Demand for U.S. petroleum increased last week, while production held well below pre-pandemic levels and continued a summer-long trend, the U.S. Energy Information Administration (EIA) said Wednesday. Meanwhile, U.S. commercial oil inventories in the week ended July 30 — excluding those in the Strategic Petroleum Reserve – increased by 3.6 million bbl from the previous…

Tag / Oil prices

SubscribeOil prices

Articles from Oil prices

WTI Oil Price to Average $75 in 2022 and Remain Elevated for Years, Raymond James Predicts

With demand mounting and global supply in catch-up mode, oil prices are likely to climb in the second half of 2021 and hold strong for several years, as economies around the world recover from the coronavirus pandemic and drive up energy needs, analysts at Raymond James & Associates Inc. said Monday. The analysts, including John…

Hess Moving Forward with Bakken Ramp-Up on Strong Oil Prices

U.S. independent Hess Corp. said Wednesday it was moving forward with plans to ramp up drilling activity in the Bakken Shale amid continued commodity price strength. Hess plans to add a third rig in the Bakken in September, something it previously said it would consider if oil prices continued to improve. “We have been operating…

Higher Commodity Prices Driving Crestwood’s Activity, Enhanced Margins

Crestwood Equity Partners LP expects the higher commodity prices that drove increased drilling and completion activity in the second quarter of 2021 to fuel even higher utilization of its assets in core areas for the remainder of the year. The Houston-based midstreamer’s gathering and processing (G&P) segment, which was hit hardest during last year’s Covid-induced…

With Demand Rebounding, OPEC-Plus Reaches Deal to Lift Crude Production Through 2021, into 2022

The Organization of the Petroleum Exporting Countries and its allied group of leading oil producers headed by Russia, aka OPEC-plus, on Sunday reached a deal to further boost production through the end of the year and into 2022. The member countries, led by Saudi Arabia, committed to bringing back all the crude supply they had…

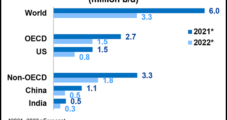

OPEC Forecasts Ongoing Oil Demand Increases in 2022 as World Emerges from Pandemic

In its first detailed estimates for 2022, the Organization of the Petroleum Exporting Countries (OPEC) said Thursday global crude demand would increase through next year as coronavirus vaccination efforts expand and consumption of travel fuel mounts. In its closely watched Monthly Oil Market report, OPEC said demand next year would increase by 3.3 million b/d…

PE-Backed WildFire Energy Acquiring Eagle Ford Pure-Play Hawkwood in $650M Deal

Eagle Ford pure-play Hawkwood Energy LLC is set to be acquired by private equity-backed platform WildFire Energy I LLC, the firms announced Thursday. The transaction, slated to close in the third quarter, values Denver-based Hawkwood at about $650 million. Hawkwood’s liquids-weighted gross production currently stands at about 15,000 boe/d, spanning 160,000 net acres in the…

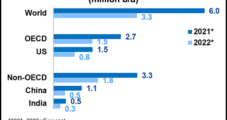

U.S. Natural Gas Rig Count Up Two as GOM Activity Rises

The U.S. natural gas rig count rose two units to finish at 101 during the week ended Friday, a week that also saw a notable uptick in drilling activity in the Gulf of Mexico (GOM), according to updated data from oilfield services provider Baker Hughes Co. (BKR). Drilling gains in the United States for the…

U.S. Crude Inventories Fall Further, Setting 2021 Low as Petroleum Demand Mounts

As both domestic and global demand for travel fuels derived from oil builds, domestic crude inventories dropped substantially for a third straight week, the U.S. Energy Information Administration (EIA) said Wednesday. Excluding those in the Strategic Petroleum Reserve, domestic oil inventories for the week ended July 2 decreased by 6.9 million bbl from the previous…

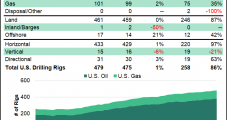

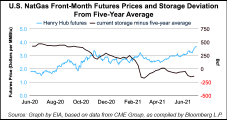

EIA Predicts $72 Brent for 2H2021, Tacks on 14 Cents to Henry Hub Forecast

Brent crude prices gained $5/bbl from May to June and are on track to average $72 during the second half of 2021 (2H2021), the Energy Information Administration (EIA) said in an updated forecast published Wednesday. Brent prices rose to $73 in June, up $5 month/month and up $33 from year-ago prices, EIA said. Rising production…