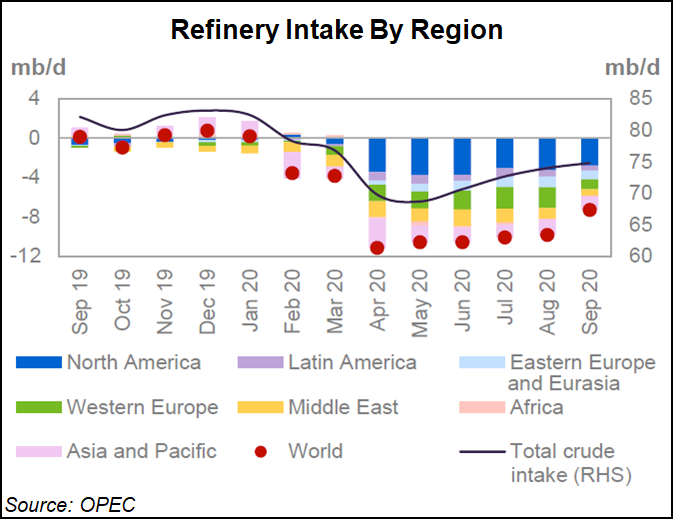

Energy demand contraction triggered by Covid-19 lockdown measures has drastically reduced U.S. fuel consumption, but a cold winter could boost heating oil consumption as more people continue to work from home, the Organization of the Petroleum Exporting Countries (OPEC) said Tuesday.

The oil cartel issued its global winter forecast in the latest Monthly Oil Market Report (MOMR).

Specifically in the United States, the “prospects for a colder-than-normal winter could add support” to overflowing fuel stocks, researchers said. “However, tele-working will negatively impact transportation fuels.”

Product stocks still “remain exceedingly high, which will pressure distillate margins. Moreover, the switch to winter-grade gasoline requires additional volumes of naphtha-based...