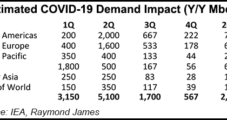

The impact of Covid-19 on pressuring U.S. natural gas prices remains a wildcard, but supply/demand changes point for the strip to move lower this year before 2021 ushers in “extremely bullish” prices, Raymond James & Associates Inc. said Monday.

Crude

Articles from Crude

LNG 101: Exploring the Curious Case of Oil-Indexed LNG Contracts

The notion of linking natural gas to crude oil is a funny one for the uninitiated in North America, where an abundance of supplies and a robust wholesale market reign. However, nearly three-quarters of all the world’s liquefied natural gas (LNG) trade is tied to oil prices.

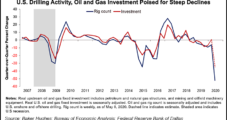

Dallas Fed Sees Q2 Oil, Natural Gas Capex Falling 35% on Weak WTI Price, Storage Constraints

Investment by U.S. oil and gas producers is likely to drop by at least 35% in the second quarter versus the first quarter of this year due to the crushing impact of Covid-19 on crude prices and a lack of available storage capacity, the Federal Reserve Bank of Dallas said Friday.

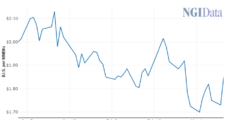

Natural Gas Futures Steady as Forecasts Warm; Cash Mixed

Natural gas futures snapped a three-day losing streak, edging up Monday as weather models hinted at what could be a warmer-than-normal summer. However, with a looming storage “tsunami,” the June Nymex gas futures contract settled only three-tenths of a cent higher than Friday’s close at $1.826. July climbed .008 cents to $2.085.

NGI The Weekly Gas Market Report

Enterprise ‘Creating Value,’ Cutting Costs Amid Coronavirus Uncertainty

Enterprise Products Partners LP (EPD) has yet to see a “material change” to volumes across its system, but given the “highly uncertain” impacts of the coronavirus for the remainder of 2020, it has reduced planned growth capital investments by $1 billion and sustaining capital expenditures (capex) by $100 million.

Natural Gas Futures Surge as WTI Crude Goes Negative, but Waha Cash Trades at Record Low

Still struggling to get a grasp on how much demand is being lost amid the coronavirus pandemic, natural gas traders on Monday took their cue from unparalleled deterioration in the oil markets. After an initial sell-off early in the session, the May Nymex gas futures contract rallied, shattering resistance and settling the day at $1.924, up 17.1 cents from Friday’s close. June climbed 14.6 cents to $2.049.

NGI The Weekly Gas Market Report

Raymond James Sees WTI Falling into $20s in 2Q on Covid-19, Price War

Extraordinary measures are continuing to slam the oil and gas markets, as more North American producers, including EQT Corp. and EOG Resources Inc., are announcing cuts to spending while oil prices — and demand — are slaughtered.

NGI The Weekly Gas Market Report

Prolonged Oil Price Slide Factoring More into Global Natural Gas Market, Analysts Say

As the oil market rout continues, a clearer picture is emerging of its impacts on global natural gas trade, with analysts predicting both downside and upside consequences for various regions across the world.

Amid Oilsands Scrutiny, Canadian Natural Exec Lauds ‘Impressive Results’ On Emissions Intensity in Alberta

As Alberta oilsands producers face increasing scrutiny over the greenhouse gas (GHG) emissions intensity of their operations, Calgary-based Canadian Natural Resources Ltd. is leading efforts to make exploration and production (E&P) in the province more sustainable, management said Thursday.

NGI The Weekly Gas Market Report

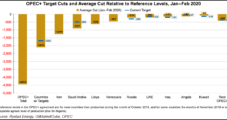

OPEC Calls for Bigger Oil Production Cut Through Midyear, with Overall Reductions Through 2020

In another sign of the impact on energy demand from the worldwide coronavirus, the Organization of the Petroleum Exporting Countries (OPEC) on Thursday recommended that members reduce global crude output through the end of the year, with an additional adjustment through June.