Natural gas futures gave up more ground Tuesday on a weakening heat outlook and concerns that diminishing cooling needs could keep power demand in check at a time when production shows signs of increasing and liquefied natural gas (LNG) exports remain soft. The July Nymex contract fell 2.7 cents day/day, settling at $1.637/MMBtu. August lost…

Markets

Articles from Markets

Canada’s OFS, Supply Sectors Forecast to Suffer Biggest Job Losses from Covid-19 Activity Slump

Oilfield service and supply contractors continue to suffer the biggest job losses in the Canadian oil and gas activity slump driven by the Covid-19 pandemic, according to an industry monitoring agency. Cuts of 6,100 field positions accounted for 89% of 6,870 Canadian industry layoffs during May, based on records compiled by Petroleum Labor Market Information…

‘Great Compression’ Seen for Lower 48 E&Ps as Impairments Likely to Spur Consolidation

The U.S. onshore oil and gas industry is against the wall with the unconventional boom in its 15th year, now facing accelerated insolvencies and a wave of consolidation, according to new research. Second quarter earnings may bring a “surge of asset impairments” as U.S. operators that work in shale and other tight resources enter a…

Diminishing Jobs in U.S. OFS Sector Said to Jeopardize Energy Supply Chain

The oilfield services (OFS) sector has been looking for a break, brought low for several quarters by reduced exploration and development spending and further upended by Covid-19, but it’s expected to be a long, hard slog before activity moves into high gear. Meanwhile, the jobs picture for the energy industry, and in particular the OFS…

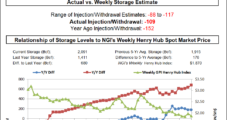

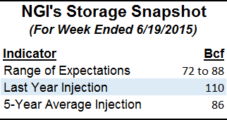

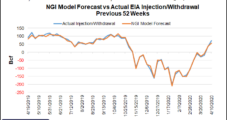

Natural Gas Futures Climb After Storage Build Meets Expectations; Forecasts Call for Late June Heat

Natural gas futures advanced Thursday after the latest storage report met expectations and forecasts continued to call for more June heat. However, demand concerns lingered as markets absorbed an economic outlook that pointed to protracted fallout from the coronavirus pandemic. The July Nymex contract settled at $1.813/MMBtu, up 3.3 cents day/day. August rose 3.0 cents to $1.900.

Natural Gas Futures Steady as Forecasts Warm; Cash Mixed

Natural gas futures snapped a three-day losing streak, edging up Monday as weather models hinted at what could be a warmer-than-normal summer. However, with a looming storage “tsunami,” the June Nymex gas futures contract settled only three-tenths of a cent higher than Friday’s close at $1.826. July climbed .008 cents to $2.085.

Production Drop, Cooler Forecasts Fuel Natural Gas Futures; Cash Strong Too

Coming off a mild winter, weather models that showed chilly weather lingering a bit longer aided a rebound for natural gas futures to start the week. Reinforced by a sustained drop in production that first showed up at the end of last week, the June Nymex gas futures contract climbed 10.3 cents to settle Monday at $1.993. July rose 9.6 cents to $2.230.

Natural Gas Futures Fall as Market Gears Up for ‘Dramatic’ Storage Injections in May

An initial bump in natural gas futures prices failed to gain momentum Wednesday, with demand destruction weighing more heavily on the front of the curve than any declines in production. The June Nymex gas futures contract, on the first day in the prompt-month position, fell 7.9 cents to $1.869. July also dropped 7.9 cents to hit $2.091.

‘Roller Coaster’ Continues at Full Speed for Natural Gas Futures; Permian Cash Gains Again

Early selling in natural gas futures failed to hold, with erratic, non-fundamentally driven price fluctuations continuing midweek. After sinking to a $1.774 intraday low, the May Nymex gas futures contract settled Wednesday at $1.939, up 11.8 cents on the day. Increases continued throughout the curve, with June picking up 6.9 cents to hit $2.053.

Natural Gas Futures Surge as WTI Crude Goes Negative, but Waha Cash Trades at Record Low

Still struggling to get a grasp on how much demand is being lost amid the coronavirus pandemic, natural gas traders on Monday took their cue from unparalleled deterioration in the oil markets. After an initial sell-off early in the session, the May Nymex gas futures contract rallied, shattering resistance and settling the day at $1.924, up 17.1 cents from Friday’s close. June climbed 14.6 cents to $2.049.