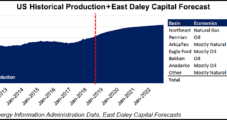

Going back to last year, natural gas production forecasts based on drilling fundamentals missed key signals from equity markets that had predicted the recent surge in Lower 48 supply, according to East Daley Capital’s Matthew Lewis, who directs financial analysis for the firm.

Growth

Articles from Growth

Shell’s LNG Sales Jump 17% in 1Q, with Volumes Rising 9%

Royal Dutch Shell plc in the first three months of the year benefited from its substantial — and growing — natural gas liquefaction business, with global sales climbing 17% year/year to 18.58 million metric tons (mmt) and volumes increasing 9% to 8.9 mmt.

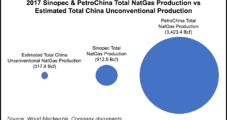

China’s Unconventional Natural Gas Output to Double by 2020, Says Wood Mackenzie

China’s unconventional natural gas production has undergone significant progress in the past 10 years, increasing to nearly 600 wells and 9 bcm (317.8 Bcf) of production in 2017, and output is likely to double to 17 bcm (600 Bcf) in 2020, according to Wood Mackenzie.

EIA Says U.S. Natural Gas Storage Capacity Increases 1% in 2017

Underground natural gas storage capacity in the Lower 48 grew by less than 1% year/year to November 2017, with most of the new capacity coming from expansions made to facilities in the East storage region, according to the U.S. Energy Information Administration (EIA).

Robust U.S. Land Permit Data Pointing to Another Year of E&P Outspending, Says Evercore

Strong drilling permit growth so early in 2018 points to “substantial” outspend by the exploration sector yet again, Evercore ISI analysts said.

More E&Ps Expected to Achieve Free Cash Flow in 2018 Despite ‘Death of Cheap Money’

An evolving strategic focus on capital discipline by U.S. onshore exploration and production (E&P) companies that began quietly within the last couple of years is expected to become far more widespread in 2018, with nearly half of a sampled group of independent producers — mostly in the Permian Basin — generating free cash flow (FCF) in 2018, according to BTU Analytics.

Permian Player Concho Grows Production, Sets Eyes on Repeat Success in 2018

After reporting more than 28% growth in total production in the fourth quarter, Permian Basin pure-play explorer Concho Resources Inc. said it expects to grow 2018 output by 16-20%, with crude oil rising by about 20%, using a $2 billion capital expenditures (capex) program.

Antero Nets $1B-Plus in Stock Offering, NatGas Hedge Restructuring

Antero Resources Corp. said Thursday that it earned more than $1 billion through a stock offering and changes to its natural gas hedge portfolio, securing some of the cash it needs to support year/year production growth of 20-22% through 2020.

MDU Resources Eyeing Midstream Infrastructure Opportunities

Bismarck, ND-based MDU Resources Group Inc. is eyeing opportunities to shore up infrastructure through its midstream pipeline and construction business units, the multi-state utility holding company’s executive team said.

Without (Unlikely) Black Swan Event, BMO Sees Lower Oil, NatGas Prices Sticking Around

The collapse in crude oil prices that began in mid-2014 shows no signs of abating soon, and in fact oil — and natural gas — prices could remain relatively weak for a couple more years, BMO Capital Markets analysts said Monday.