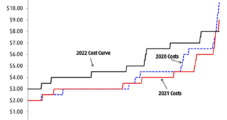

Implied costs for natural gas-weighted producers rose by 46% year/year in 2022 to $4.51/Mcfe, according to a new study by BMO Capital Markets. The three-year average cost trend rose 6% to $4.06/Mcfe, the BMO team said. This is based on a comparison to a global Brent oil and Henry Hub basket price. Viewed by the…

Producers

Articles from Producers

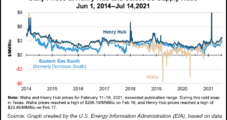

Natural Gas Forward Prices Surge on Heat, Lagging Production

With the scorching temperatures the South Central United States is used to seeing in the summer finally starting to build, and production lagging recent highs, August natural gas forward prices soared 32.0 cents on average during the trading period ending July 21, according to NGI’s Forward Look. Price gains were just as impressive for the…

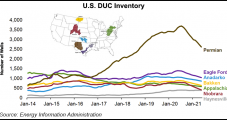

Lower 48 E&Ps Working Down DUC Count as Development Looks to Accelerate

U.S. oil and gas producers have held the line on capital spending and concentrated on completing wells rather than costly new development, the Energy Information Administration (EIA) said. The EIA’s Drilling Productivity Report (DPR) issued earlier this month noted that the backlog of drilled but uncompleted wells, aka DUCs, had declined in May by 247…

Bitcoin Mining Digging for E&P’s Natural Gas Gold in Lower 48

A symbiotic relationship is burgeoning in North America between oil and natural gas producers and miners of the cryptocurrency Bitcoin. Both groups are seeking to capitalize on immense volumes of excess and/or stranded natural gas flared off or shut in by a lack of infrastructure. Bitcoin mining offers a new outlet for this gas at…

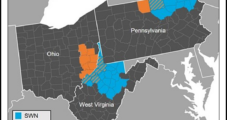

Southwestern Strikes All-Stock Deal for Appalachian Pure-Play Montage

Southwestern Energy Co. agreed to acquire Montage Resources Corp. in an all-stock deal that would create the third largest oil and natural gas producer in the Appalachian Basin, with 3 Bcfe/d of combined production. The deal is valued at $857 million, including debt, according to Raymond James & Associates Inc. It would give the Houston-based…

Senators Call For Federal Government Loans to U.S. Energy Producers

A group of 11 U.S. Senators is calling on the Trump administration to make loans accessible to domestic energy producers in an effort to protect American jobs associated with the industry.

Benefits of Cheap Oil ‘Largely Theoretical’ Until Consumption Improves, Says Raymond James

Until people are traveling again, on the road or in the air, the economic benefits of cheap oil “remain largely theoretical,” as Covid-19’s hit to global demand is worse than the impact of the financial crisis, according to Raymond James & Associates Inc.

Benefits of Cheap Oil ‘Largely Theoretical’ Until Consumption Improves, Says Raymond James

Until people are traveling again, on the road or in the air, the economic benefits of cheap oil “remain largely theoretical,” as Covid-19’s hit to global demand is worse than the impact of the financial crisis, according to Raymond James & Associates Inc.

NGI The Weekly Gas Market Report

Dallas Fed Energy Survey Confirms ‘Overwhelmingly’ Bleak Conditions in Texas, Louisiana and New Mexico

Oil and natural gas activity in Texas, southern New Mexico and northern Louisiana fell off a cliff in the first three months of the year, unsurprising news from the Federal Reserve Bank of Dallas.

And the Survey Says: Producers Facing Rough Fall Redetermination Season

For the first time in three years, oil and natural gas producers are expected to see their borrowing bases decline as credit availability contracts on a worsening outlook for commodity prices, according to a survey of 221 industry respondents conducted last month by Haynes and Boone LLP.