LNG | International | LNG Insight | Markets | NGI All News Access | NGI The Weekly Gas Market Report

European Natural Gas Prices Surge as Russian Forces Encircle Ukraine, Deepening Supply Fears

European natural gas prices on Wednesday reached their highest level since Russia attacked Ukraine last week, as fighting intensified and fears over supply disruptions continued to grow.

The Title Transfer Facility was up across the curve, while the prompt month soared by a record 60% from Tuesday’s close to hit an intraday high of nearly $64/MMBtu. Ultimately, the April contract finished close to $54, not far off a record of $59.550 set in December.

Russian troops were moving to encircle key cities in Ukraine and the escalating conflict was pressuring commodity prices across the globe. Brent crude for May delivery hit an intraday high of $115.11/bbl, while Asian spot LNG prices were assessed nearly $10 higher day/day near $41. U.S. natural gas prices also climbed, but are more insulated from the war than others across the globe.

Energy exports have been excluded from the West’s sanctions against Russia. But the threat of further actions, plus some self-sanctioning among market participants to avoid Russian commodities or the financing needed to buy them, has spooked the market. The prospect of damaged infrastructure in Ukraine as fighting rages there has also factored into natural gas prices.

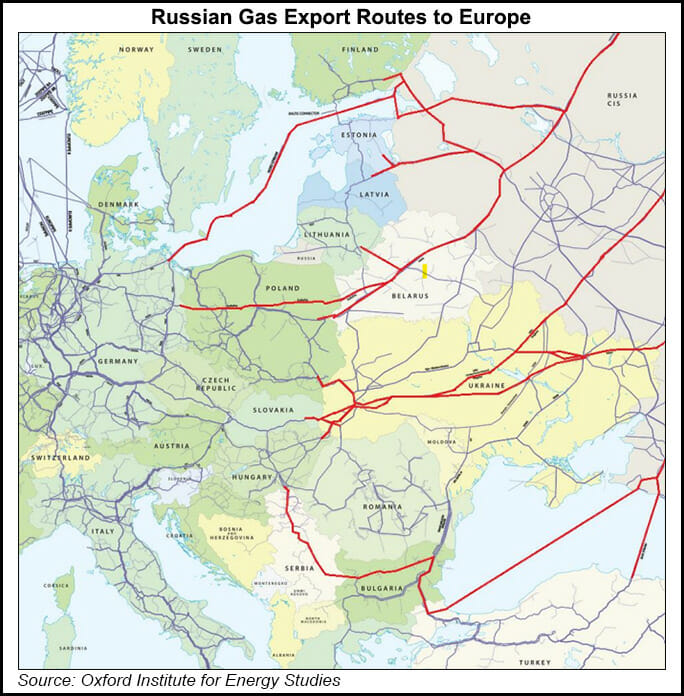

Europe relies on Russia for about a third of its natural gas imports, and roughly 20% of those volumes move through Ukraine. The Gas Transmission System Operator of Ukraine said on Twitter Wednesday that its administrative buildings in Mykolaiv and Kharkiv had been hit by artillery shelling. Employees were evacuated to safety. Operations were not disrupted.

‘Extreme Market Uncertainty’

While natural gas flows from Russia to Europe again remained strong Wednesday as they have since fighting broke out, traders are said to be avoiding some deals with Gazprom PJSC affiliates.

“Extreme market uncertainty because of Russia’s increasing military operations in Ukraine and the similarly intensifying risk of sanctions – which may soon include energy exports – are likely driving the surge, with traders factoring in the rising probability of sanctions on gas for each day the offensive continues,” said Rystad Energy analyst Kaushal Ramesh in a note on Thursday.

Russian ships are turning away from some European ports. PAO Sovcomflot-owned LNG vessel Christophe de Margerie abruptly changed destinations late last week after the UK said it would deny port access to Russian-owned ships, according to ship-tracking data. Calls are growing to deny additional Russian LNG tankers from docking at UK terminals.

Italy had also reportedly halted its share of financing for the Arctic LNG 2 project being developed by privately-held Russian natural gas producer PAO Novatek. Russia is the world’s fourth largest LNG exporter. Engie EnergyScan analysts said Wednesday that “the sustainability” of the country’s exports volumes are now being called into question.

In another major development that’s seen clouding Europe’s supply outlook, reports surfaced Tuesday that Gazprom affiliate Nord Stream 2 AG had terminated its workforce and filed for bankruptcy.

The company said online Wednesday that it could not confirm the bankruptcy, saying only that it had ended the contracts of 106 employees. The Switzerland-based company also shut its website down in the face of what it said were growing cyber attacks.

German oil and gas producer, Wintershall Dea AG, also said it would write off its financing of the Nord Stream 2 (NS2) pipeline project for a total of $1.1 billion, stop payments to Russia and halt investments in the country. Shell plc said it would exit the project as well.

The moves are part of a broader exodus from Russian ownership stakes and further capital investments among major western oil and gas companies, including BP plc, Equinor ASA, ExxonMobil and TotalEnergies SE.

The 764-mile, 5.3 Bcf/d NS2 system that traverses the Baltic Sea is completed, but it needed German and European Union approval to start-up. Germany suspended the project last week as part of a package of sanctions that have made it difficult for the company to continue doing business. The pipeline was seen as a key passage for more Russian gas to reach the continent as supplies there have been short since last year.

The possible bankruptcy signals the project is “now dead,” Rystad’s Carlos Torres-Diaz, head of gas and power markets, told NGI. “Given the current circumstances, it is very unlikely that the German government will be willing to increase its dependency on Russian supplies,” he added, noting that the move is likely to boost European LNG demand in the near term.

The infrastructure will remain under Gazprom’s ownership, but the project “is not going to work,” said Anna Mikulska, a nonresident fellow in energy studies at Rice University’s Baker Institute for Public Policy, when asked about the project’s prospects of entering service.

Oil Market Shocks

The oil market has been thrown even further into chaos. Brent was at its highest point since 2014 and surging Wednesday. The benchmark gained $7.96 on Wednesday for one of its biggest rallies over the last decade.

Russian oil is trading at a steep discount to other benchmarks as buyers have been reluctant to purchase it, creating additional shortages for an already tight global market.

OPEC and its allies also agreed at a meeting Thursday to only gradually increase production output by sticking to its plan of monthly production increase of 400,000 b/d in April.

The International Energy Agency said this week it would release 60 million bbl of oil reserves to counter disruptions imposed by fallout from Russia’s invasion of Ukraine. The United States said 30 million bbl of that total would come from its Strategic Petroleum Reserve.

“The world could be facing staggering supply risks, because Russia can dig a bigger hole in supply than strategic reserves or global spare capacity can sustainably fill in,” said analysts at ClearView Energy Partners LLC.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |