MPLX LP management said its 2024 growth outlook is anchored in the Permian Basin and Marcellus Shale, which provide steady sources of opportunities, particularly around natural gas and natural gas liquids (NGL) assets. It also sees potential in the Utica Shale. “We plan to continue growing these operations through organic projects, investment in our Permian…

Growth

Articles from Growth

Aramco to Expand Oil Deliveries to China for Refinery and Petrochemical Growth

Saudi Arabian Oil Co. is taking a 10% stake in a Chinese petrochemical company to expand its crude oil presence in the country. Aramco, as it is known, said it would pay around $3.6 billion to buy the interest in Rongsheng Petrochemical Co. Ltd. Aramco Overseas Co. (AOC) would manage the stake. Under a long-term…

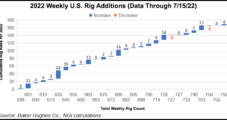

Baker Hughes Sees Years of Growth in U.S. Natural Gas, LNG Sectors

Baker Hughes Co. (BKR) management on Wednesday offered a bullish assessment of natural gas growth opportunities but conveyed a more measured outlook for the oil market. “Overall, we remain very positive on the outlook for natural gas,” Baker Hughes’ CEO Lorenzo Simonelli told analysts during the oilfield services (OFS) giant’s 2Q2022 earnings call. “We also…

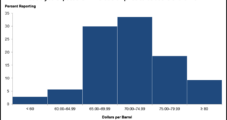

U.S. E&P, OFS Executives Foresee Lower Natural Gas, Oil Prices by Year’s End

Solid growth continued across some of the biggest oil and natural gas production regions in the country during the third quarter, but supply costs are rising and executives are a bit more wary than earlier this year, the Federal Reserve Bank of Dallas said Wednesday. The Dallas Fed, as it is known, collected data across…

Natural Gas, Oil Found to Support Sizeable Chunk of U.S. GDP, Including Pennsylvania

Pennsylvania’s oil and natural gas industry supported 6.1% of the total jobs and 9.7% of its gross domestic product (GDP) in 2019, according to a new study commissioned by the American Petroleum Institute (API). The industry overall supported 480,000 total jobs (102,500 direct and 377,800 indirect) and contributed $78.4 billion ($39.4 billion direct and $38.9…

Devon CEO Urges Lower 48 E&Ps to Focus on Generating Cash, Limiting Oil, Gas Production

Devon Energy Corp. CEO Rick Muncrief said it’s time for his peers to get their act together and stop expanding oil and gas production until demand outpaces supply. Speaking with investors during a first quarter conference call on Wednesday, Muncrief took the pulpit to preach to fellow exploration and production (E&P) companies. Mirroring comments by…

‘Writing is on the Wall,’ says Total’s Pouyanné as Major Shifting to LNG, Renewables

France’s Total SE plans to base its growth strategy on liquefied natural gas (LNG) and renewable electricity during the 2020-2030 period and propose a name change to shareholders to reflect the shift in focus, management said Tuesday. “The writing is on the wall,” said CEO Patrick Pouyanné upon presenting the major’s 2020 earnings to analysts…

LNG Export Trade in Growth Mode for ‘Some Time,’ Says Yergin

All claims to the contrary, the oil and gas industry is not dying a slow death, with the outlook for U.S. exports looking strong long term, according to one of the energy world’s leading thought leaders. Master storyteller Daniel Yergin, more often the inquirer, had much to share with NGI in a recent conversation about…

4Q2019 Earnings: MPLX Remains Focused on Permian, Trims Capex Another $500M

MPLX LP is targeting high-return projects in the Permian Basin-to-Gulf Coast corridor as it continues to streamline 2020 growth capital expenditures (capex) to $1.5 billion, down by another $500 million from the most recent estimate.

4Q2019 Earnings: MPLX Remains Focused on Permian, Trims Capex Another $500M

MPLX LP is targeting high-return projects in the Permian Basin-to-Gulf Coast corridor as it continues to streamline 2020 growth capital expenditures (capex) to $1.5 billion, down by another $500 million from the most recent estimate.