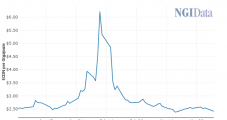

Could more natural gas-focused exploration and production (E&P) or midstream transactions be in the works after Chesapeake Energy Corp. and Southwestern Energy Co. agreed to combine into the Lower 48’s largest gas producer? Oil-focused dealmaking powered much of the consolidation in the U.S. oil and gas industry in 2023, with associated gas production riding the…

Deals

Articles from Deals

Uptick on the Horizon in Upstream Natural Gas and Oil Dealmaking? – Listen Now to NGI’s Hub & Flow

Click here to listen to the latest episode of NGI’s Hub & Flow for a preview of what’s on the dealmaking horizon among public and private U.S. exploration and production companies. In the podcast, Seenu Akunuri, principal for PwC’s U.S. Energy, Resources, and Utilities Deals, highlights upstream trends he’s seeing. He highlights investors’ growing appetite…

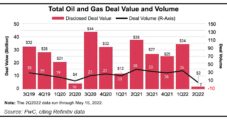

PwC Study Shows Growing Appetite for Natural Gas, Oil Investor Deals

Higher commodity prices have whetted investors’ appetite for more natural gas and oil deals, and the pace of activity should pick up for the rest of this year, PwC predicted in a recent midyear report. “Private equity deals are on pace for another record year as traditional oil and gas investments become attractive once again,”…

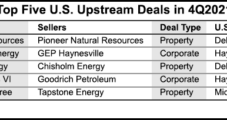

U.S. Upstream Dealmaking Fueled by Permian, Haynesville

The Permian Basin and natural gas-rich Haynesville Shale accounted for nearly all of the upstream transactions in the final three months of 2021, but dealmaking overall was down sharply from the third quarter, Enverus reported. The value of Lower 48 merger and acquisition (M&A) activity between exploration and production (E&P) companies totaled $9 billion in…

Whitecap Expands Montney Shale Footprint with Kicking Horse Acquisition

Whitecap Resources Inc. increased its liquids-rich Montney Shale natural gas assets with a C$300 million ($240 million) takeover of private equity-backed Kicking Horse Oil & Gas Ltd.The acquisition includes ownership interests averaging 65% in 92 square miles of Montney production and future drilling targets in the Grande Prairie area of northwest Alberta. “We are excited…

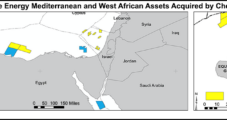

Chevron’s $13B Deal for Noble to Add Lower 48 Heft, Natural Gas Promise in Offshore Eastern Med, Equatorial Guinea

Chevron Corp. has clinched a definitive agreement to acquire Houston super independent Noble Energy Inc. in an all-stock transaction worth $5 billion that carries a total enterprise value, including debt, of $13 billion. The transaction, which values Noble at $10.38/share, would trade 0.1191 Chevron shares for each Noble share. Noble’s massive natural gas operation offshore…

Permian Still Hot, but Slumping Lower 48 M&A Market Looking to Rebound in 2020

Following an overall paltry return for Lower 48 oil and gas property sales in 2019, the dealmaking market may be looking for a repeat, as well-financed operators prowl for quality assets at bargain prices, according to energy data specialist Enverus.

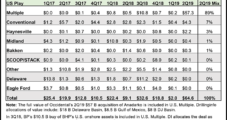

Occidental/Anadarko Takeover Obscures Modest Rebound in U.S. M&A Activity

U.S. upstream merger and acquisition (M&A) activity rebounded in the second quarter from historic lows earlier this year, but the value was super-sized with Occidental Petroleum Corp.’s $57 billion proposed takeover of Anadarko Petroleum Corp., according to a review by DrillingInfo.

U.S. E&P Dealmaking at Breakneck Pace During First Quarter

Enthusiastic investors set a torrid pace for U.S. energy dealmaking in the first quarter, breaking the record for first quarter deal values, according to a tally by PwC.

Shale-Related Projects Set Record Investment Level in Southwest Pennsylvania Last Year

The Pittsburgh Regional Alliance (PRA) said this month that it tracked the largest-ever amount of capital investment in the 10-county region surrounding the city in southwestern Pennsylvania last year, attributing most of the $10.2 billion recorded to shale gas-related growth.