NGI All News Access | LNG Insight | Markets

Natural Gas Futures Climb After Storage Build Meets Expectations; Forecasts Call for Late June Heat

Natural gas futures advanced Thursday after the latest storage report met expectations and forecasts continued to call for more June heat. However, demand concerns lingered as markets absorbed an economic outlook that pointed to protracted fallout from the coronavirus pandemic. The July Nymex contract settled at $1.813/MMBtu, up 3.3 cents day/day. August rose 3.0 cents to $1.900.

Small losses were seen across most of the country, sending NGI’s Spot Gas National Avg. down 4.0 cents to $1.580.

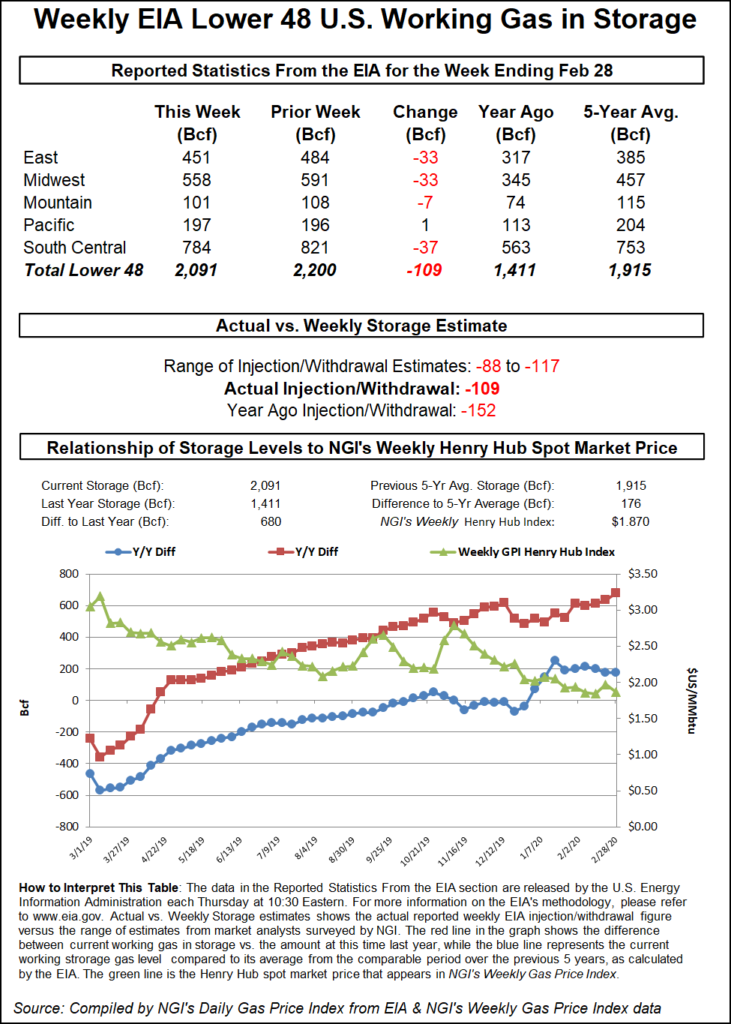

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 93 Bcf into storage for the week ending June 5. The figure was well below the previous week’s inventory build of 102 Bcf and lower than the 107 Bcf increase recorded in the same week a year earlier.

The print came in slightly below the five-year average build of 94 Bcf and was in line with expectations. A Wall Street Journal survey produced an average of 93 Bcf, while a Bloomberg poll landed on a median of 94 Bcf. NGI estimated a 96 Bcf build.

The latest injection indicated enough supply/demand tightening to help push gas futures higher, yet it left substantial surpluses of 422 Bcf, NatGasWeather said. “Next week’s build is also expected to be near the five-year average, so no significant improvement in deficit for several more weeks, while also filling national supplies to an impressive 3 Tcf before the end of June.”

The build for last week increased inventories to 2,807 Bcf, above the year-earlier level of 2,059 Bcf and the five-year average of 2,386 Bcf, according to EIA.

On the weather front, forecasts called for cooler weather across the midsection of the country near term and then into the East over the weekend and next week. However, heat is expected to return across much of the country later in the week, NatGasWeather said, potentially driving increased cooling demand.

“It’s up to the hotter camp coming through at all times this summer due to hefty supplies,” the firm said.

Bespoke Weather Services forecasters agreed that a boost in energy demand appears likely this month. “June as a whole is still shaping up to be impressive” in terms of greater gas-weighted degree day totals, “with our estimate being the highest June total since 2011.”

Long-term demand, however, remains uncertain against the backdrop of the coronavirus pandemic and the economic recession it induced in the Lower 48 and across much of the world. Producers need industrial power use to return somewhere near pre-virus levels to soak up excess supplies ahead of next winter.

Weak conditions in Europe and Asia are similarly tenuous, curbing demand and putting downward pressure on gas prices in countries across both continents. That has constrained needs for U.S. exports, limiting access to what were, prior to the pandemic, vital destinations for American-produced liquefied natural gas.

Stronger economic data would signal the specter of increased demand, but conditions remain fragile and the outlook dubious. The Federal Reserve Bank, for example, this week projected the U.S. jobless rate would average between 9% and 10% in the fourth quarter. That would mark a decline from 13.3% in May but still nearly triple the level of February, before the pandemic took hold.

Fed Chairman Jerome Powell said during a virtual news conference Wednesday all 17 policymakers expect to keep interest rates near zero into 2022 to help support a fragile economy. “We’re not even thinking about thinking about raising rates,” Powell said.

A day later, Moody’s Investors Service Inc. downgraded its outlook for the global midstream energy sector to negative from stable.

“The negative outlook for the global midstream sector reflects the rapid pace and magnitude of production declines that have now spilled into midstream operations and will compromise the sector’s credit quality over the next 12-18 months,” said Moody’s Andrew Brooks, senior credit officer. “Midstream throughput volumes have fallen in line with cuts in oil and gas exploration and production, the extent of which will depend on the duration of the economic downturn.”

Spot gas prices declined across most of the country, as a weather system that tracked over the Midwest pushed into the East, bringing rain and highs in the 60s and 70s, according to NatGasWeather.

Dominion North declined 9.0 cents day/day to average $1.395; Algonquin Citygate dropped 11.5 cents to $1.535; and Chicago Citygate dipped 3.5 cents to $1.570.

West Texas, where heat has settled in, was the lone region to post consistent price advances.

Transwestern climbed 5.5 cents to $1.455, and El Paso Permian rose 2.5 cents to $1.440.

In pipeline news, Columbia Gas Transmission (TCO) said it plans maintenance work that could restrict up to 121 MMcf/d of receipts from Friday through June 29. The planned maintenance is to perform hydrotest work on Line K, which travels from southern New York into eastern Pennsylvania, according to Genscape Inc.

The Wagoner Line K location, an interconnect with Millennium Pipeline, is to be set to zero total capacity for all of the project. Over the past 30 days, Genscape showed flows through Wagoner Line K averaging 115 MMcf/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |