After a successful attempt at breaching $1.80/MMBtu, May natural gas futures slammed the brakes as widespread demand losses from Covid-19-related shutdowns continued to dominate markets. However, volatility remained high and the prompt month went on to settle Monday at $1.724, off only nine-tenths of 1 cent from last Thursday’s closing price. June climbed 1.6 cents to $1.879.

Markets

Articles from Markets

Natural Gas Futures See Wild Swings in ‘Obscenely Loose’ Market; Cash Rebounds

After a successful attempt at breaching $1.80/MMBtu, May natural gas futures slammed the brakes as widespread demand losses from Covid-19-related shutdowns continued to dominate markets. However, volatility remained high and the prompt month went on to settle Monday at $1.724, off only nine-tenths of 1 cent from last Thursday’s closing price. June climbed 1.6 cents to $1.879.

Natural Gas Futures Down, Then Up, Amid Coronavirus Unease

Riding the waves of economic unease in the face of a growing pandemic, natural gas futures turned in an up-and-down day of trading Monday before settling close to unchanged. The April Nymex contract traded as low as $1.519/MMBtu, then rebounded to as high as $1.628, ultimately finishing at $1.602, off 0.2 cents.

Natural Gas Traders See Bright Side to Oil Price Carnage

On another day of widespread economic uncertainty, natural gas futures recovered from an early swoon Monday, rallying sharply as bulls latched onto the prospect of the oil price collapse leading to cuts in associated gas output. After trading as low as $1.610/MMBtu, the April Nymex contract went on to settle at $1.778, up 7.0 cents day/day. Gains were even stronger further along the strip, with the Winter 2020/21 contracts gaining around a dime.

Natural Gas Futures Continue Gains as ‘Solid Bottom’ Potentially in Place

The natural gas futures market extended its recent move higher Wednesday, with fading cold weather potentially allowing traders to shift their attention to tighter balances. Continuing to rebound after a test of long-term support late last week, the April Nymex contract picked up another 2.7 cents to settle at $1.827/MMBtu. May settled at $1.865, also up 2.7 cents.

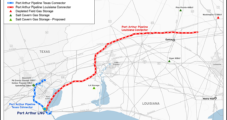

LNG Recap: Busy Stretch for U.S. Export Development as Global Outlook Remains Weak

U.S. liquefied natural gas (LNG) exports bounced back during the week ending Feb. 26 as 18 vessels departed carrying 69 Bcf, according to the Energy Information Administration (EIA).*

Like Crude and Stocks, Natural Gas Futures Rally to Open Week; Cash Soft on Mild Temps

Energy and stock markets steadied themselves Monday after last week’s swoon over Covid-19 fears, and natural gas futures followed the broader trend, rebounding decisively despite a lack of weather-driven demand in the forecast. The April Nymex contract added 7.2 cents to settle at $1.756/MMBtu, while May picked up 6.5 cents to $1.797.

Natural Gas Futures Fall as Weather Patterns May Stay ‘Quite Warm’; Cash Mostly Lower, But AECO Up

After taking a few steps back last week, natural gas futures moved more convincingly lower on Monday following further warming in the latest weather models. The March Nymex gas futures contract settled at $1.827/MMBtu, down 7.8 cents from Friday’s close. April dropped 7.4 cents to $1.843.

Dramatically Warmer Weather Forecasts ‘Final Nail in the Coffin’ for Natural Gas

A major shift in weekend weather forecasts that may solidify this winter as one of the warmest on record sent Nymex natural gas futures plunging to fresh lows on Monday. The March Nymex contract tumbled 9.2 cents to settle at $1.766/MMBtu. April fell 8.8 cents to $1.804.

Late-Session Rally Trims Losses for Natural Gas Futures; Cash Markets Mixed

Weather models are playing mind games with natural gas traders. After stalling the return of colder weather overnight, the latest weather model run put it back on track and increased its intensity. With another drop in production, the March Nymex gas futures contract went on to settle Wednesday at $1.861/MMBtu, down just 1.1 cents. April slipped 1.5 cents to $1.887.