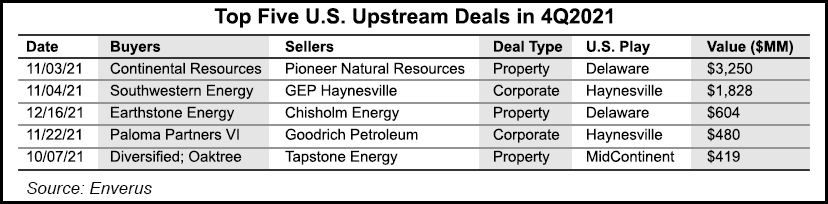

The Permian Basin and natural gas-rich Haynesville Shale accounted for nearly all of the upstream transactions in the final three months of 2021, but dealmaking overall was down sharply from the third quarter, Enverus reported.

The value of Lower 48 merger and acquisition (M&A) activity between exploration and production (E&P) companies totaled $9 billion in 4Q2021, versus $18.5 billion in 3Q2021, the energy data analytics firm said.

For the full year, M&A values reached $66 billion, 25% higher than in 2020, when oil and gas deal values were pummeled by Covid 19. The annual total for 2021 was below the $72 billion average fetched between 2015 and 2019, before the pandemic.

“Since the emergence of Covid, upstream M&A has been characterized by fewer, but larger, deals,”...