U.S. oil and gas producers that weren’t prepared to get down to business as prices rose may be out of luck, Occidental Petroleum Corp. CEO Vicki Hollub said Wednesday.

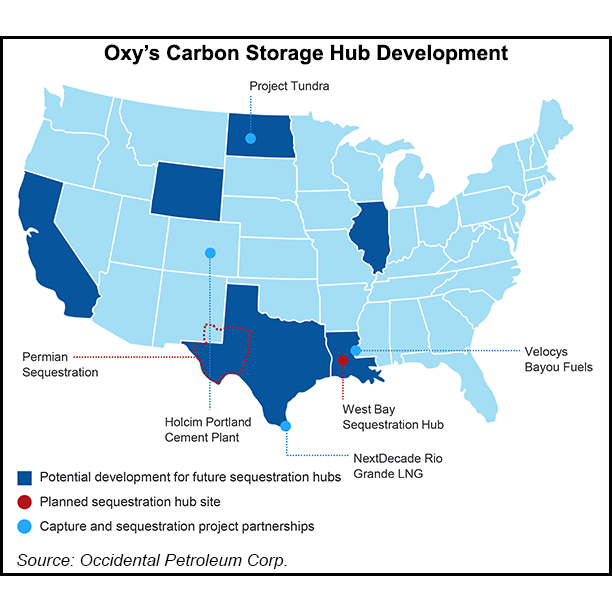

Hollub helmed a first quarter conference call, joined by CFO Robert Peterson and Richard Jackson, president of U.S. Onshore Resources and Carbon Management. They shared with investors what’s ahead in the Lower 48, deepwater Gulf of Mexico and overseas. The plans are centered around turning more wells to sales in the Lower 48, while laying plans to build carbon capture hubs in key locations.

For producers that were not prepared to ramp up following the upward swing in commodity prices, it already may be too late, Hollub said.

Oxy, as it is better known, had “materials lined up to purchase,” she said...