M&A | E&P | Eagle Ford Shale | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Chevron’s $13B Deal for Noble to Add Lower 48 Heft, Natural Gas Promise in Offshore Eastern Med, Equatorial Guinea

Chevron Corp. has clinched a definitive agreement to acquire Houston super independent Noble Energy Inc. in an all-stock transaction worth $5 billion that carries a total enterprise value, including debt, of $13 billion.

The transaction, which values Noble at $10.38/share, would trade 0.1191 Chevron shares for each Noble share. Noble’s massive natural gas operation offshore Israel includes the 22 Tcf Leviathan project, whose first phase includes four subsea wells, each capable of flowing more than 300 MMcf/d. Proved reserves are estimated at 3.3 Tcf net.

Noble also is a leading operator in the Denver-Julesburg (DJ) Basin, and it has around 92,000 acres in the Permian Basin of West Texas as well as a midstream business in the Eagle Ford Shale.

“Our strong balance sheet and financial discipline gives us the flexibility to be a buyer of quality assets during these challenging times,” said CEO Michael Wirth. “This is a cost-effective opportunity for Chevron to acquire additional proved reserves and resources.”

Noble’s assets “play to Chevron’s operational strengths, and the transaction underscores our commitment to capital discipline.”

Chevron has been eyeing big acquisitions since last year. It lost out on an attempt to merge with frequent partner Anadarko Petroleum Corp. after Occidental Petroleum Corp. secured an agreement worth an estimated $57 billion.

With the Noble deal, Chevron estimated run-rate synergies would be about $300 million a year. The synergies “will be partially headcount-related, as we’ve got some reductions primarily in corporate functions,” Wirth said during a conference call with investors. Chevron also expects to high-grade the exploration portfolio, reduce the number of office buildings, information technology and insurance costs.

“We see the opportunity here to accelerate that even further,” Wirth said. “We haven’t had a chance to get into things like the supply chain to look for procurement efficiencies and other things, but I’m sure we’ll see some of those as well…

“The market is not calling for more production right now, which is why we’ve exercised our flexibility in our capital program to bring these activity levels down,” the Chevron CEO said. “We’ll bring that activity back up when we see the indicators that suggest it’s appropriate to do so.”

Noble CEO David Stover said his management team became “more and more comfortable” with the idea of pairing with Chevron. “It wasn’t just the assets. It wasn’t just the execution. It was the overall fit of the two companies, the cultural aspects, how we make decisions, how we think about not just the short term but the long term.”

Combining with Chevron builds on Noble’s “positive momentum,” Stover said.

In May, Stover had said Noble would move cautiously through the year in the Lower 48 by shutting in wells and clawing back activity, while still working to build natural gas infrastructure overseas. Since March, Noble as of May had reduced capital expenditures for 2020 three times since March, about 53% from the midpoint of original guidance.

Based on Noble’s proved reserves at the end of 2019, Chevron said the deal would add around 18% to oil and gas reserves at an average cost of less than $5/boe, with almost 7 billion boe of risked resource under $1.50. The transaction should be accretive to return on capital employed, free cash flow and earnings/share one year after closing at $40/bbl Brent, according to Chevron.

In the Lower 48, the deal would give Chevron a new position in Colorado’s DJ, add to its legacy Permian portfolio and build an integrated midstream business in the Eagle Ford Shale.

Eastern Med A Gas, Gas, Gas

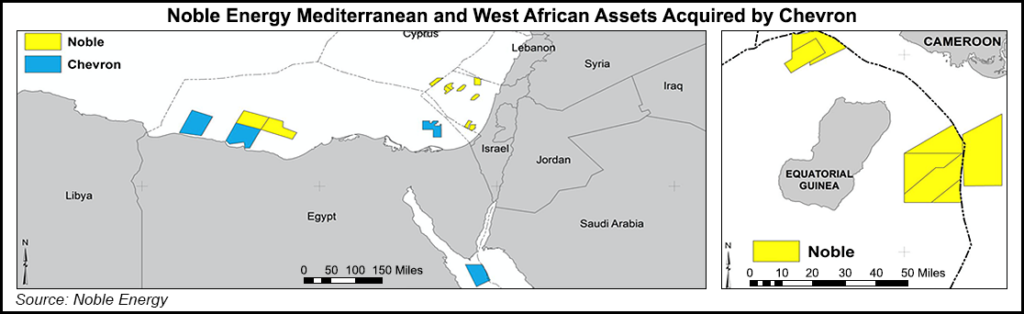

The Eastern Med position would diversify Chevron’s portfolio, while in West Africa, the supermajor would add opportunities in Equatorial Guinea (EG). Noble in 1Q2020 finalized a liquefied natural gas marketing agreement for offtake from the Alen project underway offshore EG.

The Eastern Med gas assets are particularly intriguing, Wirth said. “The Eastern Med is proving to be really quite a prolific hydrocarbon basin, and Noble was right there at the very beginning. It made some bold moves to make early discoveries and take the risk to begin to commercialize the resource, and so they’ve got a great position.”

It’s “acknowledged that natural gas is a fuel that will continue to displace coal for power generation,” Wirth said. “As the economies grow in that region and beyond, we think that the demand will continue to support further development” in terms of liquefied natural gas (LNG).

“There is some idle LNG capacity in Egypt right now that can leverage this as feed gas” about which there are ongoing discussions, Wirth noted.

“I think when you’ve got a large low cost resource base like this, approximate to large economies, we will find ways to move the gas to market in a manner that’s competitive…Obviously, commercialization of that will be a very important activity. It’s something that we do around the world with many different customers in many different countries and in many different modes of transportation.”

Better Than Anadarko?

Reaction to the tie-up by Wall Street was positive.

Raymond James & Associates Inc.’s Pavel Molchanov noted the merger proposal comes one year after Chevron “missed out, very fortunately in retrospect as it eventually turned out, on buying Anadarko.” Like the Anadarko deal, Chevron didn’t need to buy anything, he noted.

“However, the scale is much smaller, in both absolute and relative terms than Anadarko would have been. Also, the premium is notably lower. Thus, while we would rather see Chevron deploy more capital on its existing asset base, in other words, move from the current unsustainable level of austerity rather than expand the asset base, the overall effect is modest.”

Never rule out a bidding war, however, Molchanov said. As Noble is smaller, “prospective buyers would find it easier to replicate via other means, without having to fight a bidding war.”

Wood Mackenzie’s Tom Ellacott, senior vice president, noted the Chevron-Noble merger would be the “first large-scale corporate acquisition of this downturn.” Upstream research analyst Jean-Baptiste Bouzard called the Israeli assets the “crown jewel,” saying they would provide Chevron with “a new core international geography that will rebalance the portfolio toward gas and provide a springboard to capture further upside potential in the region.”

Look to see if the acquisition boosts development plans for “Noble’s Aphrodite discovery offshore Cyprus, as well as ramping up production from its flagship assets in Israel, Tamar and Leviathan,” Bouzard said. “Both companies also recently entered upstream Egypt, with a focus on frontier exploration in the offshore Herodotus basin.”

Enverus senior merger and acquisition analyst Andrew Dittmar said the deal made perfect sense.

“Given the natural fit of the assets, Noble has been viewed as likely being on Chevron’s radar from the moment Chevron chose to walk away from any bidding contest with Occidental over Anadarko,” Dittmar said.

“Along with the Permian, the best fit and biggest draw in Noble’s portfolio for Chevron may be the Eastern Mediterranean gas projects at Leviathan and Tamar,” Dittmar said.

“These are premier, long-life fields providing gas to Israel, Egypt, and Jordan. Chevron, like its major peers, has targeted these types of international gas projects as key pieces of its portfolio likely seeing long-term secular tailwinds to support gas demand over the next few decades.”

The 100% stock trade is not surprising given Chevron’s cautious approach to mergers, he noted. “For Noble shareholders, Chevron equity likely looks like a fine landing spot, even absent a cash sweetener, given Chevron’s operational experience for the assets, balance sheet strength, and ability to fund dividends even in a tough market…”

The Enverus analyst said the merger may lay out a “blueprint for what post-Covid consolidation will likely need to look like with all-stock consideration, a moderate premium, and asset fit and synergies that are an easy and natural story to tell investors. This could certainly ignite a wave of additional consolidation, although that is by no means certain as we saw with not many majors deals after the Anadarko takeover.

“While potential targets may be more plentiful, there aren’t that many companies with Chevron’s balance sheet strength and investor support to make up a buyer base.”

The transaction has been unanimously approved by the boards and is expected to be completed by year’s end pending Noble shareholder approval.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |