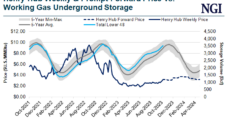

Updated weather forecasts pointed to ongoing mild conditions that would generate a lack of heating demand through the first half of December. The outlook drove January natural gas futures another leg lower, even as the market eyes what could be the first triple-digit withdrawal from inventories of the season in data due out Thursday. At…

Forecasts

Articles from Forecasts

U.S. Natural Gas Prices Reflect ‘Amply Supplied’ Market This Winter, but Optics Less Clear in South Central

Record power burns and elevated gas exports have halved the surplus of Lower 48 working gas in storage since the summer. However, with an expected loosening of supply/demand balances, supply risks are unlikely this winter except in the most severe cold weather scenarios, according to analysts. The storage surplus to the five-year average has fallen…

Russia’s Invasion of Ukraine Upends OPEC’s Oil Demand Forecast; Dallas Fed Sees Uncertainty

Global oil demand this year was tracking to a strong recovery, fueled by demand in goods and services, but the Russian incursion into Ukraine has upended all forecasts and there is no clarity in the near term, according to energy experts. In OPEC’s Monthly Oil Market Report (MOMR) issued Tuesday, the Saudi-led cartel noted that…

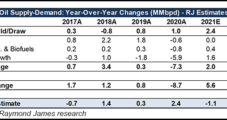

Raymond James Looks Past Omicron, Raises Oil Price Forecast

Despite fears about the Omicron variant of the coronavirus and rising global oil output, Raymond James Financial Inc. analysts are increasingly optimistic about strong crude prices through 2023. “Our bullish oil view over the next few years not only remains firm, but we’re actually increasing our long-term price forecast,” the analysts, John Freeman and Justin…

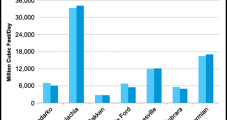

EIA Predicts Shrinking NatGas Output, Rising Oil from U.S. Plays in June

Natural gas production from seven key U.S. onshore regions is set to decline from May to June, while oil supply is poised for growth thanks to output from the Permian Basin, according to the Energy Information Administration (EIA). In its latest Drilling Productivity Report (DPR), EIA said it expects the Anadarko, Appalachia and Permian basins,…

Natural Gas Futures Advance on Potential for Harsh Winter Freeze; Cash Prices Jump

Natural gas prices surged early on Tuesday amid expectations for intensifying U.S. liquefied natural gas (LNG) export demand and increased anticipation of subfreezing air descending from Canada and covering large parts of the Lower 48 in late January. After spiking about 15 cents in morning trading, the February Nymex gas futures contract gave back much…

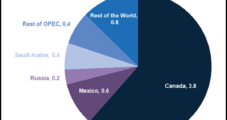

North America Oil Output Creating Global ‘Supply Shock,’ Says IEA

A “supply shock” to the global energy markets being created by North American oil production will be as transformative to the market over the next five years as was the rise of Chinese demand in the last 15, forcing operators to overhaul global investment strategies and reshape the way oil is transported, stored and refined, the International Energy Agency (IEA) said Tuesday.

Still More Cold Lifts Northeast, But Futures Retreat

Cash natural gas prices were unchanged on average in Friday for weekend and Monday trading. Northeast points managed gains as weather forecasts proved supportive, but Rocky Mountain points were steady to lower, and eastern points fell a couple of cents.

Devon’s Permian Success Lifts U.S. Oil Output 23%

A standout performance in the Permian Basin increased oil production 23% year/year in the first three months of this year, but it’s not the only racehorse in the stable, Devon Energy Corp.’s top executive said Wednesday. Encouraging results from the emerging Mississippian Lime, for example, may provide the “next leg of growth.”

Keep Canadian NatGas, Bitumen at Home, Says Group

Armed with fresh benefits forecasts, Canadian domestic industry is reviving a generations-old crusade for a priority spot on energy policy agendas dominated by government support for export pipeline projects. Provincial and federal authorities are being told that enough current refining and petrochemical development opportunities have been identified in Alberta alone to add about C$6.4 billion to Canada’s annual gross domestic product and create 18,600 jobs.