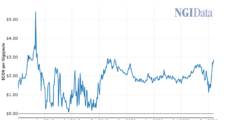

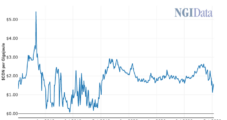

Natural gas futures on Monday dropped as mid-range weather worries overshadowed continued strong liquefied natural gas (LNG) levels. The December Nymex contract shed 11.0 cents day/day and settled at $3.244/MMBtu. January lost 9.4 cents to $3.375. Spot gas prices, meanwhile, dipped lower despite a chilly start to the week. NGI’s Spot Gas National Avg. fell…

Tag / Coronavirus

SubscribeCoronavirus

Articles from Coronavirus

U.S. Oil Demand, Production Continue Choppy Runs, EIA Data Show

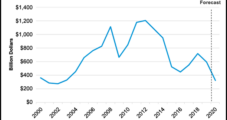

Demand for domestic oil rebounded last week, as gasoline and jet fuel use jumped, the U.S. Energy Information Administration (EIA) said in its latest Weekly Petroleum Status Report (WPSR). EIA said for the week ending Oct. 23 demand increased 8% week/week, recovering from a decline the previous week and extending a run of choppy results…

Alberta E&P Taxes to Decline on Government Response to Covid-19

Alberta natural gas and oil producers predict their annual taxes will drop by C$85 million ($64 million) thanks to provincial and municipal reductions announced Monday as a response to the Covid-19 andemic. The relief program for exploration and production (E&P) companies cuts levies on wells, drilling equipment, pipelines and industrial property for three years. While…

U.S. Oil Inventories Decline Further, but Coronavirus Threats Lurk

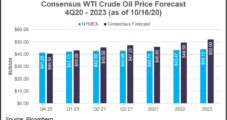

Demand for petroleum products mounted early in October, cutting into U.S. inventories of crude and refined products, but a resurgence of the coronavirus pandemic across swaths of the Lower 48 and Europe threaten to thwart the trend and weigh down oil prices. Demand for fuel derived from oil was crushed earlier this year by the…

Raymond James Says Natural Gas to Jump in 2021, Boosted by Production Cuts

The extensive oil production declines amid the coronavirus pandemic’s fallout cut deep enough into associated gas supplies to likely help drive up Henry Hub natural gas prices in 2021, according to Raymond James & Associates. “The 2020 oil crash is still likely to drive a massive imbalance in U.S. gas supplies in 2021,” Raymond James…

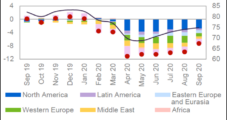

U.S. Home-Bound Workforce Sharply Impacting Transportation Fuel Outlook, Says OPEC

Energy demand contraction triggered by Covid-19 lockdown measures has drastically reduced U.S. fuel consumption, but a cold winter could boost heating oil consumption as more people continue to work from home, the Organization of the Petroleum Exporting Countries (OPEC) said Tuesday. The oil cartel issued its global winter forecast in the latest Monthly Oil Market…

Lower 48 Tight Oil Output to Recover, but Possibly Not As Strong Pre-Covid, Says OPEC

U.S. tight oil production should recover quickly as world energy demand recovers from Covid-19, but Lower 48 output may not again hit its previous forecasts, the Organization of the Petroleum Exporting Countries said Thursday. The Saudi-led oil cartel, aka OPEC, in its flagship 14th annual World Oil Outlook (WOO), cited the “unprecedented scale and impact”…

Alberta Natural Gas Industry Considered Integral to Economic Recovery Post Covid-19

Natural gas rose to the top of the Alberta government’s economic recovery agenda in a plan announced Tuesday to reverse supply/demand declines that set in well before the Covid-19 pandemic. “For more than 100 years, natural gas has been the cornerstone of Alberta’s energy economy,” said a provincial policy paper titled “Getting Alberta Back to…

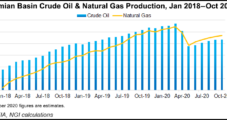

Permian Output Seen Ramping Up in 2021

Production in the Permian Basin will likely decline through the year but then begin to increase through at least 2026, even if prices do not rise significantly, according to analysts. “We see the Permian as a relative winner among domestic basins given favorable production economics, independent of a call on higher commodity prices,” the Morgan…

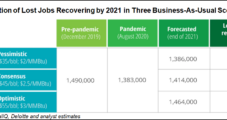

Energy Sector Job Losses Said Unlikely to Return Until Late 2021

The downturn in the U.S. energy sector caused by the Covid-19 pandemic is “truly like no other” as 70% of the jobs lost this year may not come back until the end of 2021, the Deloitte consultancy said Monday. However, the economic devastation presents opportunities for the oil and gas industry to accelerate its transformation…