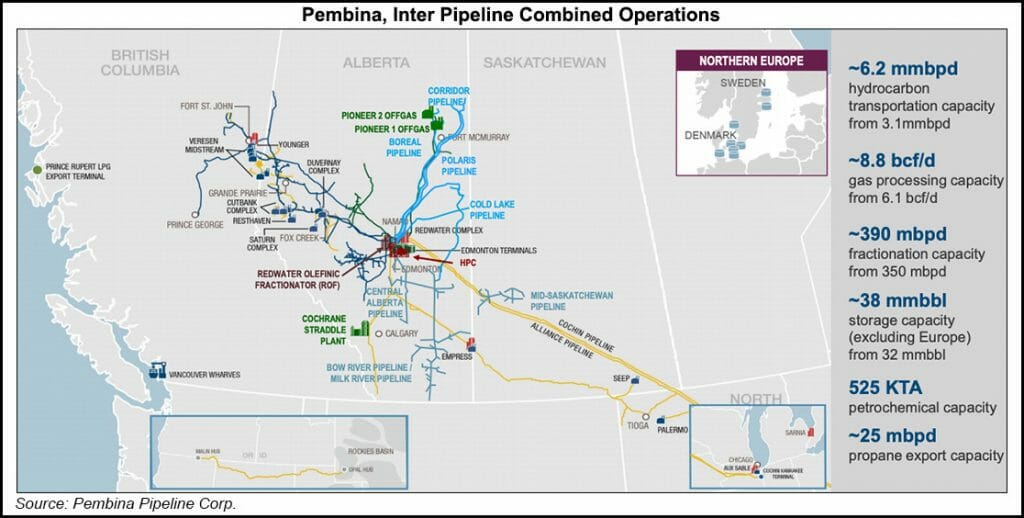

Pembina Pipeline Corp. will take over Inter Pipeline Ltd. in an agreement announced Tuesday to combine their Calgary-based western Canadian delivery, processing and storage networks for natural gas, liquid byproducts, oil and petrochemicals.

The all-stock deal values Inter Pipeline at C$8.3 billion ($6.6 billion), topping a rejected bid from Brookfield Infrastructure Corp. in Toronto by 17.8%. Counting Inter Pipeline debt, the total transaction value is C$15.2 billion ($12.2 billion).

Pembina reported that the merged company will boast 6.2 million boe/d of natural gas and liquids pipeline capacity, 8.8 Bcf/d of natural gas processing plants, 390,000 b/d of liquids extraction facilities, and 38 million bbl of storage capacity.

Pembina also will acquire an Inter Pipeline plant...