The world’s energy companies are becoming more pragmatic in their approach to reaching net-zero emissions and Baker Hughes Co.’s customers plan to boost their natural gas exposure in the coming years, CEO Lorenzo Simonelli said. It is “becoming clearer just how complex the undertaking is for the transition of the world’s energy ecosystem,” Simonelli said…

Topic / International

SubscribeInternational

Articles from International

EU Energy Watchdog Says LNG Demand Could Peak This Year

The European Union’s (EU) LNG demand is likely to peak this year and buyers on the continent are likely to be over-contracted by 2030 as efforts to displace Russian natural gas over the last two years have been successful, according to the bloc’s energy watchdog. Since 2022, when Russia invaded Ukraine and cut off gas…

Japan’s LNG Consumption Expected to Decline This Year

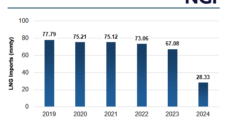

Despite fuel restrictions at four of Jera Co. Inc.’s gas-fired power plants in Tokyo last month, Japan’s LNG imports are again expected to decline this year. Liquefied natural gas stockpiles hit their lowest point since January 2021 last month, when they fell below the five-year average of 2.14 million tons (Mt). Cargo deliveries were delayed…

Groningen Field to Permanently Close as the Netherlands Increases Pipeline and LNG imports

The Netherlands is expected to permanently close the huge Groningen natural gas field, the Dutch Senate announced this week. Groningen, one of the largest gas fields in Europe, caused earthquakes and damage to local communities for more than 20 years, which created debate among politicians, local residents and gas industry supporters for years about whether…

U.S. LNG Could Be Heading for Open Arbitrage Moment, but Shipping Challenges Persist

With geopolitical tensions in the Middle East continuing to make the Suez Canal a risky crossing, almost 20% of all U.S. LNG exports have taken the longer route around southern Africa so far this year, according to data from Kpler. After conflict in Israel and Gaza sparked off in October, the threat of rocket attacks…

Oman Continues LNG Supply Push With Two New Deals – Three Things to Know About the LNG Market

NO. 1: Feed gas deliveries to U.S. LNG export plants ticked back up on Thursday after recent downturns as maintenance season gets underway. Overall, U.S. feed gas demand was nominated at 10.8 Bcf, up 5% from Wednesday. Nominations for the Freeport liquefied natural gas export terminal in Texas on Thursday were at 276 MMcf, or…

ExxonMobil Greenlights Another Stabroek Project Offshore Guyana

ExxonMobil keeps powering ahead in its offshore Guyana program even as a contract dispute and geopolitical tensions cast a shadow over the oil-rich project. The company made a final investment decision for the Whiptail development, its sixth project on the offshore Stabroek block. It has the necessary approvals in place and the offshore platform is…

March CPI Data Show Energy Inflation Reawakened Despite Depressed Natural Gas Prices

Stable natural gas prices were not enough to offset spikes in other energy costs in March, pushing the government’s measure of energy prices higher for the first time in a year. The U.S. Department of Labor said the Consumer Price Index (CPI) increased at a rate of 3.5% in the 12-month period through March. That…

Pieridae Seeks to Transfer Goldboro LNG Approvals to Irish Buyer

Pieridae Energy Ltd. could be looking to sell its abandoned Goldboro LNG project in Nova Scotia to an Irish energy firm, according to a recently published regulatory filing. Calgary-based Pieridae asked Nova Scotia’s utility and review board for permission to transfer its approvals for the potentially 1.3 Bcf/d export project to Simply Blue Group, a…

Equinor Bets On Electrification to Sustainably Extend Natural Gas Supply to Europe

Equinor ASA is phasing out gas-fired generation in one of its most prolific natural gas production hubs in favor of electricity as it looks to increase both the sustainability and the lifespan of its North Sea operations. Norway’s Equinor disclosed that its offshore facilities at the Sleipner field and the adjacent Gudrun platform had been…