly as demand soared this year, with Permian Basin and LNG supply expanding, CEO Darren Woods said Friday. On the back of the Permian and a flood of investments in Guyana and liquefied natural gas projects worldwide, ExxonMobil’s deep pockets have…