The latest ranking of the top 20 natural gas pipeline capacity traders by volume from Capacity Center includes an upset in the top position as well as the departure of seven companies from the ranking. Deals have increased in duration, and there is more concentration in the sector, too, the firm said.

Deals

Articles from Deals

U.S. E&P Dealmaking Stalls; Execs Cite Risks to Replace, Expand Reserves

U.S. natural gas and oil industry dealmaking stalled in the first quarter as operators attempted to find their footing, but more executives are optimistic about opportunities to invest and expand over the coming year, new research indicates.

U.S. E&P Dealmaking Stalls; Execs Cite Risks to Replace, Expand Reserves

U.S. natural gas and oil industry dealmaking stalled in the first quarter as operators attempted to find their footing, but more executives are optimistic about opportunities to invest and expand over the coming year, new research indicates.

Oil and Gas Industry Deals Remain Flat This Year, Deloitte Says

The oil and gas industry continues to narrow its focus on development this year, heeding the call of investors who expect maximum returns from existing portfolios and taking advantage of higher commodity prices, especially in North America, according to the Deloitte Center for Energy Solutions.

Mega Deals Surge in Domestic Oil, NatGas Sector

Mergers and acquisitions (M&A) within the U.S. oil and natural gas sector was the strongest second quarter activity in five years, led by asset transactions, PwC US said Wednesday.

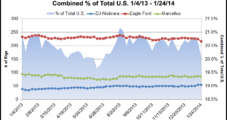

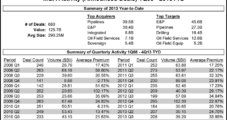

Eagle Ford, Marcellus, Niobrara Topped M&A Interest in 4Q

Dealmakers in late 2013 mostly were drawn to the Eagle Ford Shale in South Texas, where five mergers and acquisitions (M&A) led to $6.5 billion total in transactions, compared to the Marcellus Shale, where four captured $1.5 billion, a new analysis by PwC found. The Niobrara formation’s two transactions were valued at $1.2 billion, while two in the Utica Shale contributed $263 million.

Power, Utility Sector M&A Activity Ramped Up in 4Q2013

Merger and acquisition (M&A) activity in the North American power and utilities industry increased in 4Q2013 compared to both 3Q2013 and 4Q2012, with several large deals based on natural gas-fired power generation facilities driving overall deal volume and value higher, according to an analysis by PwC.

‘Clear Rebound’ in Confidence of Senior Oil, Natural Gas Executives

More than one-third of 169 senior oil and natural gas executives worldwide expect to go after acquisitions in the next year, according to EY’s ninth biannual Oil and Gas Capital confidence barometer.

U.S. M&A Falls on Lack of Midstream, Mega Energy Deals

A significant drop-off in midstream merger and acquisition (M&A) activity, coupled with lackluster number of mega deals, resulted in a decline in deal values for the third quarter from a year ago, PwC US said Thursday.

Bakken-Focused Kodiak Raises Spending, Production Guidance

Denver-based Kodiak Oil & Gas Corp., which is focused on the Bakken Shale in North Dakota’s Williston Basin, grew oil and gas sales volumes by 83% during the second quarter compared to a year ago; crude oil accounted for 87% of second quarter sales. The company has raised capital spending and production guidance for the remainder of the year.