Midstreamer NuStar Energy LP has unveiled plans to boost capacity by 6,000 b/d on a 293-mile refined products pipeline that runs from the Panhandle in Texas to Albuquerque, NM. The San Antonio-based limited partnership said Wednesday it would upgrade pump stations on the 17.2 million b/d Amarillo-to-Albuquerque Pipeline, which it jointly owns with Phillips 66…

Crude

Articles from Crude

EIA Reports Increase in U.S. Crude Inventories, Decline in Exports

Commercial crude oil inventories in the United States increased by 4.4 million bbl during the week ending Jan. 15 amid an uptick in net imports, according to data published Friday by the Energy Information Administration (EIA). Crude inventories excluding the Strategic Petroleum Reserve increased to 486.6 million bbl for the period, about 9% above the…

Oil Market Seen Swinging from Oversupply to Deficit in 2021 on Vaccine Rollout, Boosting WTI Price

The new year could see the global oil market swing from its current state of oversupply to some of the highest monthly supply deficits in years as the rollout of Covid-19 vaccines propels a recovery in demand, according to experts. Raymond James & Associates Inc. analysts said Monday they expect “hefty” crude oil inventory draws…

U.S. Crude Stocks Fell Amid Stronger Exports Last Week as Holiday Demand Sagged, EIA Says

U.S. demand for petroleum products eased lower last week and lagged well behind year-ago levels, although commercial crude stockpiles declined by 600,000 bbl for the period amid an increase in exports, the Energy Information Administration (EIA) said Wednesday. A gauge for domestic demand, EIA reported 19.088 million b/d of total products supplied during the most…

U.S. Oil Exports Decline Amid Pandemic, Demand Destruction, EIA Says

After setting a record in February, U.S. oil exports declined over four consecutive months amid the shocks of the coronavirus pandemic, the U.S. Energy Information Administration (EIA) said. Demand dropped in March and in the three ensuing months as countries across the globe initiated measures to limit virus outbreaks. With travel and overall activity limited,…

Permian Crude Sets Sail from Buckeye’s New South Texas Export Terminal

Sourced with Permian Basin crude oil, Buckeye Partners LP on Thursday loaded the first vessel for export at its new South Texas Gateway (STG) terminal in Ingleside, TX. The start of operations at the terminal, located at the mouth of the Corpus Christi Ship Channel, follows first deliveries of crude in June from one of…

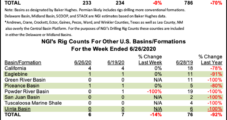

U.S. Rig Count Down as Oil, Gas Patch Shows Signs of Stabilizing Post-Covid

Posting its smallest weekly decline in months, the U.S. rig count dropped one unit to finish at 265 for the week ending Friday (June 26), suggesting that upstream activity could finally be stabilizing after a prolonged period of Covid-induced retrenchment. According to the latest Baker Hughes Co. (BKR) data, total U.S. natural gas-directed rigs finished…

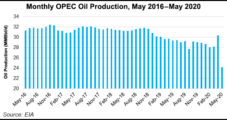

Oil Market Tightening Said Imminent As OPEC-plus Extends Cuts Another Month

The Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, on Saturday agreed to extend May and June oil supply cuts for another month to continue rebalancing an oversupplied global crude market.

NGI The Weekly Gas Market Report

OPEC, Allies Extend Supply Cuts Another Month, Signaling Tightened Market Ahead

The Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, on Saturday agreed to extend May and June oil supply cuts for another month to continue rebalancing an oversupplied global crude market.

NGI The Weekly Gas Market Report

Majors Seeking to Streamline Portfolios through Oil, Natural Gas Asset Sales Amid Covid-19 Impacts, Rystad Says

Oil and gas companies around the world have announced plans to divest non-priority assets with recoverable reserves totaling some 12.5 billion boe since December 2019, according to new analysis by Rystad Energy.