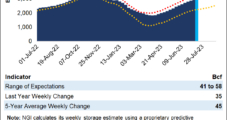

Natural gas futures fell again Monday, losing ground for a fourth consecutive regular session amid ongoing supply/demand imbalance concerns. The August Nymex gas futures contract lost 2.7 cents day/day and settled at $2.512/MMBtu. September slid 2.6 cents to $2.504. At A Glance: Prompt month sheds 2.7 cents U.S. production holds strong Weather demand endures Cash…

Cash

Articles from Cash

October Natural Gas Futures Skyrocket Ahead of Expiration, Reach New 2021 High

Natural gas futures sailed higher on Monday, rallying for a third straight session ahead of prompt month expiration and amid a potential global energy supply crunch. The October Nymex contract spiked 56.6 cents day/day and settled at $5.706/MMBtu. October rolls off the board as the prompt month at the close of trading Tuesday. November jumped…

Natural Gas Futures, Cash Prices Soar Above $5.00 as Nicholas Amplifies Production Worries

Natural gas futures surged on Monday as a new tropical storm threatened to further shake the Gulf of Mexico’s (GOM) production foundation, a development that could hamper supply/demand balances at a time when gas in storage for winter is already light. The October Nymex contract cruised 29.3 cents higher day/day and settled at $5.231/MMBtu. November…

U.S. E&Ps Wary of Rising OFS Costs, Living Within Cash Flow, Says Raymond James

U.S. exploration and production (E&P) management teams expect their biggest hurdles this year will be rising service costs and an effort to thrive within cash flow, according to a survey by Raymond James & Associates Inc.

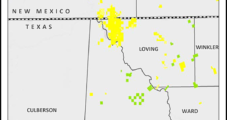

WPX Bulks Up Permian Portfolio in West Texas

WPX Energy Inc. has struck a $775 million agreement to bolt on more West Texas land to increase its Permian Basin portfolio to 120,000-plus net acres.

U.S. E&Ps Shifting from Thrift to ‘Massive’ Capex Surge, Says Raymond James

The domestic oil and natural gas industry likely will see “massive” cash flow increases over the coming years, as the two-year mentality to shrink rapidly shifts back to growth.

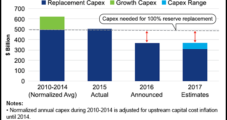

Limited E&P Cash Flows Pose Risk of Underinvestment, Deloitte Says

The global exploration and production (E&P) sector is on pace for major underinvestment through 2020, as companies use cash flows to shore up their balance sheets, according to a report released Wednesday by Deloitte LLP.

Shell Prioritizing Deepwater, Chemicals, While Slowing NatGas, Unconventionals

Natural gas and unconventionals are taking a backseat at Royal Dutch Shell plc in the near term as it turns its focus to “cash engines,” driven by deepwater and petrochemicals opportunities, the global producer said Tuesday.

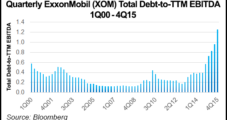

S&P Clips ExxonMobil’s ‘AAA’ Rating

After carrying a “AAA” credit rating for more than 66 years, ExxonMobil Corp. was brought down a notch by Standard & Poor’s Ratings Services (S&P) on Tuesday, citing expectations for continuing low oil and natural gas prices, high reinvestment requirements and large dividend payments.

S&P Clips ExxonMobil’s ‘AAA’ Rating

After carrying a “AAA” credit rating for more than 66 years, ExxonMobil Corp. was brought down a notch by Standard & Poor’s Ratings Services (S&P) on Tuesday, citing expectations for continuing low oil and natural gas prices, high reinvestment requirements and large dividend payments.