Magnolia Oil and Gas Corp. may be at the beginning of a year-long surge in production growth after a strong showing in the first three months of the year in the Eagle Ford Shale and Austin Chalk formation. The Houston-based independent previously launched development programs for parts of its South Texas assets, including the Giddings…

Earnings

Articles from Earnings

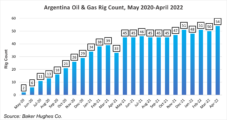

Vaca Muerta Shale Driving Natural Gas Production Surge for Argentina’s YPF

U.S. onshore producers may be limiting annual production growth to 5% or less, but don’t tell that to Argentina’s 51% state-owned YPF SA. The Vaca Muerta shale play in the Neuquén Basin drove a 16% year/year increase in oil and gas output to 506,000 boe/d during the first quarter for the integrated producer. On a…

PDC Eyeing Double-Digit Oil, Natural Gas Output Growth

Denver-based PDC Energy Inc. earlier this month closed on its $1.3 billion acquisition of crosstown independent Great Western Petroleum LLC and is forecasting production growth of as much as 23% by the end of June “We’re ready to start this integration,” CEO Bart Brookman told analysts during the earnings call for the first quarter. PDC…

Archaea Builds RNG Development List, Looking for More Long-Term Contracts

Archaea Energy Inc. spent the first three months of the year adding renewable natural gas (RNG) assets and projects to boost its production nine-fold within the next six to eight years. The Houston-based RNG producer, which is majority owned by Rice Investment Group, is still relatively fresh from its merger with Aria Energy LLC last…

Ovintiv Pursuing Natural Gas Price ‘Diversification,’ Citing Strong Market Fundamentals

Ovintiv Inc. is exploring options to increase the exposure of its multi-basin upstream portfolio to a dynamic global natural gas market, CEO Brendan McCracken said. The Denver-based independent works in numerous onshore plays throughout North America, including in the Montney Shale, Anadarko Basin, Permian Basin, Bakken Shale and Uinta Basin. On a call to discuss…

Oxy Prepared for Volatile Year, but Some Oil, Gas Producers Not So Lucky, Says Hollub

U.S. oil and gas producers that weren’t prepared to get down to business as prices rose may be out of luck, Occidental Petroleum Corp. CEO Vicki Hollub said Wednesday. Hollub helmed a first quarter conference call, joined by CFO Robert Peterson and Richard Jackson, president of U.S. Onshore Resources and Carbon Management. They shared with…

Portland’s NW Natural Advances Renewable Natural Gas Business

Portland, OR-based natural gas utility NW Natural continues to build its renewable natural gas (RNG) portfolio as it moves to carbon neutrality by 2050. In January, the company started operations at an RNG facility in Lexington, Nebraska in conjunction with Tyson Foods Inc. and BioCarbN. Construction on a second facility has begun with commissioning slated…

Coterra Energy Searching for Opportunities in ‘Crowded LNG Market’

Coterra Energy Inc.’s CEO Thomas Jorden called for the government and investors to provide the proper signals in response to an energy crisis “unlike anything the world has seen in almost 50 years.” In order for the U.S exploration and production (E&P) sector to “respond with increased U.S. supply, we need well-thought-out regulation and policies…

U.S. Midstreamers Using Expansions as ‘Quick Market Solutions’ for Rising Production

U.S. midstream operators are focusing on incremental additions to their natural gas infrastructure in the Haynesville Shale, Permian and Appalachia basins as quicker and lower-risk solutions to rising production growth. DCP Midstream LP is in “advanced discussions” with its partners on the Gulf Coast Express Pipeline (GCX) to bring “quick and efficient” capacity to the…

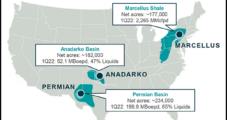

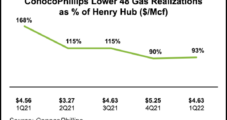

ConocoPhillips Taking Advantage of Permian Position, Ramping Up More Wells

ConocoPhillips joined other exploration and production (E&P) companies in reporting rising earnings, thanks to geopolitical impacts to oil and gas prices, but management said it should move on “full value chain” opportunities in liquefied natural gas (LNG) to further enhance its gas business. The Houston-based independent, the world’s largest, has substantial global holdings in gas.…