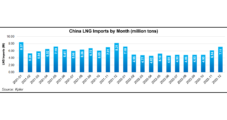

China’s thirst for LNG is likely to rebound in 2023, which could exacerbate the global energy crunch, but to what extent the country returns to the spot market remains unclear as it continues to grapple with Covid-19. China has eased restrictions aimed at curbing the spread of the virus. Those measures limited economic activity and…

Tag / Coronavirus

SubscribeCoronavirus

Articles from Coronavirus

With U.S. Output Flat and War in Ukraine Stoking Fresh Global Supply Worries, Oil Prices Surge

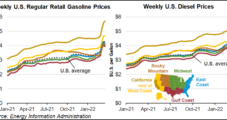

U.S. crude production was flat last week, as it has been throughout 2022, even as the Russia-Ukraine conflict drags on and global supply worries intensify. Output for the week ended March 18 held at 11.6 million b/d, even with the prior week and a month earlier, the U.S. Energy Information Administration (EIA) said Wednesday. American…

OPEC-Plus Agrees to Ramp Up Oil Output Despite Omicron

A coalition of major oil producing countries agreed on Tuesday to further boost output to meet expectations for strong demand, despite concerns about the rapidly spreading Omicron variant of the coronavirus. Policymakers from the Organization of the Petroleum Exporting Countries (OPEC), headed by Saudi Arabia, and a Russia-led group of allies known as OPEC-plus, said…

Near-Term Cold Fuels Monstrous January Natural Gas Bidweek Gains in Some Locations

On the cusp of the winter season’s first widespread cold snap, natural gas prices for January baseload were a mixed bag during the bidweek trading period from Dec. 27-29. Propelled by hefty premiums on the West and East coasts, which countered $1.00-plus losses elsewhere across the country, NGI’s January Bidweek National Avg. climbed 18.5 cents…

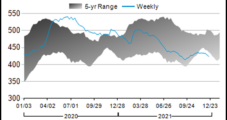

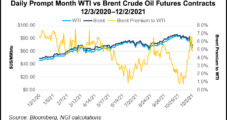

U.S., Global Oil Prices Poised to Extend Rebound into New Year

Despite a November lull imposed by the Omicron variant of the coronavirus, crude prices in the United States and globally were positioned Thursday to finish 2021 up more than 50% on the year, led upward by mounting demand for travel fuels and heating oil that outshined modestly increased production levels. West Texas Intermediate (WTI) oil…

U.S. Petroleum Demand Tapers as Omicron Cases Mount

Americans pulled back on distillate fuel, gasoline and jet fuel consumption last week as spread of the Omicron variant of the coronavirus accelerated, data from the U.S. Energy Information Administration (EIA) showed. EIA said Wednesday that total petroleum demand for the week ended Dec. 17 dropped 12% week/week to 20.5 million b/d. Demand for gasoline…

OPEC-Plus Forges Ahead with Increased Production Despite Omicron, Demand Concerns

Russia, Saudi Arabia and other top oil producing countries plan to keep pumping more crude into early 2022, despite worries about the coronavirus Omicron variant and the potential for easing demand. The Saudi-led Organization of the Petroleum Exporting Countries (OPEC) and its Russia-led allies, collectively known as OPEC-plus, said Thursday they would boost production by…

‘Return of North American LNG FIDs’ Seen in 2022 — LNG Spotlight

The environment for North American liquefied natural gas (LNG) final investment decisions is looking brighter in 2022, with buyer interest in long-term contracts on the rise amid record-high spot prices. While the Covid-19 pandemic caused global demand to soften and resulted in project delays in 2020 and 2021, a handful of North American projects are…

Global Oil Consumption in 2022 Likely Above Pre-Covid Levels, Says OPEC

Global oil demand in 2022 is gathering pace to exceed pre-pandemic levels, the Organization of the Petroleum Exporting Countries (OPEC) said Monday. In its Monthly Oil Market Report, the cartel said the Covid-19 Delta variant put a crimp in forecasts for the second half of 2021. However, economic growth worldwide in 2021 and 2022 remains…

Citgo’s Refining Unit in South Texas Disrupted as Covid Cuts Oxygen Supply

Citgo Petroleum Corp. shut down a key component of its Corpus Christi, TX, refinery following an oxygen supply disruption from a vendor because of increased demand from the medical industry. In a filing with the Texas Commission on Environmental Quality (TCEQ) last Thursday (Sept. 2), Citgo said it shut down the Sulfur Recovery Unit B-Train…