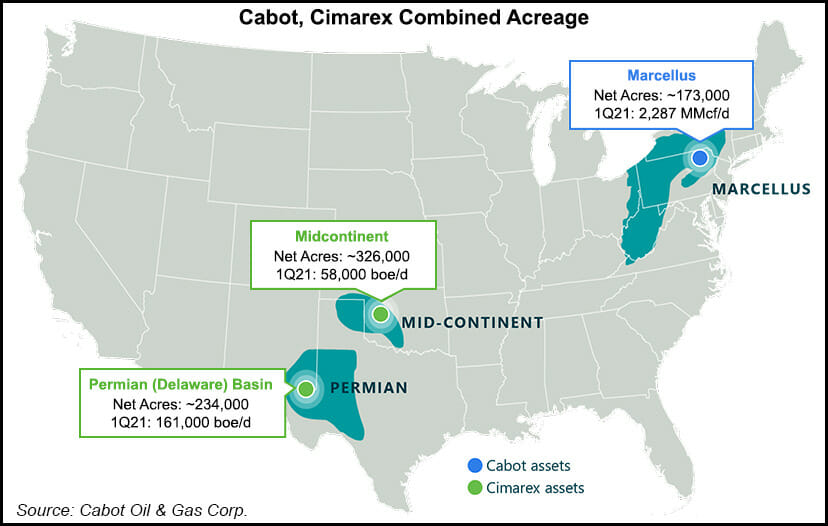

Cimarex Energy Co. and Cabot Oil & Gas Corp. on Monday agreed to combine in an all-stock merger, tying together their extensive operations in the Marcellus Shale, Permian and Anadarko basins.

Denver-based Cimarex controls 560,000 net acres combined in the Permian and Anadarko, while Houston-based Cabot has 173,000 net acres in the Marcellus. Cabot CEO Dan Dinges has been tapped as executive chairman, while Cimarex chief Tom Jorden would be CEO of the to-be-named company.

The merger is “the start of the next chapter in our histories,” Dinges said. Management has “long understood the long-term benefits of expanding geographically and beyond the Marcellus and adding more scale to our operations.

“This transaction does that,” creating an “operator with a geographic...