Tulsa’s WPX Energy Inc. has added more natural gas and oil hedges to protect cash flows through 2017. About two-thirds of anticipated gas production in 2016 is hedged at $3.63/MMBtu. Close to 75% of its expected 2016 oil volumes, 29,380 b/d, are hedged at $60.85/bbl, including 2,000 b/d added since the end of September. For 2017, WPX has hedged 92,500 MMBtu of gas at $3.22 and 9,304 b/d of oil at $61.66. The onshore operator also has reduced its long-term debt by about 17% by repurchasing $68 million in notes of a $400 million maturity due in early 2017. The next debt maturity is in 2020. WPX said it “remains engaged in discussions with third parties” to sell its San Juan Basin gathering system and all or a portion of its Piceance Basin assets. The operator is scheduled to deliver its quarterly results on Feb. 25.

Cash

Articles from Cash

Panhandle Leases 4K Permian Acres For $2M Plus Royalties

Panhandle Oil and Gas Inc. is leasing more than 4,000 acres in the Permian Basin in West Texas to an undisclosed lessee for $2 million in cash plus royalties, the company said Monday.

NGI The Weekly Gas Market Report

Analysts Praise KMI’s 75% Dividend Cut; Investors Buy In

Kinder Morgan Inc.’s (KMI) dividend cut after market close Tuesday lifted shares in Wednesday’s trading. Some analysts and investors were relieved that KMI would retain its investment-grade credit rating and not be accessing unattractive equity markets to fund growth.

NGI The Weekly Gas Market Report

Freeport-McMoRan Suspending Dividend, Dropping Rigs in Deepwater GOM

Freeport-McMoRan Inc. (FCX), which for months has been eyeing strategic options for its U.S.-focused oil and gas business, said Wednesday it has suspended its dividend and is dropping deepwater rigs in the Gulf of Mexico (GOM) to cope with deteriorating market conditions.

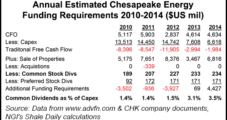

Chesapeake Liquidity ‘Adequate,’ Debt Offering Called ‘Creative,’ But Investors Not Convinced

Persistently weak oil and natural gas prices, combined with OPEC’s decision last week to hold production steady, likely will reduce spending plans for many U.S. producers in 2016, but the debt-laden operators face even more pressure as they consider how to finance their go-forward plans.

Extended Weather Outlook Moderates; December Seen 8 Cents Lower

December natural gas is expected to open 8 cents lower Tuesday morning at $2.31 as longer-term weather forecasts turned milder and traders mull market support sustained by low cash prices. Overnight oil markets fell.

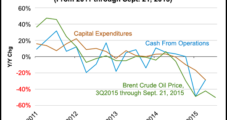

Global Oil/Gas Companies Show ‘Wide Deficit’ of Operating Cash to Capex

Despite cuts in capital expenditures (capex), oil and natural gas producers worldwide are seeing greater declines in their operating cash flow and, consequently, lower cash balances, trends that could continue into 3Q2015 if crude oil prices continue to fall, the U.S. Energy Information Administration (EIA) said.

E&Ps, Oilfield Services Walking Tightrope, With M&A to Cushion Fall, Says Deloitte

Balance sheet stress is intensifying in the U.S. natural gas and oil sector, which means more takeovers and asset sales are likely by the end of this year, researchers said Thursday.

Maintenance Costs, Debt Ding Cash Flow Plans of Big Independents, IHS Says

Chesapeake Energy Corp. and Encana Corp. have the highest maintenance capital costs and debt in their peer group, while EOG Resources Inc., Range Resources Corp., and EQT Corp. may be among those best positioned, enabling them more easily to replace forecasted production this year with cash flow, according to IHS Inc.

Chesapeake Scrapping Dividend, Selling Oklahoma Properties

Chesapeake Energy Corp. is eliminating its dividend and selling some onshore properties to cope with the continuing slump in natural gas and oil prices.