Calfrac Well Services Ltd., a Calgary-based specialist in hydraulic fracturing that works in Canada, as well as Argentina, Russia and the United States, said a revival in drilling last year and commodity prices provide momentum, but there is uncertainty on the horizon. “A prolonged period of underinvestment in the upstream sector, in combination with a…

Commodity

Articles from Commodity

Traders Mulling Supportive Weather, Lean Storage Stats; November Called A Nickel Higher

November natural gas is set to open 5 cents higher Wednesday morning at $2.94 as forecasters expect a round of warm, moist weather to hit important Mid-Atlantic markets. Overnight oil markets eased.

Natural Gas-Heavy Vanguard Files for Chapter 11

Relief in commodity prices toward the end of 2016 was not enough to pull natural gas-rich Vanguard Natural Resources LLC out of the bankruptcy vortex, with the Houston-based onshore explorer filing for Chapter 11 protection on Thursday.

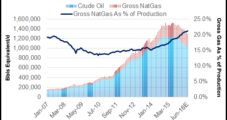

Williston Basin Said Prime Candidate for NatGas, Liquids Growth in Next Commodity Cycle

Natural gas and natural gas liquids (NGL) may get more attention in the Williston Basin in future years as commodity prices turn upward and producers continue their pursuit of wringing more value-added returns out of the Bakken Shale in North Dakota, stakeholders said this week.

Most Senior U.S. Energy Execs Not Optimistic about Higher NatGas Prices in 2016

Many energy executives expect natural gas prices to remain below $3.00/MMBtu this year while renewables are expected to continue to take more market share, according to an annual survey by KPMG Global Energy Institute.

CFTC Fines JPMorgan $225,000 For Inaccurate Trader Reports

The U.S. Commodity and Futures Trading Commission (CFTC) levied a $225,000 fine against two entities of JPMorgan Chase & Co. (JPMC), the largest bank in the United States, for filing inaccurate large trader reports (LTRs) for physical commodity swaps positions for more than one year.

Oil & Gas Liquidity Stress Index At Record High, Says Moody’s

Liquidity stress in the oil and gas industry reached its highest-ever level in February, continuing a trend that began in late 2014, Moody’s Investors Service said in a note published Tuesday.

Chesapeake Denies Plans to Pursue Bankruptcy

Chesapeake Energy Corp. said it is not planning to seek bankruptcy protection, knocking down a report that led investors Monday to bail on the second largest U.S. natural gas producer.

No Bankruptcy Filing Underway, Says Chesapeake

Rattled shareholders of Chesapeake Energy Corp. headed for the exits Monday following a report, later denied by the company, that restructuring experts had been hired to assist with a bankruptcy filing.

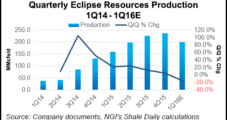

Eclipse Reveals Steep Price-Related Impairments in 2015

Eclipse Resources Corp. revealed Thursday that “substantially lower commodity prices” led to a 58% writedown of its proved reserves as of Dec. 31 compared to 2014 year-end reported values.