The U.S. Court of Appeals for the District of Columbia Circuit has upheld a ruling by the U.S. District Court for the District of Columbia that found the Commodity Futures Trading Commission (CFTC) did not act illegally in promulgating Dodd-Frank regulations. The Investment Company Institute and the U.S. Chamber of Commerce brought the action against the CFTC, arguing that the adopted regulations applying to derivatives trading were unlawfully adopted and invalid. The district court “granted summary judgment in favor of the Commission. Because we agree with the district court that the Commission did not act unlawfully in promulgating the regulations, we affirm,” ruled the appeals court. Specifically, the two groups challenged a rule that would subject registered investment companies (RIC) engaged in derivatives trading to many of the Dodd-Frank requirements. Prior to 2003, RICs engaged in rare derivatives trading activities, but that has since changed, according to the CFTC. It is the agency’s latest legal victory with respect to its Dodd-Frank regulation of the $300 trillion.

Commodity

Articles from Commodity

Marcellus Gas Wells — Dry or Wet — Competing with Bakken

Given current commodity prices, natural gas wells drilled in the Marcellus Shale — wet or dry — compete favorably with marginal Bakken Shale oil wells, but that’s the only gas play in the U.S. onshore that today can compete with Bakken oil well economics, according to an analysis by Barclays Capital.

Marcellus Gas Wells — Dry or Wet — Competing with Bakken Economics

Given current commodity prices, natural gas wells drilled in the Marcellus Shale — wet or dry — compete favorably with marginal Bakken Shale oil wells, but that’s the only gas play in the U.S. onshore that today can compete with Bakken oil well economics, according to an analysis by Barclays Capital.

CFTC: Full Funding Key for Market Surveillance

The chairman of the Commodity Futures Trading Commission (CFTC) Tuesday called on a Senate panel to support President Obama’s request for additional funds for the agency in fiscal year (FY) 2014 so that it can protect the derivatives and futures markets from fraud, manipulation and other abusive practices.

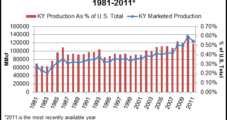

Eastern Kentucky Shales Await Higher NatGas Prices

The Kentucky Oil and Gas Association’s (KOGA) first comprehensive research of the economic impact of the oil and gas industry found that the state had 14,632 producing natural gas wells in 2011 and produced more than 3 million bbl of oil in 2012, but the number of horizontal well permits issued has declined each year since 2009.

District Judge Rejects Challenge to Dodd-Frank Regulations

A U.S. District Court judge in Washington, DC, on Friday dismissed Bloomberg LP’s challenge of the Commodity Futures Trading Commission’s (CFTC) Dodd-Frank regulations on the multi-trillion over-the-counter (OTC) derivatives market.

Senators Claim Energy Swaps Fly Under CFTC Radar

Expressing “alarm” that the Commodity Futures Trading Commission (CFTC) is not registering all swap dealers that are active in energy markets, six prominent West Coast senators said they are “increasingly concerned” that the $8 billion annual de minimis threshold exemption in the agency’s Dodd-Frank Wall Street Reform Act rules may allow the vast majority of the energy swap market to fly under the regulator’s radar.

Western Senators: Energy Swaps Fly Under CFTC Radar Screen

Expressing “alarm” that the Commodity Futures Trading Commission (CFTC) is not registering all swap dealers that are active in energy markets, six prominent senators from the West Coast said they were “increasingly concerned” that the $8 billion annual de minimis threshold exemption in the agency’s Dodd-Frank rules may allow the vast majority of the energy swap market to fly under the regulator’s radar.

CFTC Votes Out Final Swaps Reform Rules

U.S. financial markets “took a step closer…to enhanced transparency,” Commodity Futures Trading Commission Chairman Gary Gensler said Thursday after the Commission voted out final rules covering the vast swap transactions market.

CFTC Votes Out Final Swaps Reform Rules

U.S. financial markets “took a step closer today to enhanced transparency,” Commodity Futures Trading Commission Chairman Gary Gensler said Thursday after the Commission voted out final rules covering the vast swap transactions market.