Toronto-based Brookfield Infrastructure Partners LP won a prolonged takeover contest for Inter Pipeline Ltd. (IPL) in Calgary today after adding an all-cash option to its bid for shareholder support and raising the total offer to about C$8.6 billion ($6.9 billion). At a cost of a deal-breaking penalty of C$350 million ($280 million), IPL canceled a…

Tag / Consolidation

SubscribeConsolidation

Articles from Consolidation

Ranger Further Expands Wireline Footprint with PerfX Acquisition

Ranger Energy Services Inc. has further boosted its wireline presence in the Lower 48 following the acquisition of PerfX Wireline Services, its second takeover since May. The Houston-based oilfield services company said last week it had acquired Minot, ND-based PerfX in an all-stock deal. The deal follows the acquisition of Patriot Completions Solutions LLC in…

U.S. Oil, Natural Gas M&A on Torrid Pace in 2Q, while Canada Led International Dealmaking

After a cold start to the year, North American upstream merger and acquisition (M&A) activity heated up in the second quarter, with U.S. dealmaking alone hitting more than 40 deals valued at around $33 billion. Energy data analytics expert Enverus on Monday issued its 2Q2021 report on U.S. exploration and production (E&P) activity. Finbrook Pte…

Contango Snags ConocoPhillips’ Gassy Wind River Assets for $67M

U.S. independent Contango Oil & Gas Co. plans to boost its natural gas production by more than half later this year with the acquisition of ConocoPhillips’ conventional assets in Wyoming’s Wind River Basin for $67 million. The assets are estimated to have a net production run rate of about 78 MMcfe/d as of July 1.…

PE-Backed WildFire Energy Acquiring Eagle Ford Pure-Play Hawkwood in $650M Deal

Eagle Ford pure-play Hawkwood Energy LLC is set to be acquired by private equity-backed platform WildFire Energy I LLC, the firms announced Thursday. The transaction, slated to close in the third quarter, values Denver-based Hawkwood at about $650 million. Hawkwood’s liquids-weighted gross production currently stands at about 15,000 boe/d, spanning 160,000 net acres in the…

Civitas Looking to Create DJ Beast by Merging Crestone Peak with Bonanza, Extraction Tie-Up

If all goes to plan, Civitas Resources Inc. could become a giant among giants in the Colorado oil and natural gas world as it looks to merge another Denver Julesburg (DJ) Basin producer into its operations. DJ pure-plays Bonanza Creek Energy Inc. and Extraction Oil & Gas Inc. agreed to merge in early May. That…

Inter Pipeline Said Sticking with Pembina Offer After Brookfield Launches Second Bid

Calgary takeover target Inter Pipeline Ltd. rejected a second uninvited bid Thursday by Toronto-based Brookfield Infrastructure Partners. Inter Pipeline said a combination announced Tuesday (June 1) with Calgary-based Pembina Pipeline Corp. would be a better industrial match with growth prospects. Both firms have pipeline, processing and storage networks, and Inter Pipeline is building a new…

Alberta’s Pembina Acquiring Inter Pipeline Natural Gas, Oil Infrastructure in $6.6B Tie-up

Pembina Pipeline Corp. will take over Inter Pipeline Ltd. in an agreement announced Tuesday to combine their Calgary-based western Canadian delivery, processing and storage networks for natural gas, liquid byproducts, oil and petrochemicals. The all-stock deal values Inter Pipeline at C$8.3 billion ($6.6 billion), topping a rejected bid from Brookfield Infrastructure Corp. in Toronto by…

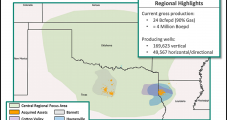

Diversified Energy Expanding Outside Appalachia Through Barnett, Haynesville Natural Gas Acquisitions

Appalachia-focused natural gas producer Diversified Energy Co. plc on Friday announced its second transaction in as many months to expand into a different gassy region of the United States. Birmingham, AL-based Diversified said it has entered into a conditional agreement to acquire upstream assets in the Barnett Shale of North Texas from Blackbeard Operating LLC…

Cimarex, Cabot Combination ‘Building an Ark, Not a Party Boat’ in Lower 48 Oil, Natural Gas

Cimarex Energy Co. and Cabot Oil & Gas Corp. on Monday agreed to combine in an all-stock merger, tying together their extensive operations in the Marcellus Shale, Permian and Anadarko basins. Denver-based Cimarex controls 560,000 net acres combined in the Permian and Anadarko, while Houston-based Cabot has 173,000 net acres in the Marcellus. Cabot CEO…